Trending Assets

Top investors this month

Trending Assets

Top investors this month

Market Cycles: The Rhyme of History

Many outstanding investors have been fanatical students of history because history teaches you to place events into perspective, to understand that industries boom and fade; cycles repeat and human folly is never-ending.

In their calmer moments, investors recognize their inability to know what the future holds. In moments of extreme panic or enthusiasm, however, they become remarkably bold in their predictions: they act as though uncertainty has vanished and the outcome is beyond doubt. Reality is abruptly transformed into that hypothetical future where the outcome is known. These are rare occasions, but they are unforgettable: major tops and bottoms in markets are defined by this switch from doubt to certainty.

The venerable Ben Graham argued that an investor should “have an adequate idea of stock market history, in terms, particularly, of the major fluctuations. With this background he may be in a position to form some worthwhile judgment of the attractiveness or dangers….of the market.”

Cycles are prevalent in all aspects of life; they range from the very short-term, like the life cycle of a June bug, which lives only a few days, to the life cycle of a planet, which takes billions of years.

No matter what market you are referring to, all go through the same phases and are cyclical. They rise, peak, dip, and then bottom out. When one market cycle is finished, the next one begins.

For some time now, commodity investors have been eager for the start of a super cycle, and some believe it's already underway. The signs certainly are there, but perhaps not all of them. I've often mentioned my fondness for GoRozen and their natural resource market commentaries and I've been reading them faithfully since 2021, but I recently came across this one from 2020 I hadn't seen yet.

I thought it would be worthwhile to take a closer look (with some help from GoRozen) at what has led to past commodity super cycles, and if we aren't currently in the start of one then it would appear as though we are very close. Only one factor seems to be missing, but there are signs indicating that catalyst is currently underway.

