Trending Assets

Top investors this month

Trending Assets

Top investors this month

10 Market Lessons I Learned the Hard Way

These are 10 market lessons I’ve picked up over the years that have cost me tens of thousands of dollars. However, I don’t regret losing this money, as each mistake was a stepping stone that guided me forward as an investor.

In no particular order:

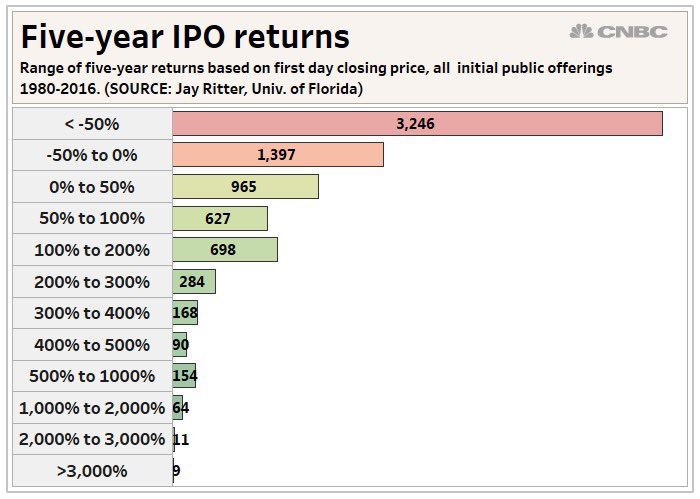

- Don’t rush to buy IPOs.

In a study conducted by the University of Florida from 1980-2016, 3,246 companies returned -50% or less compared to their first day’s closing price over a 5-year period. 1,397 returned -50% to 0%, and 3,070 returned 0% or greater.

It’s always reasonable to wait for the first earnings report, or at least until major share lock-up periods expire. Many hyped up IPOs that I have tracked over the past 5 years have fallen below their opening-day IPO price at some point in time, highlighting the need to be patient when targeting a newly traded company. These include: SE, SNOW, CRWD, NET, UBER, and many more.

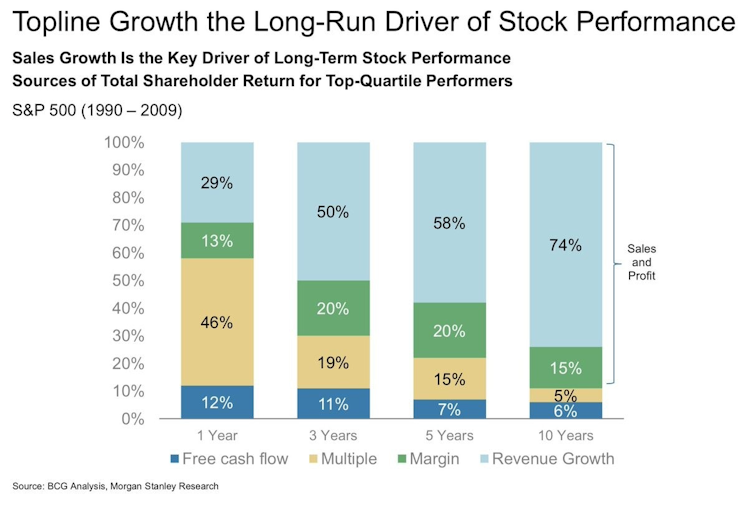

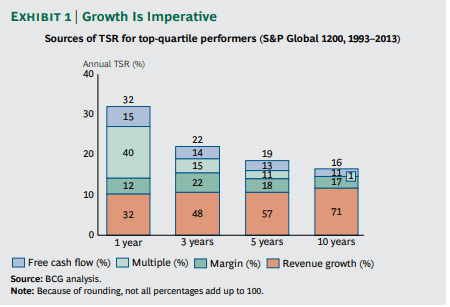

- Revenue drives long-term stock performance.

In a joint research study, Boston Consulting Group and Morgan Stanley concluded that revenue growth, or sales growth, is the major key driver for stock appreciation over the long-term.

Note: Topline growth is synonymous with revenue/sales growth.

TSR= Total Shareholder Return.

The effect of revenue on stock performance is most evident when moving from Year 1 to 3 and increases each year. The longer the time horizon, the more important revenue growth becomes for the shareholder.

