Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why Bitcoin $BTC.X Makes Sense

Over past few years, quite a few people have reached out to me asking if they should buy Bitcoin. I usually respond with links to several of the best resources I know but have found that this can be a bit overwhelming. So I made an attempt at writing one definitive guide that I can send to people instead. In it, I do my best to explain the following topics:

- The problem Bitcoin solves

- What is money and why are some forms of money better than others?

- Will society converge on Bitcoin as a store of value?

I hope it's helpful.

The full essay can be found here, but for the sake of brevity, I'm posting the key points below:

- Bitcoin is fundamentally a computer science breakthrough that builds on decades of research and allows economic value to be transferred over the Internet w/o a trusted intermediary (e.g. bank or government). This was previously impossible.

- Why does this matter? In Satoshi's words: "The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust."

- In the US we don't really have to worry about this yet. But in countries w/ high economic volatility (e.g. Venezuela, Turkey) the value prop is immediately clear. Wences Casares describes how he saw his parents--sheep ranchers in Patagonia—lose their entire savings 3 times: "the first time because of an enormous devaluation, the second time because of hyperinflation and the last time because the government confiscated all bank deposits." This is ultimately the problem that Bitcoin hopes to solve and why it is such a big deal.

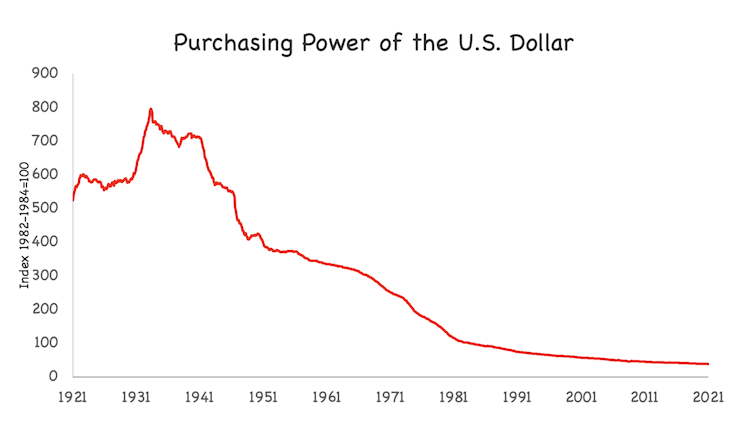

- Bitcoin is a store of value & protects citizens of countries w/ generally trustworthy institutions too. 2% inflation in the US may not sound like a lot. But if it's phrased as: "your dollars will lose half of their purchasing power every 30 years" are you a little more concerned?

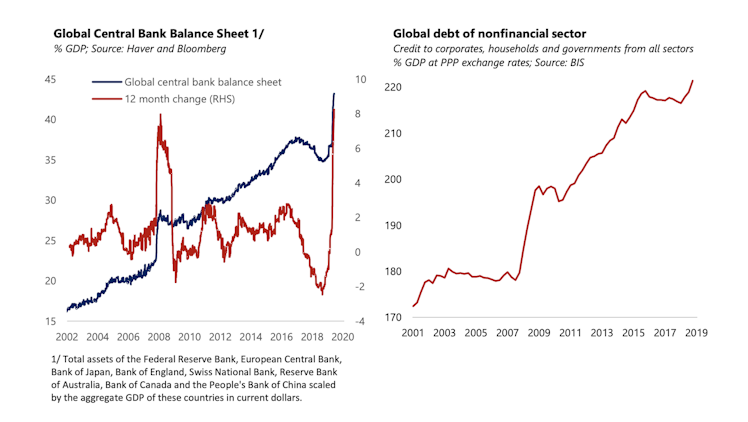

- And the situation is getting worse. Last year, western govs printed unprecedented quantities of money. As their dollars are worth less and less each year, I expect rational actors (citizens, corporations, foreign govs, etc.) to turn to BTC as a store of value & hedge.