THREE DISTINCT COMMODITY SUPER CYCLES IN HISTORY

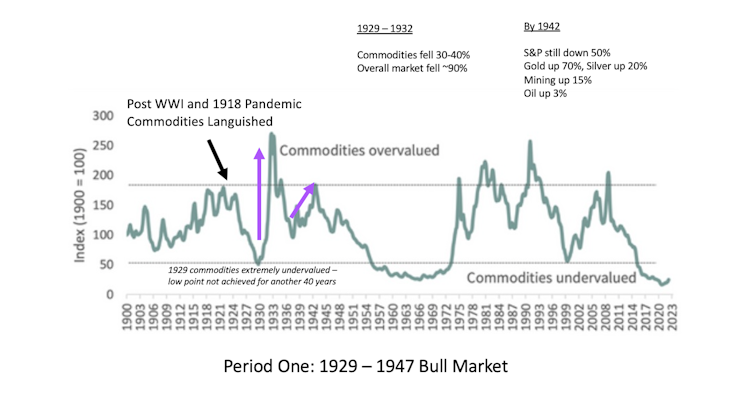

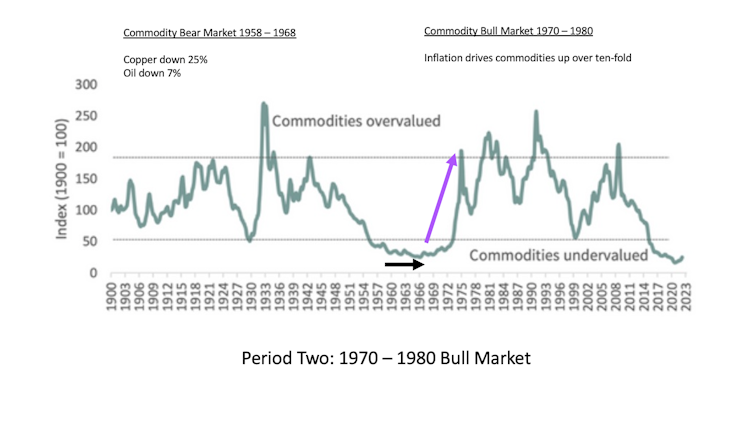

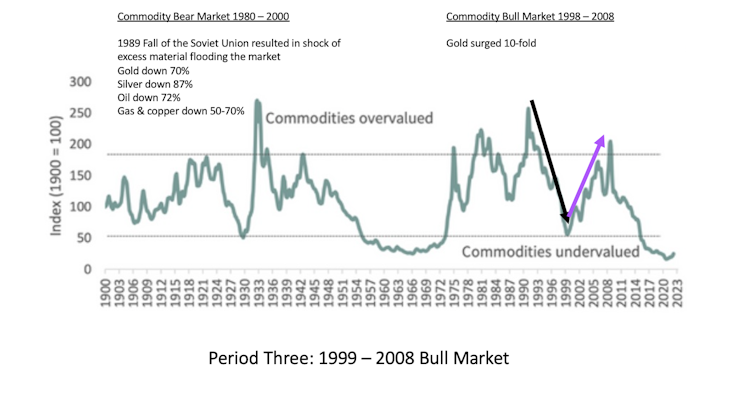

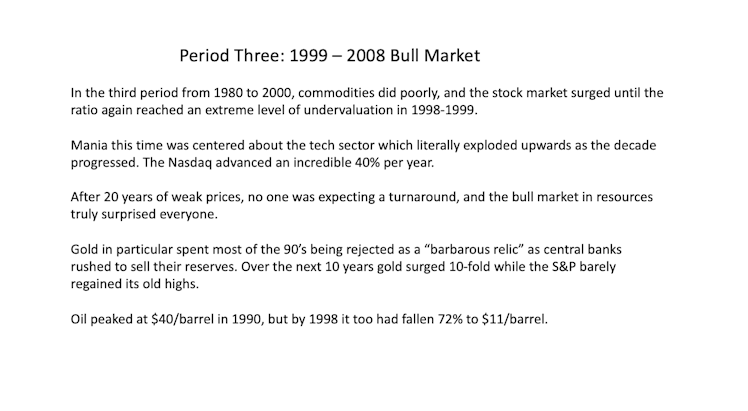

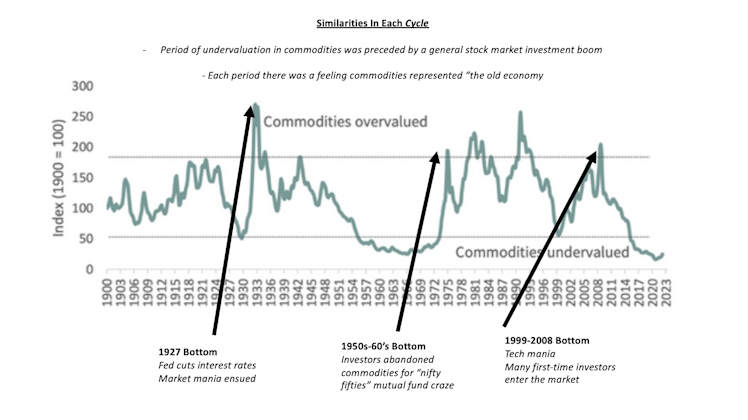

Other than today there have been three distinct periods of radical commodity undervaluation over the last 100 years and in each case, it was a great time to accumulate commodities and commodity stocks.

Commodities may not seem to make sense for long periods, but time after time they eventually do. The risk is always that investors become frustrated and get rid of their allocations at exactly the wrong moment.

ESG, index investing, and years of poor performance have left investor’s exposure is at record low levels.

Commodities have never been cheaper in the 100 years of data that GoRozen has tracked.

FANG stocks and index funds have been the asset class that has been in favour, will they now go through a massive period of underperformance?

The more research that GoRozen did, the more they were amazed at how much past cycles had in common instead of differences. They each had an extremely unique set of features in place leading up to the inflection point. In every case, these very unusual features presents themselves and then commodities surged higher.

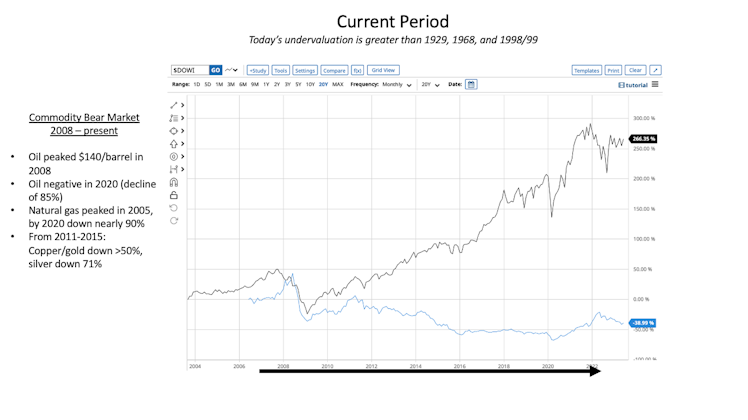

GoRozen ended their chart comparing the Dow Jones Industrial Index returns with that of Goldman Sachs Commodity Index at the end of 2022. Below is a breakdown showing the continued divergence between the two to present day.

