Trending Assets

Top investors this month

Trending Assets

Top investors this month

Gold – Don't Mock the Rock

Such developments signal a potential BRICS alliance in the global physical gold market, where BRICS countries have major stakes: China, Russia, South Africa, and Brazil are major gold producers, and China and India are also the world’s two largest gold consumers. A BRICS single gold trading system would facilitate the creation of a new gold pricing benchmark based upon global physical gold trading rather than gold derivatives. Combined with the gold-backed trading of yuan oil futures, oil producers could swap oil for gold rather than for US Treasury securities, further de-dollarizing the global oil market. Apart from de-dollarization, a BRICS single gold trading system would also help to strengthen domestic currency stability because it would free BRICS members from being subject to foreign pricing. - CAMBRIDGE UNIVERSITY

Earlier today, I posted a Kitco interview with the legendary Pierre Lassonde. As someone who has a preference for base metals, I have often struggled to present a bull case for precious metals. As geopolitical uncertainties continue and we decouple from globalization, I’m starting to change my perspective on that. The significance of gold can no longer be ignored.

Lassonde spoke to Kitco on Tuesday at the 2022 Precious Metal Summit Zurich.

"I think a lot of gold bugs are asking themselves the question: 'with inflation running at 7% to 8%, why hasn't gold responded?'" said Lassonde.

"The answer is that 80% of the value of gold, long-run, is tied to the U.S. dollar, and for the last four years the dollar has been on a tear, and it's essentially suppressed gold demand. The other reason is cryptocurrency. Cryptocurrency went from nothing to a $4 trillion industry in the space of less than 10 years. The entire Gen Z generation got attracted to it."

Lassonde said that 2023 should be a good year for gold. With cryptocurrency in the doldrums and the U.S. dollar weakening, gold should get a lift. He estimates that 20% to 40% of gold liquidity was affected by the rise of cryptocurrency.

"With crypto imploding and the dollar rolling over, I predict that 2023 will be the year of gold."

Have a look at this Nikkei Asia article and take note that it was written in 2017, prior to the war in Ukraine:

China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry.

The contract could become the most important Asia-based crude oil benchmark, given that China is the world's biggest oil importer. Crude oil is usually priced in relation to Brent or West Texas Intermediate futures, both denominated in U.S. dollars.

China's move will allow exporters such as Russia and Iran to circumvent U.S. sanctions by trading in yuan. To further entice trade, China says the yuan will be fully convertible into gold on exchanges in Shanghai and Hong Kong.

China has long wanted to reduce the dominance of the U.S. dollar in the commodities markets. Yuan-denominated gold futures have been traded on the Shanghai Gold Exchange since April 2016, and the exchange is planning to launch the product in Budapest later this year.

Yuan-denominated gold contracts were also launched in Hong Kong in July -- after two unsuccessful earlier attempts -- as China seeks to internationalize its currency. The contracts have been moderately successful.

The existence of yuan-backed oil and gold futures means that users will have the option of being paid in physical gold, said Alasdair Macleod, head of research at Goldmoney, a gold-based financial services company based in Toronto. "It is a mechanism which is likely to appeal to oil producers that prefer to avoid using dollars, and are not ready to accept that being paid in yuan for oil sales to China is a good idea either," Macleod said.

Yuan-denominated gold contracts have significant implications, especially for countries like Russia and Iran, Qatar and Venezuela, said Louis-Vincent Gave, chief executive of Gavekal Research, a Hong Kong-based financial research company.

These countries would be less vulnerable to Washington's use of the dollar as a "soft weapon," if they should fall foul of U.S. foreign policy, he said. "By creating a gold contract settled in renminbi [an alternative name for the yuan], Russia may now sell oil to China for renminbi, then take whatever excess currency it earns to buy gold in Hong Kong. As a result, Russia does not have to buy Chinese assets or switch the proceeds into dollars," said Gave.

Grant Williams, an adviser to Vulpes Investment Management, a Singapore-based hedge fund sponsor, said he expects most oil producers to be happy to exchange their oil reserves for gold. "It's a transfer of holding their assets in black liquid to yellow metal. It's a strategic move swapping oil for gold, rather than for U.S. Treasuries, which can be printed out of thin air," he said.