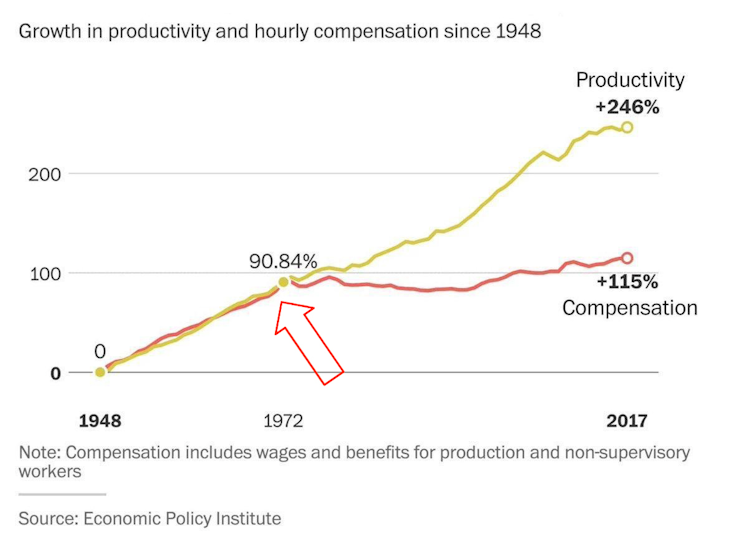

- While it might seem like the norm, a global fiat monetary system is only a 50yr experiment that began when Nixon decoupled the dollar from gold in 1971 (about the time we started to see a massive wealth transfer from labor to capital & growing wealth-inequality)

- Money is simply technology that makes our wealth today available for consumption tomorrow. Throughout human history, many things have served as money (e.g. gold, silver, salt, cattle, etc).

- What makes money unique is that we value it not for its own sake, but for its prospective exchange utility—we hope that whatever we choose to store our money in keeps its value long enough so that we can trade it in the future for stuff we actually want.

- Nobody actually wants little green pieces of paper. Nobody wants Bitcoin either. What people actually want are the things they can trade these monies for in the future, such as a car, a house, a vacation, etc.

- Throughout history, various monies have coexisted along a continuum of "soundness" (how well they keep their value), and they've always been subject to competitive network effects. In my view, Bitcoin is the most sound form of money we have ever come across.

- 12/ Carl Menger, the father of the Austrian school of economics, believed the key property that leads to a good being freely adopted as money is: salability (the ease with which a good can be sold on the market whenever its holder desires, with the least loss in its price).

There are 3 main dimensions of salability for any monetary good:

- Salability across scales: can be divided into smaller units or grouped int larger units

- Salability across space: ease of transporting.

- Salability across time: how well it holds its value into the future

- Many potential monetary goods fulfill the first 2 criteria but the last one (salability across time) is the most crucial. Money must be immune to deterioration & its supply cannot increase too drastically. The difficulty of producing new units determines its "hardness"

- Money whose supply is hard to increase is “hard money,” while “easy money” is money whose supply is easy to increase. The oldest fiat money in existence today is the British Pound. 371 years ago one pound of silver bought you 1 GBP . Today, one pound of silver buys you 174 GBP

- The supply of GBP in circulation increased at a dramatically greater rate than that of silver, and as a result the GBP depreciated more than 99% over the passing years. The same is happening with the U.S. dollar today.

- Hardness (aka scarcity) is why gold emerged as history's predominant store of value. Its supply growth has remained constant at ~2% (silver's was 5-10%). For thousands of years, gold was the best we could do in terms of a monetary good that could maintain its value over time.

- However the invention of Bitcoin has created the first truly scarce form of money to ever exist. With Bitcoin, we have a precise measurement of supply: 21,000,000, that anyone can audit with their home computer.

- Thus BTC is actually an even better embodiment of gold's most essential monetary property—scarcity. Not to mention the fact that gold is extremely difficult and costly to transport while just the other week someone transferred 19.6k BTC (~bn) in less than an hour for $39.

- While people can use whichever goods they please as their media of exchange, those who use hard money will benefit most, losing very little value due to new supply. Those who store their wealth in easy money will likely lose that wealth as new supply drives the price down.