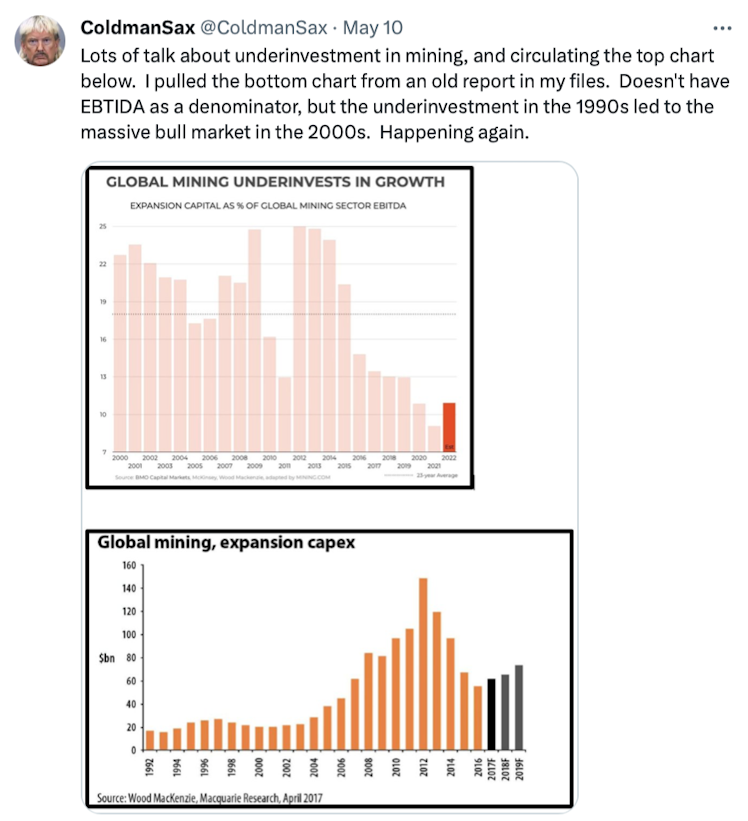

During these severe bear markets, low prices built the foundation for the next bull market.

Investor interest & capital were directed into other sectors.

Resource companies drastically reduced their expenditures and delayed/deferred the next generation of mines and oilfields.

When capital dries up, projects are cancelled, supply issues inevitably follow and the market begins to tighten.

Presently there are two investment crazes capturing investor’s attention & capital. The first – a redux of the 90’s tech boom with Facebook, Google, Netflix, Apple, and Amazon growing without bound. The other craze is passive index investing, where it is recommended to own companies according to their market cap without any active management at all.

(things that make you go hmmm...)

Today’s market feels a lot like the 1960’s investment craze, but instead of buying the ‘nifty-fifty’ to hold forever, the magic formula says to buy the broad market & add exposure to FANG.

GoRozen has shown that by the end of each period of commodity undervaluation, resources had entered a severe bear market at the same time that attention has become captivated by a catch-all investment craze supposedly “guaranteed” to deliver strong ongoing returns.

In each case, resources were thought to be passe and sold as a source of funds to invest in the craze of the day.

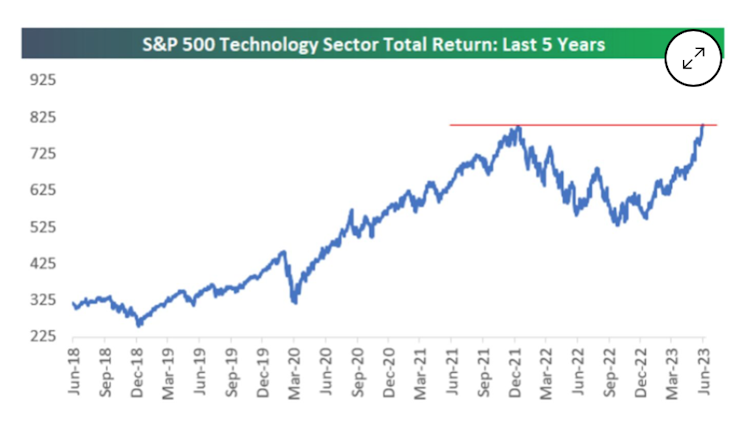

“After experiencing a drawdown of nearly 34% from its high in late 2021 to its low in late 2022, the Tech sector has now rallied more than 50% off its lows,” commented Bespoke Investment Group, which provided the chart. “How many investors had that on their bingo cards in the first half of 2023?” It’s certainly surprising and looks overbought, especially as the logic behind last year’s selloff was that the sector would be hurt by higher interest rates. Now, with rates higher and no prospect of coming down, tech has somehow made good all its losses. Can it really make sense to keep piling in to the US when it already looks so expensive?"

Credit has also played a strong role. Immediately before each period of radical commodity undervaluation, credit conditions were extremely accommodating – helping to push the mania and crazes just discussed much further than otherwise possible and extended the commodity undervaluation into record territory.

Each of these periods all saw large expansions of the financial system in general.

1920s: large increase in the number of banks in both US & Europe

1960s: birth of the professional asset manager as people poured their savings into stocks

1990s-2000s: rolling back of bank regulation put in place during depression followed by massive increase in structured financial products

All periods enjoyed high real & nominal GDP growth along with low inflation.