If Saudi Arabia accepts yuan settlement for oil, Gave said, "this would go down like a lead balloon in Washington, where the U.S. Treasury would see this as a threat to the dollar's hegemony... and it is unlikely the U.S. would continue to approve modern weapon sales to Saudi and the embedded protection of the House of Saud [the kingdom's ruling family] that comes with them."

The alternative for Saudi Arabia is equally unappetizing. "Getting boxed out of the Chinese market will increasingly mean having to dump excess oil inventories on the global stage, thereby ensuring a sustained low price for oil," said Gave.

But the kingdom is finding other ways to get in with China. On Aug. 24, Saudi Vice Minister of Economy and Planning Mohammed al-Tuwaijri, told a conference in Jeddah that the government was looking at the possibility of issuing a yuan-denominated bond. Saudi Arabia and China have also agreed to establish a $20 billion joint investment fund.

Furthermore, the two countries could cement their relationship if China were to take a cornerstone investment in the planned initial public offering of a 5% state in Saudi Aramco, Saudi Arabia's national oil company. The IPO is expected to be the largest ever, although details on the listing venue and valuation are yet scant.

If China were to buy into Saudi Aramco the pricing of Saudi oil could shift from U.S. dollars to yuan, said Macleod. Crucially, "if China can tie in Aramco, with Russia, Iran et al, she will have a degree of influence over nearly 40% of global production, and will be able to progress her desire to exclude dollars for yuan," he said.

(What’s happened since this article:

Saudi Arabia signed 35 economic cooperation agreements with China worth a total of $28 billion at a joint investment forum.

Trade between the countries increased by 32% last year, he said. Saudi Arabia also said it was working to add Chinese to the curriculum in Saudi schools and universities.

China is also making efforts to set other commodity benchmarks, such as gas and copper, as Beijing seeks to transform the yuan into the natural trading currency for Asia and emerging markets.

Yuan oil futures are expected to attract interest from investors and funds, while state-backed oil majors, such as PetroChina and China Petroleum & Chemical (Sinopec) will provide liquidity to ensure trade. Locally registered entities of JPMorgan, a U.S. bank, and UBS, a Swiss bank, are among the first to have gained approval to trade the contract. But it is understood that the market will be also open to retail investors.

November 3, 2022

https://www.bnnbloomberg.ca/mystery-whales-baffle-gold-market-after-central-bank-purchases-1.1841132

(Bloomberg) -- A normally dry research report jolted the gold market this week, when it pointed to massive but so far unidentified sovereign buyers.

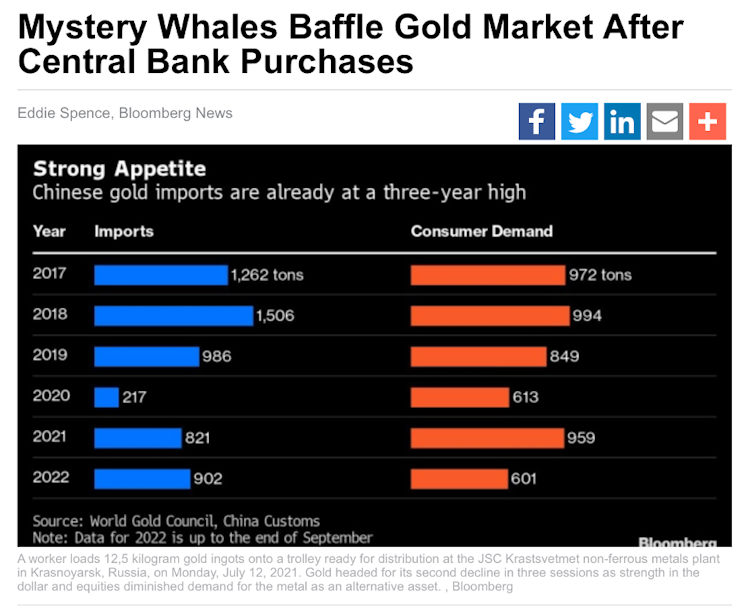

Central banks bought 399 tons of bullion in the third quarter, almost double the previous record, according to the World Gold Council. Just under a quarter went to publicly identified institutions, stoking speculation about mystery buyers. While most central banks inform the International Monetary Fund when they buy gold to supplement their foreign exchange coffers, others are more secretive. Few have the capacity to undertake the third-quarter buying spree, enough to soften the blow from investors selling bullion as the Federal Reserve hiked interest rates.