- Beyond scarcity, the other important aspect of a monetary medium’s salability is its acceptability by others. Unlike other goods w/ intrinsic value that can be valued using a DCF, the value of monetary goods is set game-theoretically.

- Everyone values the good based on how much other participants will value it. If they correctly anticipate the "right money", they will become very wealthy. Furthermore, acquiring a good in hopes that it will be a store of value hastens its adoption for that very purpose.

- This feedback loop drives societies to quickly converge on a single store of value. In game-theoretic terms, this is known as "Nash Equilibrium." Ultimately, as long as a supply boost doesn't accompany the convergence, the feedback loop is hard to stop once it gains momentum.

- The harsh reality is that we are all forced to guess—-implicitly or explicitly-—which monetary good society will converge upon as a store of value, and as Paul Tudor Jones puts it, in this scenario, you just want to own "the fastest horse".

- I agree w/ PTJ. This movement started with early adopters & now we're seeing companies like MicroStrategy ($MSTR), Square ($SQ) & Tesla ($TSLA) hold BTC on their balance sheets. And we may soon see govs get involved. The odds of Bitcoin succeeding are increasing every day.

- Volatility is an issue but money has always evolved in stages, with the store of value role preceding medium of exchange. Meanwhile, I'd much rather own something appreciating at 200%/yr w/ high volatility than something losing 2-10% of it's value each year w/ no volatility.

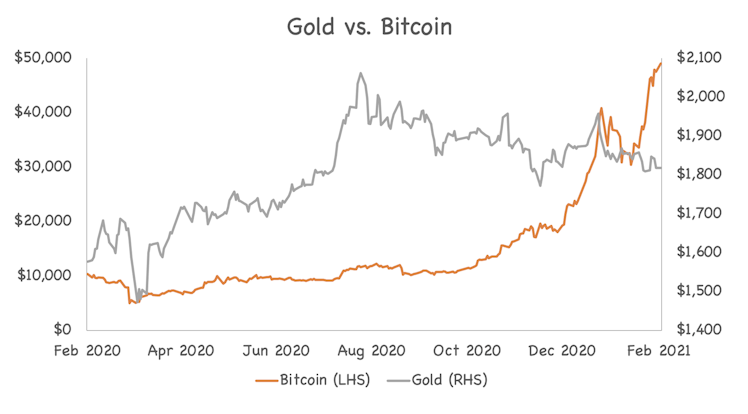

- Long story short, holding BTC over the long-term aligns yourself with the macro mega-trends of technological advance & currency debasement, both of which appear to be accelerating. The market appears to be warming up to this view by the looks of how it's pricing gold & BTC.

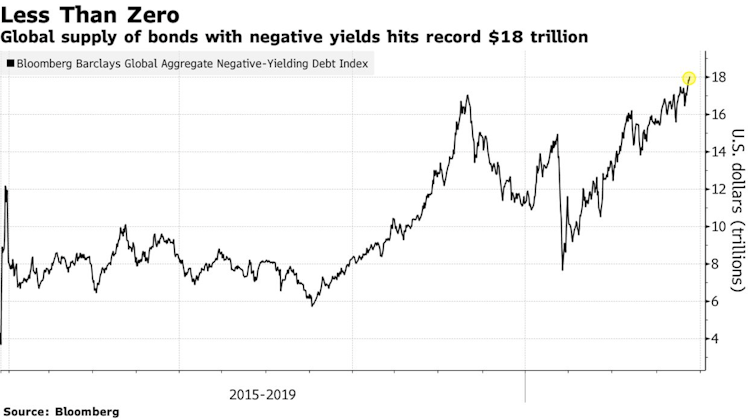

- Just for reference, if BTC's market cap eclipses that of gold ($10 trillion) that would put the price of roughly $500k per bitcoin. But the TAM is probably much bigger than gold. You don't have to look much further than the world's $18 trillion pile of negative-yielding debt.

Already have an account?