The Philips Curve formalizes that as unemployment moves down, inflation moves up. There have only been four periods where this has not held true – late 20’s, late 60’s, late 90’s and TODAY. Each period enjoyed above average economic growth with below average inflation, something that traditional economics teaches is unlikely if not impossible.

In a period of strong economic growth, little cost inflation, companies that hold few assets tend to do well because they can enjoy the growing economy without having to tie up capital owning assets to help avoid cost pressures.

In periods of relatively low to average economic growth and rising inflation, it becomes difficult to pass along your rising costs to the customer. In this case, the only saving grace is to own the asset itself whose value will keep place with inflation.

Best performing stocks at peak commodity undervaluation:

1920s asset light: specialty chemicals, electronic equipment, business consultants

1960s asset light: restaurants, leisure products, computer hardware/software

1990s, 2010 onward asset light: computer tech, financial services, microchip makers, telecoms, business services

What catalyst will trigger the shift from the commodity bear market to a new surging bull market?

The catalyst that historically ends one bear market and ushers in a new bull market has revolved around a shift in monetary regime.

1929, 1968, 1998 were all years the prevailing monetary systems collapsed and radically changed (reasons being credit conditions, asset prices, sector leadership, size of financial system).

1929: restricted credit after Fed chair Benjamin Strong dies, end of gold standard

1950s-1960s: major economies adopt the Bretton Woods exchange system, linking various exchange rates with the US which itself was convertible into gold (next 25 years)

Vietnam war expenditures, massive social programs caused mounting concerns over health of US financial system

1968: President Johnson suspended the legal requirement that the dollar be backed by 40 cents of gold (causing the Bretton Woods system to cease functioning – exactly the same moment commodities bottomed relative to financial assets) and in 1971’s ‘Nixon shock’ President cancelled convertibility of USD into gold.

1990s: The Bretton Woods system had ended in 1971, but emerging markets chose to maintain a USD peg to promote stability/confidence – system worked for 25 years as US maintained low interest rates (Asian EM’s boomed and attracted hot capital). Once conditions shifted, money flowed back out, leaving EM’s unable to defend their currency pegs.

Asian EM’s boomed and attracted hot capital - see my recent CommonStock post "Summer Heat: Emerging Markets"

"The bulk of the incoming cash - a total of $16.4 billion - went to Asian emerging markets, with equities in India, Taiwan and Korea drawing large investments."

1997: system collapsed as Thai Bhat failed, then Indonesia, Phillippines, Malaysia, South Korea all saw their currencies collapse between 35 and 80% over the next 18 months.

Trillions of dollars in capital flows were altered very quickly and resulted in a massive build up of Treasuries held in China/SE Asia. THIS SHIFT CORRESPONDS EXACTLY with the moment when commodities boomed relative to financial assets.

Bloomberg, June 2, 2023:

PRESENT

- Covid and Ukraine/Russia war created massive shifts in global monetary orders in USA & Europe.

- 2020, US monetary base grown from $4 trillion to $7 trillion (M2 growth of >26% yr on yr, highest peace time reading in history)

- Both US and UK monetized nearly 100% of US deficit in 2020, compared with less than 20% in 2019.

- Fed, ECB, & BoJ are actively controlling the yield curve

- Pre-Covid, gold production had peaked, as had US oil and gas production, copper production was likely set to peak in 2021. Currently nearly four billion people are going through a period of intense commodity consumption. Nearly 6x the number of people historically at any one time.

Yellen acknowledged that US sanctions have motivated some countries to look for currency alternatives. Her comments came during a Housing Financial Services Committee in response questions about the risk of de-dollarization. Even traditionally allied nations, such as France, have recently made non-dollar transactions.

The US dollar's reserve status has seen gradual erosion for two decades, and it saw a steep decline in 2022 even though its strength in international trade remains unchallenged, Eurizon SLJ Asset Management said in April.

Other reports have pointed toward an upsurge in foreign central banks' demand for gold as another way to reduce their reliance on dollar reserves.

But US lawmakers aren't helping the dollar's cause, Yellen suggested. Earlier in the hearing, she reiterated her long-standing concern over the US debt ceiling crisis, saying it undermines global faith in the nation's ability to meet its debt obligations, deteriorating the greenback's reputation.

See my November CommonStock post "Don't Mock The Rock" for further confirmation - a shift in monetary regimes is well underway:

Markets Insider

China stretched its gold-buying spree into the 7th straight month in May, signaling more central bank de-dollarization

China continued to amass gold, adding an additional 16 tons in May, while its foreign currency reserves fell, Bloomberg reported.

Already have an account?