“With that weight of selling, I was a bit surprised gold wasn’t weaker,” said Ross Norman, chief executive officer of Metals Daily, an information portal focusing on precious metals. “But I suppose now we have our answer.”

The WGC, a lobby group for the mining industry, uses data from consultancy Metals Focus Ltd. to produce its estimates. It in turn relies on a combination of public data, trade statistics and field research to provide figures for demand from different sectors of the gold market.

While it’s difficult to identify the gold market whales, only some central banks have the capacity for such purchases:

China

The world’s No. 2 economy rarely discloses how much gold its central bank is buying. In 2015, the People’s Bank of China revealed a nearly 600-ton jump in its bullion reserves, shocking market watchers after six years of silence. The country hasn’t reported any change in its gold hoard since 2019, fueling speculation it may have been buying under the radar.

Trade data show the country has been taking in vast amounts of bullion. China has imported 902 tons of gold so far this year, already surpassing last year’s total. That’s on top of the more than 300 tons the country’s mines typically produce each year. And while domestic demand has been strong, with citizens buying some 601 tons through the third quarter, it’s on track to fall short of 2021 levels. Earlier in the year, Covid-19 lockdowns hampered purchases of jewelry and bullion in one of the world’s top consumers.

For China, the need to find an alternative to dollars, which dominate its reserves, has rarely been stronger. Tensions with the US are high following measures taken against its semiconductor firms, while Russia’s invasion of Ukraine has demonstrated Washington’s willingness to sanction central bank reserves.

Russia

Russia is the world’s second-biggest gold mining nation, typically producing more than 300 tons a year. Before February 2022, it exported metal to trade centers like London and New York, but also to nations in Asia.

Since the invasion of Ukraine, Russia’s gold has no longer been welcome in the West, while China and India have been reluctant to import huge quantities. That raises the possibility the central bank could step in to buy those supplies, but Russia’s overall foreign exchange reserves, including gold, have declined this year.

Russia’s reserves of dollars and euros were frozen by sanctions, making it less attractive for the central bank to add to them. Moreover, it doesn’t break out its holdings of gold separately.

The nation has been a massive buyer of gold in the past, spending six years accumulating bullion before stopping at the onset of the pandemic. Russia said in February, after the invasion of Ukraine, that it was ready to buy gold at a certain price, but Deputy Governor Alexei Zabotkin said last month that purchases were no longer practical as they would push up money supply and inflation.

Oil Exporters

Few nations have done better out of this year’s energy crisis than Gulf oil exporters. Saudi Arabia, the United Arab Emirates and Kuwait have all reaped a windfall, and some have been plowing cash into foreign assets through sovereign wealth funds.

They may have looked to gold to diversify. Saudi Arabia has the biggest gold hoard in the Arab world, but hasn’t reported a change in its holdings since 2010. Back then a “difference in accounting” led to its reserves doubling to 323 tons.

India

India’s central bank has made large gold purchases before, buying 200 tons from the International Monetary Fund in 2009. Since then it’s tended to buy more gradually, while providing timely updates to the market. It may have shied away from splashing out on gold this year, given the pressure on its currency. That’s been exacerbated by strong imports of precious metals for its consumer sector in recent months.

Not long after the first gunfire erupted at the onset of Russia’s invasion of Ukraine, Russia fired another multi-pronged shot, straight across NATO’s financial bow.

First, and as a reaction to the crippling sanctions and its exclusion from the global SWIFT money transfer system imposed by the West, it moved quickly to protect the ruble by raising interest rates to 20 per cent (subsequently lowered to 11 per cent) and imposing capital controls. Then it demanded that all “non-friendlies” (the West) could only use rubles or gold to buy its much-coveted oil. Russia, which has spent the better part of the last decade getting rid of its U.S. dollars and increasing its gold reserves, also offered to buy gold (mostly from its captive gold-mining sector) at the rate of 5,000 rubles per gram. Russian President Vladimir Putin is advocating that BRICS economies look into creating an international reserve currency using the basket of their own currencies. Finally, he started making noises about creating a gold-backed ruble.