- Patience is a trait that most people aren’t born with.

I can personally attest to this, as I never held a stock for longer than one year until my 3rd year of market experience. I started off day-trading and swing-trading biotech penny stocks/stocks I interacted with in my daily life and transitioned into short-dated options after I blew up my account. After I blew up my account for a second time trading options, I knew that I needed to change my strategy.

After I graduated college and got my first high-paying job, I realized I needed to reduce my risk, as I had more money than I ever did before and needed to pay for my own costs of living. I revamped my strategy to play the “long game,” and I haven’t looked back since. My returns have improved drastically and my portfolio risk and stress have plummeted in the process.

- Opportunity cost is an under-looked aspect in investing.

It’s extremely frustrating to hold a stock down 10% the past 3 months while the overall market is up 3% in the same period. At first, I would overlook this and think to myself that I needed to be more patient. It’s fine if a stock you own outperforms the market for a few months, but when exactly do you call it quits and realize that you just made a bad investment decision? There’s really no fine line answer to this question, and I generally hold an underperforming stock for ~10 months before seriously reevaluating my holding. Nothing material may have changed about the company, but if a stock I own has been seriously underperforming the market while other stocks in general are outperforming the market for an extended period of time, then it is simply a matter of capital allocation, bad timing, and missing out on opportunity costs.

- Form your own opinion instead of relying on the media (CNN, CNBC, etc.).

The media will try to rationalize every .1% move in the major indices, which is completely unhelpful to an investor. Popular financial media outlets like CNN, CNBC, and Fox News have a daily quota for deliverables, meaning they MUST publish a certain number of articles a day, regardless of a lack of material news. Financial reporters MUST talk about something interesting during their on-air time, and they could care less if the news is insignificant, as they are getting paid either way. A majority of news will have zero effect on the market, so it’s up to the investor to sift out the useless news from the useful news.

- Follow the smart money.

The smart money being institutional investors and hedge funds. Since large financial behemoths like Blackrock and Citadel hold thousands of holdings, I prefer to analyze funds with 50 or less holdings and a consistent record of market outperformance. Additionally, I keep track of the top performing funds in a 3, 5, and 10+ year range, as well as all hedge funds in aggregate, and observe which positions are picking up the most momentum in net buys/sells each quarter.

- It doesn’t matter if you buy a stock at $45 or $55 if you are investing for the long term.

Today, the price for one share of $SHOP is $1577.50. I can guarantee that any investor who purchased shares of Shopify in 2017 for $45 wishes they purchased more, whether it be at $45, $55, or even $100. Shopify is up a mind-blowing 4,701% the past 5 years, rewarding anyone who initially purchased shares at $788.75 or below a minimum 100% return.

- Buy the leader, not the losers.

Time and time again, investors rationalize to buy the 2nd best or 3rd best company in a certain industry because it is “cheaper” and has “more room for growth.” While this certainly can be true, the majority of the time the leader in an industry is the leader for a reason. The leader oftentimes has the highest revenue growth and gross margins, which are key contributors to stock price.

- Don’t fall for the allure of penny (biotech) stocks.

Biotech penny stocks are especially alluring to the fledgling investor due to the promises of boundless innovation and market expansion. Biotech stocks are especially risky due to the volatile effect that FDA approvals can have on share prices.

Penny stocks are risky in general due to their inherent nature. They’re cheaply valued for a reason, and the chance that you pick a severely distressed company that manages to revive their business spectacularly is low (but possible). However, the risk/reward ratio is not in your favor and an investor is much better off investing in financially healthy companies.

- Last, but not least, DO YOUR OWN DUE DILIGENCE.

I can’t stress this last point enough, as it is a summation of all the previous points. I have seen it happen countless times where an eager investor gets caught up following the opinion of someone else and ends up losing a large portion of their investment.

A list of hyped up stocks that have plummeted from their recent highs:

$ATER (formerly MWK): -78.33%

$DMTK: -57.18%

$FUBO: -58.08%

$NNOX: -69.70%

$SKLZ: -65.67%

foryoureyesonly.substack.com

Coatue Management - Philippe Laffont

Top Hedge Funds

Already have an account?