Trending Assets

Top investors this month

Trending Assets

Top investors this month

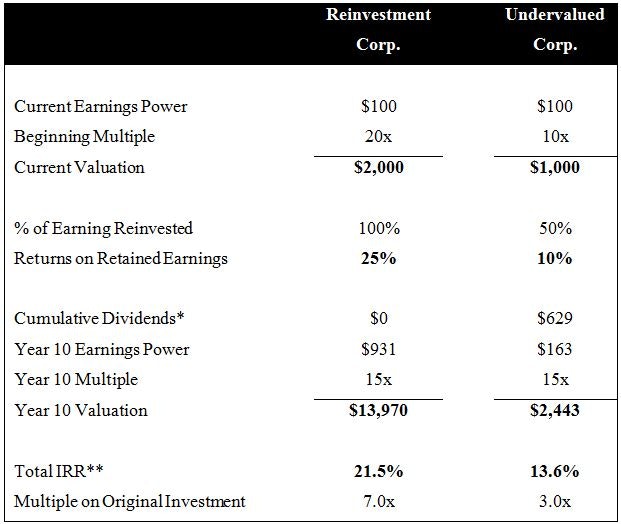

The Power Of Quality Businesses

This is a great description of the power of quality.

Source: Saber Capital

What this figure shows is:

- You can buy a business at more expensive prices and earn higher returns.

- Great companies earn high returns on retained earnings.

- If companies can reinvest earnings at high rates, their best allocation decision will be to keep pumping it back into the company and avoid dividends.

- Even if the company gets a lower exit multiple, the earnings power gives you your margin of safety.

When I posted this on Twitter, a few people mentioned that quality companies don't trade for cheap. Here are some names in my portfolio that say otherwise:

$INMD 37.88% ROIC. PE 15.

$QFIN 51.54% ROIC. PE 2.6

I don't mess with companies that have one off high ROIC numbers which drastically regress to the mean. While I admit the numbers above will slightly subside over time, they are taken during pretty poor economic conditions. If you hunt for quality that is well priced, you will find stocks that other investors are afraid to own.

Already have an account?