Trending Assets

Top investors this month

Trending Assets

Top investors this month

Citi's take on Plantir

Palantir talked a lot about AI, including comments about "unprecedented demand." But reported numbers were underwealming, with most leading indicators not signaling a growth inflection.

Total revenue was just in-line (+13% y/y), albeit towards the high end of the guidance, with largely unchanged full year revenue targets.

Customer addition momentum remained steady, though underlying commercial growth slowed vs. Q1.

While $PLTR may have some success commercializing GenAI-related offerings across their small but deep list of customers, given the deep domain knowledge, I still think packaging/monetization motion remains in its early days.

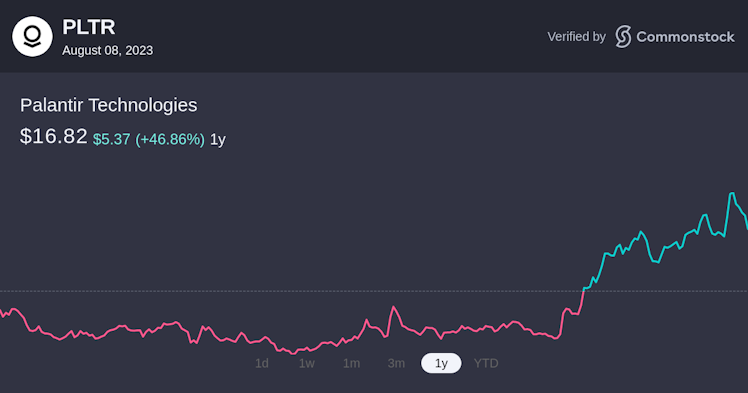

Shares are up 165% YTD and is trading at 17x EV/Sales, especially with stronger growth / clearer AI tailwinds than peers.

Citi's estimates slightly nudged up on better profitibility, but they reiterated a Sell / High-Risk Rating and $10 price target.

The recent run up does worry me, although their near-religious fanbase may hold them up over the short term

Already have an account?