A Global Monetary Reset Is Here; Countries No Longer Want to Be Held Hostage, Warns Frank Giustra

In an exclusive interview with Daniela Cambone, billionaire philanthropist, Frank Giustra lays out his thesis for the global monetary reset already underway. We're at the beginning of a currency war, "and I'm absolutely certain we're heading into a global monetary system reset," warns Frank Giustra, CEO of the Fiore Group. He tells Daniela Cambone, Russian President Vladimir Putin and Chinese President Xi Jinping, "have made it very clear they want an alternative to the U.S. dollar," after being held hostage by the currency for so long. Predicting that the dollar will lose its status as the world's reserve currency, Giustra says China will be victorious in its efforts to solidify a new central bank currency backed by gold.

"Everybody, and I mean everybody, should own physical gold," he says when asked about the increasing privacy issues posed by technology. "I think the pivot is around the corner, the [Fed's] math doesn't make any sense," claims Giustra when asked about the rate-hike cycle currently underway for the central bank. "The Fed is trying to talk inflation and something is going to break, they've ruined the American dollar," he concludes.

Who is Frank Giustra? Like Lassonde, not someone you should ignore:

Frank Giustra CM OBC (born August 22, 1957) is a Canadian businessman, mining financier and global philanthropist, who also founded Lionsgate Entertainment. He is CEO of Fiore Group of Companies and co-chair of International Crisis Group. From 2001 to 2007, he was the chairman of the merchant banking firm, Endeavour Financial, which financed mining companies.

MORE FROM THE CAMBRIDGE UNIVERSITY STUDY MENTIONED ABOVE:

The Puzzle: Is BRICS a De-dollarization Coalition?

It is puzzling why BRICS remains understudied as a de-dollarization coalition for two reasons. First, given the aggregate size of the BRICS economies and markets, as well as the risk of sanctions, the BRICS countries should theoretically have the collective motivation to de-dollarize their international settlements to reduce currency and sanction risks. Historically, all five members have experienced US sanctions, with Russia and China still under various levels of US sanctions. The shared frustrations of the five members should provide strong incentives for them to mobilize toward de-dollarization. Second, reducing dependence on the US dollar and diversifying the global currency and financial system was a publicly declared priority for BRIC when the group first gathered in 2009. When South Africa joined in 2010, BRICS reiterated its shared interest in this issue.

A de-dollarization coalition is likely to emerge when members of the dollar-based system are dissatisfied with the international status quo, including the dollar’s exorbitant privilege, the incumbent US global leadership, and the existing rules and norms. Rising powers continuously renegotiate the international status quo as they seek to increase their influence and status, aspiring to become rule-makers and agenda-setters in global finance.

However, their dissatisfaction with the system is particularly pronounced and gives rise to a counter-hegemonic coalition when they face direct threats to their financial and geopolitical autonomy. Such threats include being targeted by hostile and coercive policies or having the existing system experience a severe crisis or a shock.

When rising powers seek greater financial and geopolitical autonomy in response to a perceived threat of sanctions and currency risk, they are likely to focus on developing and accelerating “go-it-alone” strategies that emphasize the creation of new nondollar-based institutional and market mechanisms. While developing alternative institutions and markets is a long-term project and requires significant resources, rising powers would pursue fairly low-cost and near-term “reform-the-status quo” strategies to increase access to the existing trading system and global capital by using nondollar currencies and diffusing the dollar’s dominance.

A rising power coalition can promote the use of local currency in the existing global trading system to weaken the US dollar’s dominant vehicle currency status. Its members can reduce their own holdings of US dollar reserves or dollar-denominated assets to defend themselves from currency and sanction-related risks. The coalition can also seek to diversify the existing global currency composition by promoting alternative currencies, such as other national currencies, supranational currencies, or even digital currencies. Finally, coalitional members can also create and expand nondollar-based equity markets in the existing global financial system to divert capital away from the dollar-based markets.

