Trending Assets

Top investors this month

Trending Assets

Top investors this month

50% off Highs, Is NKE Stock a Buy?

Down almost 50% from highs, is Nike stock $NKE undervalued?

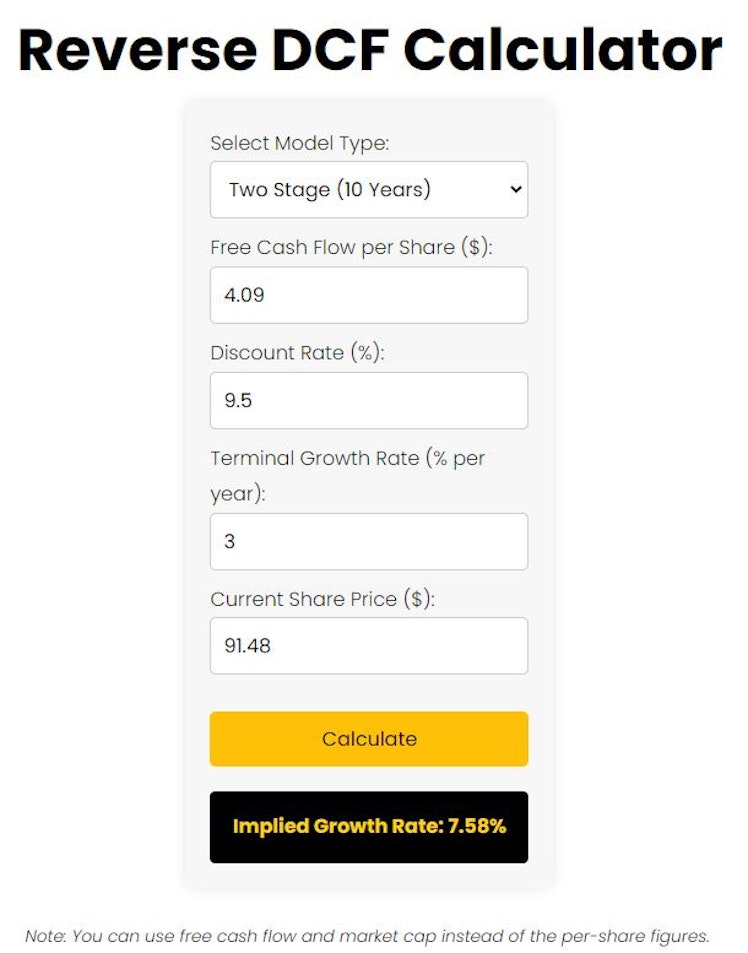

Using our reverse DCF calculator, the market is pricing NKE to grow its free cash flow by 7.58% for the next 10 years, and then by 3% every year after that. See the image below.

Can NKE achieve this growth? Analysts' FCF forecasts state that it can grow its FCF by 11.3% annually for the next 3 years.

The 9.5% discount rate (required rate of return) was taken from finbox.com

Now, if your required annual rate of return is 11%, NKE would need to grow FCF by 10.7% every year for the next 10 years.

Check out our reverse DCF calculator here: https://investorscompass.com/reverse-dcf

Investor's Compass

Reverse DCF — Investor's Compass

Already have an account?