Trending Assets

Top investors this month

Trending Assets

Top investors this month

Q2, A Distant Quarter

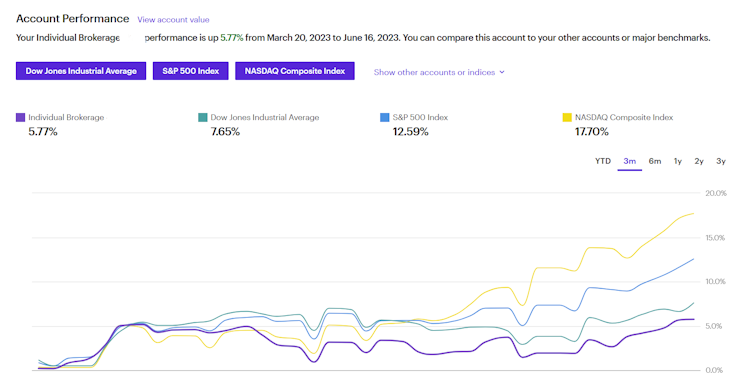

Over the last 3 months I have almost completely ignored my portfolio, all my positions, and any buying or selling of positions. This is likely what led to the big underperformance of the last quarter.

I lost my nearly 3-year streak of beating at LEAST the Dow Jones every quarter. Unfortunately, things have not gone too well (but not bad either), so let's take a look at some of the positions.

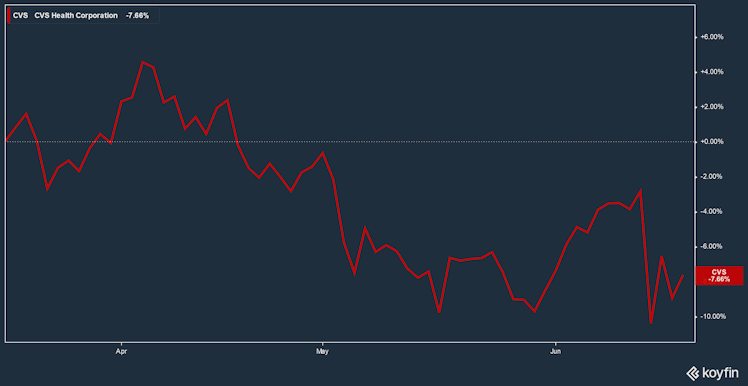

$CVS is up first as the positions lost about 8% over the last 3 months being one of the largest losers in my portfolio.

This dip in price has been led by a whirlwind of negative news, first a report detailing how a surge in older Americans are catching up on surgeries that we're previously put off because of the pandemic. This along with the $15.7 billion dollar settlement in Illinois over the opioid crisis, CVS will be paying that large new debt over the next 15 years.

Other than that no really negative news about the company itself which is good to see.

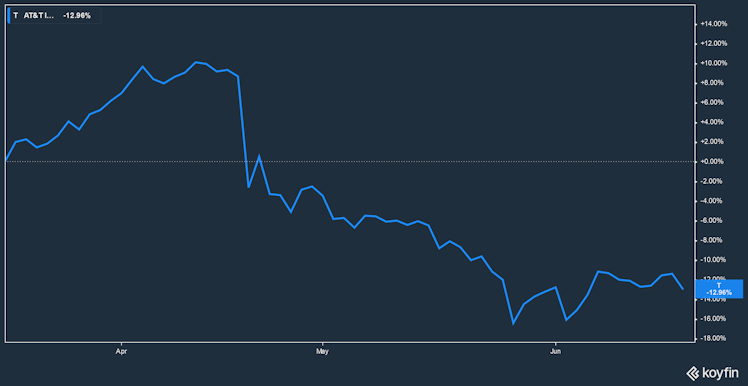

The main drag was their Q1 Earnings. Free Cash Flow came in lower than expected, but the rest of the quarter looked pretty good. Postpaid additions were solid, ARPU grew Q/Q, and 5G rollout + Fiber subscribers both saw an uptick and are on a good path forward.

