Trending Assets

Top investors this month

Trending Assets

Top investors this month

3 Reasons to own $DHR

Sixth day of my "3 reasons to own" series, today with a compounding monster: Danaher

1st reason: Danaher is a serial acquirer. In 2021 they acquired 10 companies for over $10 billion. Why are they so good at acquisitions? Find out in the 2nd reason.

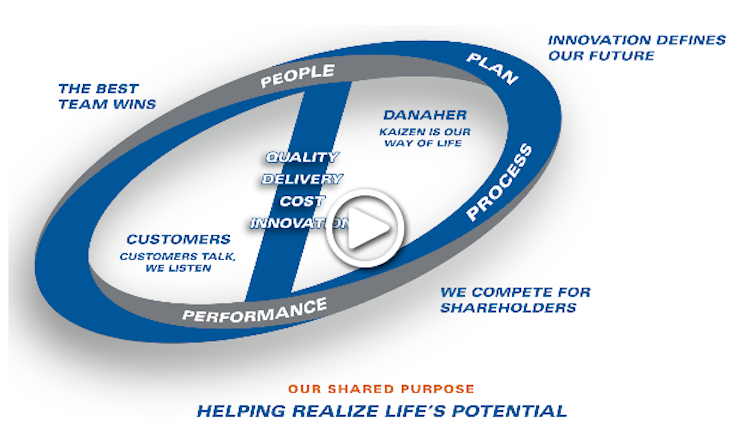

2nd reason: Danaher business system (DBS) was introduced in the 1980s and is a framework which is used for every decision in Danaher. To quote Danahers IR: " exceptional PEOPLE develop outstanding PLANS and execute them using world-class tools to construct sustainable PROCESSES, resulting in superior PERFORMANCE. Superior performance and high expectations attract exceptional people, who continue the cycle. Guiding all efforts is a simple philosophy rooted in four customer-facing priorities: Quality, Delivery, Cost, and Innovation."

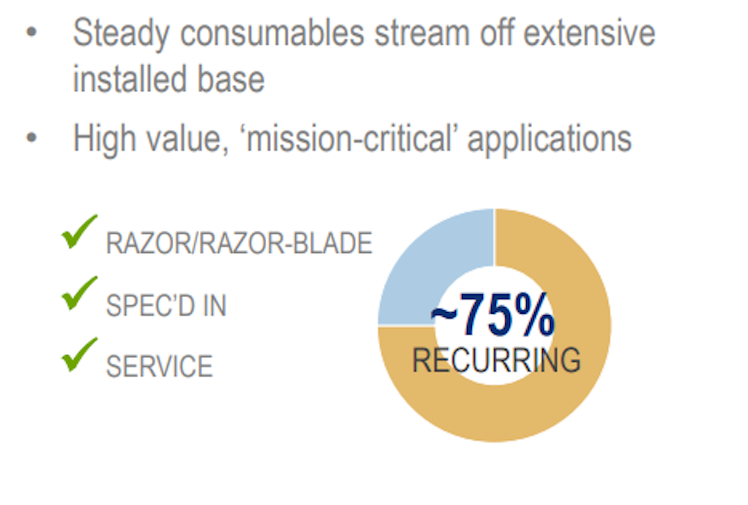

3rd reason: I looooove recurring revenues. If you thought that SaaS subscriptions are the only viable recurring revenue streams then think again. Danaher has 75% (up from 45% in 2015) of their revenues recurring. This is especially important for steady cashflows, which really help if you are a serial acquirer. Another company that has a similar business is $SRTOY, another holding of mine (I'll post about them next week, don't worry).

So I hope you enjoyed this post, tomorrow I'll be back with $TDOC

Already have an account?