Trending Assets

Top investors this month

Trending Assets

Top investors this month

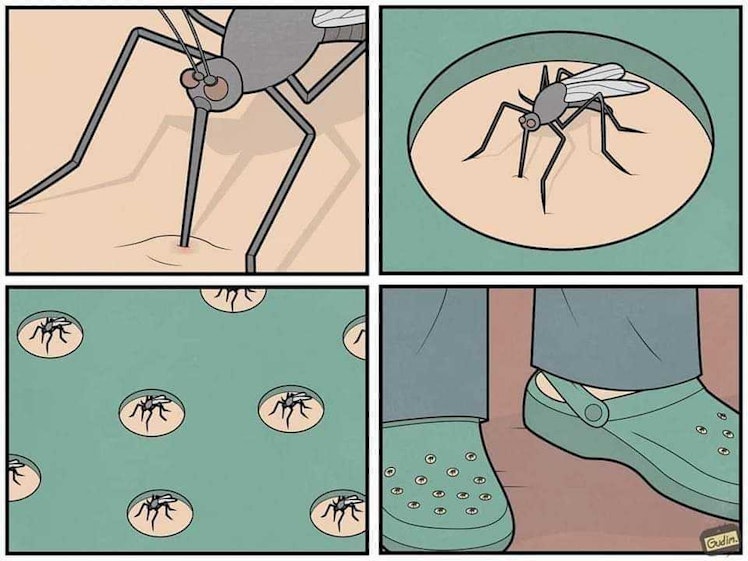

There's holes in the Cros Thesis

First, the good stuff:

• $CROX has excellent profitability.

• Revenue has tripled

• EPS turned from a loss to $8.82 in just five years.

Yet, it dropped over 20% from its recent high, and its forward PE ratio fell to 10, falling short of its 5-year average by around 50%.

For a company with significant growth prospects, this valuation seems cheap.

Why has it been dropping?

Here are the holes in the Cros thesis:

• The acquisition of HEYDUDE, a casual footwear brand

• Longer term liquidity issues

• Changing tastes / roll-off of pandemic interest

HEYDUDE

• HEYDUDE adds significant debt to Crocs' balance sheet.

• HEYDUDE's margins are much lower than Crocs. In 2022, the gross margin for the Crocs Brand was 56.3%, while the gross margin for HEYDUDE Brand was 40.8%.

Liquidity Issues

Over a longer-term horizon, 2029 will be a challenging year for Crocs Inc. as a $350 million redeemable senior notes and the $2 billion term loan facility will mature.

Changing Tastes

Leisure footwear is a semi-discretionary product. During the pandemic, people who normally wouldn't buy Crocs because of the look did choose to buy for the comfort. But as the world returns to normal, it remains to be seen if these people will remain long term buyers of Crocs.

If you're thinking about buying $CROX, remember, Crocs have holes!

Already have an account?