Trending Assets

Top investors this month

Trending Assets

Top investors this month

$STNE update

Hi guys. Released my post on $STNE along the weekend.

All in, Stone will likely continue to face challenges in posting significant earnings expansion. First, the company suspended the origination in its credit business after issues with the receivables chambers, postponing monetization.

Second, Brazilian Central Bank has been increasing interest rates (+875bps in the cycle so far), pressuring Stone’s financial expenses and pass-through in prices.

Third, $STNE has been signalizing to the market higher selling expenses from now on. In my view, low-hanging fruits are over, so incremental merchants’ addition should come at higher costs.

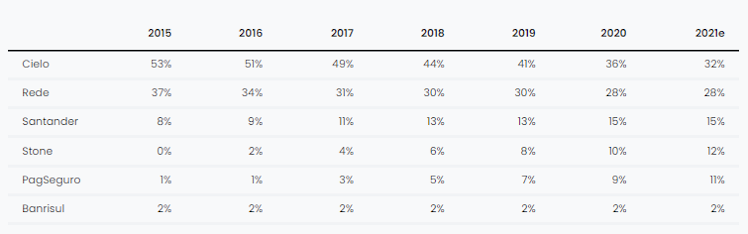

Gathering the information provided by the large acquirer’s companies and the data provided by ABECS, the main highlights for 2021:

- New entrants are still gaining market share from incumbents (+200bps in the year). It’s interesting to notice, but Getnet lost market share throughout the year, even though the feedback I heard was that the company was going strongly in commercial propositions.

- $STNE and $PAGS were the main highlights. $STNE lost share in the first half of the year, but PAGS has shown significant share gain along the year.

- ABECS is pointing to a 30% growth in the industry TPV for 2021, versus the 24%expected by the beginning of the year. For 2022, ABECS expects another strong year, with a 24% growth (vs. 2021).

Keep in mind the Stone’s market share evolution over the past five years. I think the company will sustain the pace (+200bps) for the foreseeable future.

However, the company has been pointing out that the cost of acquiring customers has also been increasing.

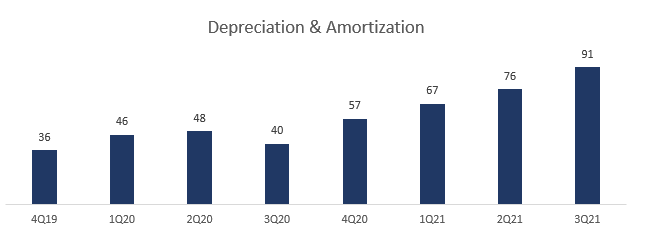

Stone’s CAC (Customer Acquisition Cost) invests in hubs and POS hardware. Therefore, the increase, or decrease, in the D&A could foresee how aggressive the company is about future investments.

One might discuss that Stone is looking for a share greater than 200bps in 2022, and the actual CAC is the same, but I don’t see it this way. As we’ll discuss later on, Stone’s cash availability will be limiting its growth over the following years.

### Funding cost pressure

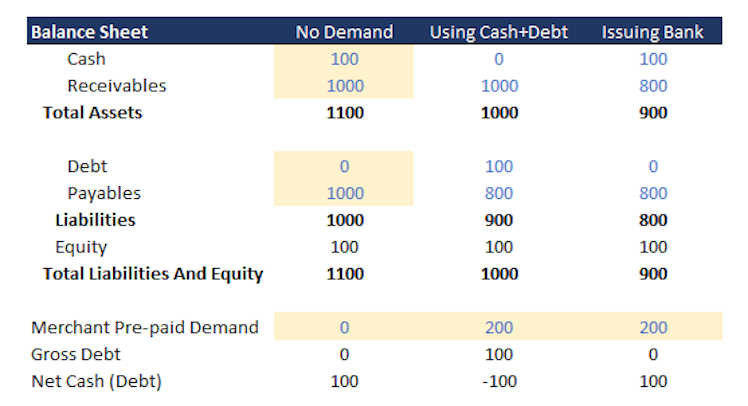

Unlike most companies, acquirers deploy massive capital into the pre-payment business. As a result, the reported balance sheet and the actual figures for cash and debt may diverge.

When an acquirer receives a demand to prepay money from merchants, it could use proprietary cash, issuing banks, or debt.

However, as the image above shows, the balance sheet doesn’t show the real impact when an acquiring company issues a bank for the pre-payment.

I don’t think that, formally, there is a name for this off-balance debt that is not in the Balance Sheet, so I named it Virtual Debt.

Channel Checks suggest that the tenor (length of time remaining before a financial contract expires) is between 50 and 65 days. So, considering that the period for a contract is 60 days, $STNE would have issued a ton of intra-quarter debt to fulfill its obligation to merchants.

Wanna continue the reading? Why don't you access my Substack and redeem a free trial coupon?

giro.substack.com

Subscribe to Giro's Newsletter

An independent investment newsletter that offers insightful analysis of LatAm's most incredible businesses and impacting events. Click to read Giro's Newsletter, by Giro Lino, a Substack publication with thousands of subscribers.

Already have an account?