Trending Assets

Top investors this month

Trending Assets

Top investors this month

InMode Roundup $INMD

Since early 2021 we've had a group of people on Commonstock watching InMode, a company that makes non-Invasive aesthetic procedure devices.

I thought it would be fun to do a roundup of different thoughts and wins the Commonstock community has had about $INMD over the last couple of years:

"I think society will demand aesthetic treatments at a much higher rate moving forward. I consider this a huge thematic trend." — Pat Connolly, 2/2/21

"Overall institutional ownership is 60.42% of shares outstanding as of Q2 2021." — Hedge Vision, 9/27/23

"To understand InMode's distribution and product, check out their Instagram page. Inmode's customer isn't the end user, it's the medical office. Once an office buys a device, they jump onto social media to educate consumers on their new service. This is a really powerful cycle that drives both patient interest in the treatments and medical office's desire to invest in an InMode device." — Pat Connolly, 1/10/22

"InMode has 46% profit margin. 5-year sales growth is over 25%. Return on Equity over 25%."

"Quality companies don't trade for cheap. Here are some names in my portfolio that say otherwise: $INMD 37.88% ROIC. PE 15." — The Thinking Investor, 8/1/23

"InMode management brings up their goal of 83-85% gross margins on nearly every single conference call. They will not budge on these margins, and even though they've had supply chain issues, their latest quarter still was >83% GM. Throughout the time they have gone public, they have kept this number in their guidance range." — The Thinking Investor, 8/8/22

"Incredible margins for a company with TTM rev up 41%, profitable, and FCF/S of 45% TTM. Buying back shares as well." — Steve Matt, 9/28/22

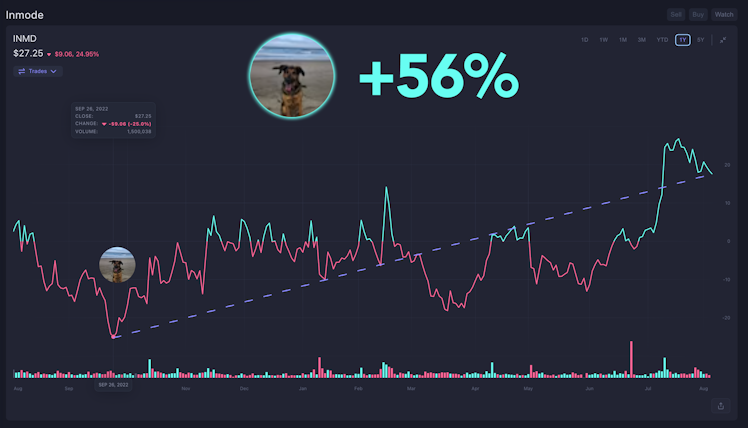

Steve also bought the stock at that time. He's still holding, and is up 56% on his position:

"How is $INMD different from other medical devices companies? 1) Direct sales model 2) Emphasis on research and development 3) Emphasis on minimally invasive treatments."

"InMode trades at 13x FCF, despite growing sales by 51% annually over the last five years and 31% YoY in its previous quarter. $INMD offers non and minimally invasive procedures that are an alternative to many older plastic surgery techniques." — Josh Kohn-Lindquist, 7/12/23

"InMode's balance sheet is truly incredible, with strong returns on their invested capital and assets, attractive gross margins, and impressive growth in their income, EBITDA, and revenues. They also have reasonable valuations on earnings and FCF ratios, though their P/E ratio to growth figures looks highly unattractive, with a PEG ratio of 194. My main concern for the stock is that plastic surgery is hardly what you would call ‘necessary spend.’ In periods of macro-economic difficulty, InMode may struggle. There was some evidence of this in 2022, when revenue growth fell of a cliff to 27% from 74%. However, this is still a decent growth figure and may suggest that the high-income nature of the patients interested in plastic surgery provides some buffer on the downside." — Jared Leary - Hourglass, 8/4/23

www.instagram.com

Login • Instagram

Welcome back to Instagram. Sign in to check out what your friends, family & interests have been capturing & sharing around the world.

Already have an account?