The most recent de-dollarization milestone was achieved amid the COVID-19 pandemic at the BRICS 2020 Summit when BRICS agreed to reinforce and advance the current de-dollarization processes. Under Russia’s chairmanship in 2020, the group jointly issued the Strategy for BRICS Economic Partnership 2025. This Strategy reiterated the members’ long-standing commitment to reforming the Bretton Woods institutions. More importantly, it identified several “priority areas of partnership” directly related to de-dollarization, including: to promote the use of local currencies in mutual payments, to strengthen BRICS cooperation on payments systems, to collaborate on the development of new financial technologies, to advance the CRA mechanism, to continue cooperation on establishing the BRICS Local Currency Bond Fund, and to continue to facilitate the NDB in development financing while expanding the use of local currencies (BRICS, 2020).

Over the past two decades, BRICS has shown consistent commitment to reforming the global financial system and diversifying the global currency structure. Catalyzed by the global financial crisis and the COVID-19 pandemic, the group has implemented targeted policies and broadened areas of cooperation to help members reduce their dependence on the US dollar.

While the NDB represents a BRICS’ coalitional challenge to the US dollar’s dominance by establishing a new multilateral institution governed by its members, there are also important de-dollarization trends in the global oil market that can be augmented by expanding BRICS energy cooperation.Footnote 12The US dollar’s hegemonic position in the global financial system has been critically grounded in its exclusive position as the funding vehicle and pricing currency of the global oil trade. The world’s leading crude oil pricing benchmarks, namely the West Texas Intermediate (WTI) and Brent, are priced in US dollars. Scholars have argued that “the main front where the future of the dollar will be decided is the global commodity market, especially the USD1.7 trillion oil market” (Reference LuftLuft, 2018). The use of nondollar currencies in global oil markets “is a serious challenge to the petrodollar system” (Reference FosterFoster, 2018). BRICS as a group is certainly strong enough to mount that challenge: in terms of consumption power and forms a bigger oil-importing bloc than the entire European Union. China, the world’s largest energy importer, and Russia, the world’s largest energy exporter, are mobilizing within BRICS to promote “yuan oil futures,” thereby challenging the US dollar’s hegemonic position in the global oil market.

China’s new oil futures are priced in renminbi, and renminbi is also convertible into gold on the Shanghai Gold Exchange and Hong Kong Gold Exchange.Footnote 13 This process has led to China, the world’s largest oil importer, having an entirely domestic infrastructure for trading oil using gold, and that China’s oil suppliers can receive payment in renminbi and immediately convert it into gold. This shift marks the beginning of a nondollar financial instrument and nondollar price discovering mechanism for a major global commodity. The Shanghai-traded yuan oil futures still lag behind rivals such as the London-traded Brent oil futures and the New York-traded WTI oil futures in terms of volume, but they have already surpassed comparable offerings traded in Tokyo and Dubai by a significant amount (Figure 5). The renminbi oil futures’ accelerated growth has received the attention of leading central bankers in advanced economies. For example, Bank of England Governor Mark Carney (2019) observed that “the renminbi is now more common than sterling in oil future benchmarks, despite having no share in the market prior to 2018.”

The potential of the yuan oil futures to advance global oil trade de-dollarization goes even further when considering the linkage to gold. China has sweetened the yuan oil futures by providing trading infrastructure to facilitate swapping oil into gold, with the renminbi serving as an intermediary funding step. If BRICS had their own pricing benchmark for gold – rather than being subject to London or New York’s pricing – this infrastructure would potentially complete the goal of de-dollarizing the global oil trade, making it possible to trade oil using gold with minimum exposure to exchange risk.

It’s one thing to be looked at as a conspiracy theorist for speculating on the motivations of global players and the potential manipulation of metal prices, but it’s another to be willfully ignorant of facts. The facts clearly indicate that even if retail buyers aren’t seeing a reason to buy gold, central banks are.

Cambridge Core

Can BRICS De-dollarize the Global Financial System?

Cambridge Core - Economics: General Interest - Can BRICS De-dollarize the Global Financial System?

Already have an account?