Trending Assets

Top investors this month

Trending Assets

Top investors this month

Not a Market Timer? Just Buy $VOO

Pretty much any asset you buy is a form of market timing. For example, if you are buying a value tilted ETF such as $AVUV, you are timing that value will out perform the market in the future time period you will be owning $AVUV. This same principle goes for most secruities. If you buy $META, you are timing that $META will out perform the market in the time period you hold Meta for.

Since we all know how hard market timing is, why not just dollar cost average DCA into $VOO (or equivalent S&P500, total market, total international index fund)?

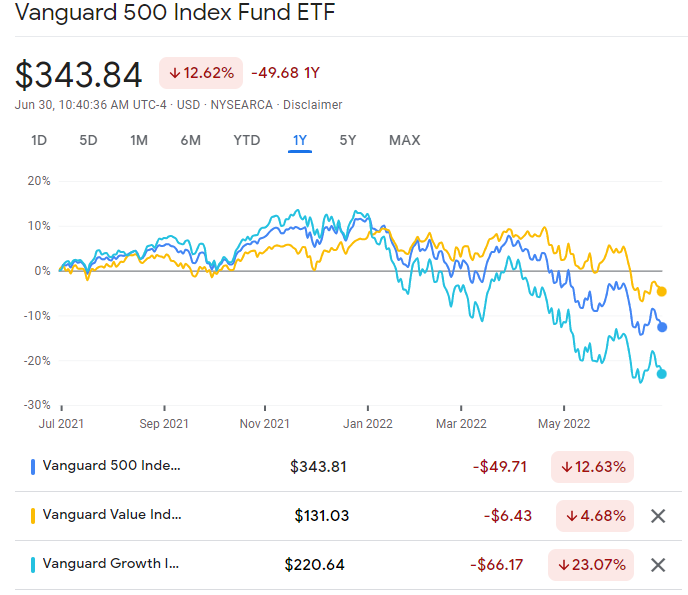

In the past year Value has outperformed the market

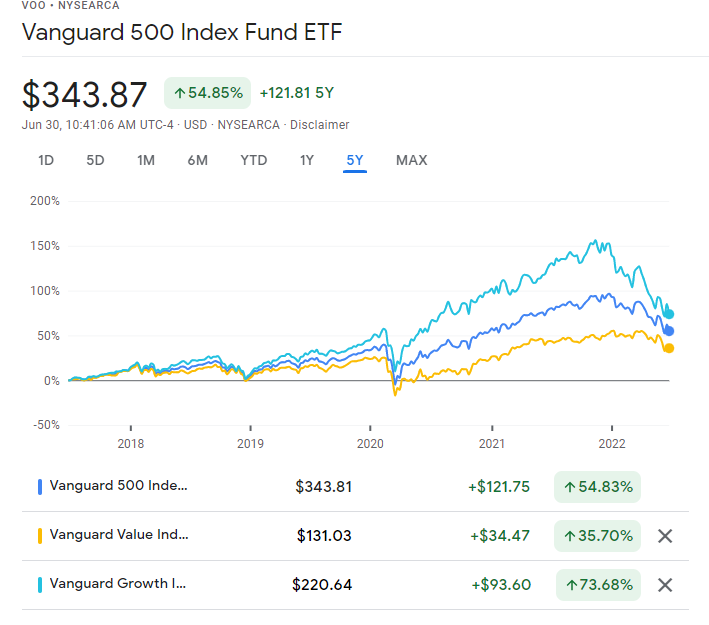

In the past 5 years Growth has outperformed the market

However, you can see in both time periods the market will always be right smack in the middle. Of course, if you invested in growth you would have been lucky and considered yourself a great market timer (until this year), and vice versa if you bought value this year.

My point is don't rely on luck. Just buy the market!

Already have an account?