It doesn't seem like there was to much wrong with the report other than investors (many of whom seem to still be income investors) balked at AT&Ts uneasy cash flow situation.

Those two seemed to be the biggest losers, Paypal ended up down in the last 3 months but only a few percentage points, everything else was up.

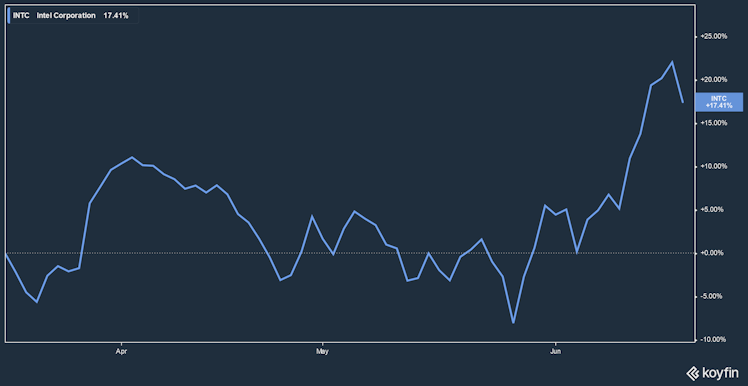

I must admit it feels really good to have Intel be the biggest winner of my portfolio in the last 3 months. $INTC really did;t have good news but instead benefitted strongly from Nvidias run on the back of AI.

The company has been quite busy however, from a new $33 Billion dollar plant in Germany (with government help that is), to new plants in Poland and Isreal, and several new product reveals.

Despite this a 17% rise from my largest position was unable to keep my portfolio afloat.

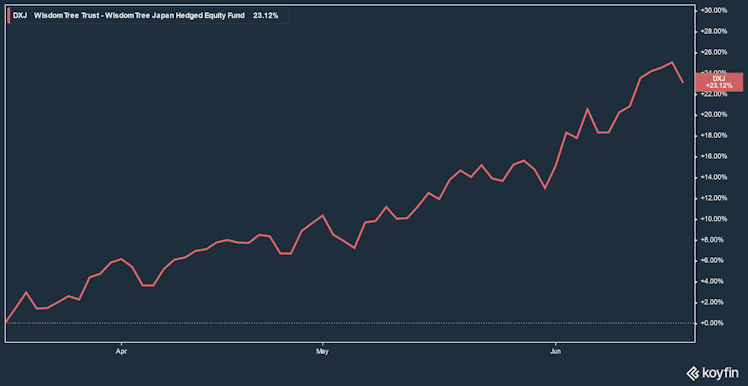

The other big winners are the pair of $DXJ and $DXJS. For a long time I have been a proponent of investing in Japan. The country recovering from the pandemic benefitted massively as its huge industrial sector recovered and the ETF has been rocking and rolling.

During this a report came out that most of this price action is from foreign investors looking to score big in the country. And this run, as seen nearly 40 years ago is being faded by Japanese investors who are running for the exits.

Given this development I imagine this performance will likely come to an end as international investors lose favor in the country.

Those were the high level, big stories from my portfolio over the last few months. Again it seems much of my underperformance actually came from a lack of activity, usually I am consistently bottom ticking my buys for my largest positions but that has been absent this last quarter.

Over the next few weeks I plan on getting back into the swing of things and continuing the consolidation of my portfolio into strong positions.

I hope you enjoyed this little recap and I look forward to future posts.

Fierce Network

AT&T lowers estimates for Q2 postpaid subscriber adds

Speaking at a Bank of America analyst event this morning, AT&T’s Chief Financial Officer Pascal Desroches said that AT&T expects its postpaid phone net adds in the second quarter to be abou | AT&T's CFO cited a few factors causing postpaid phone net adds to drop. One is that AT&T walked away from a government contract that it determined wasn’t sufficiently profitable, and that contract included 75,000 postpaid phones.

Already have an account?