Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update

Stocks are slightly higher, continuing yesterday’s momentum. Both $DIA and $SPY posted their biggest 1-day gains since January and are now poised to end the week higher. Now focus shifts to the FOMC meeting next week, with markets currently pricing in a 88% chance of a rate hike.

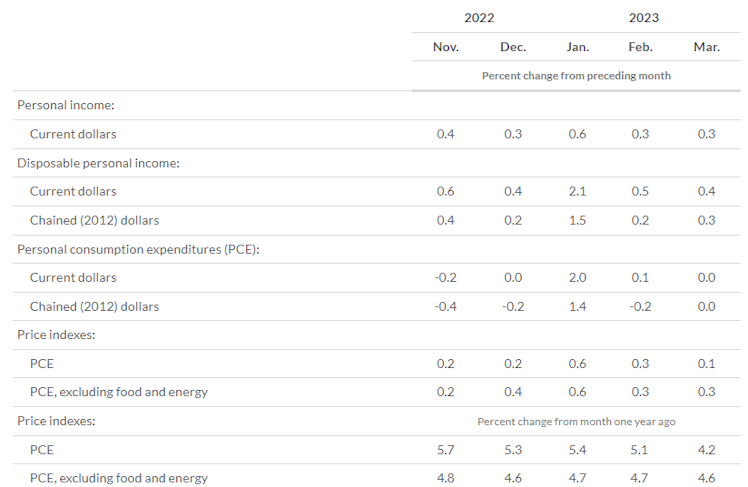

For economic data today, consumer spending was flat in March, matching expectations, while personal incomes were up 0.3%, just above expectations.

The PCE Index was up 0.1% for the month and 4.2% YoY, down from 5.1% the previous month. The closely watched Core PCE Index rose 0.3% in March and 4.6% YoY, just below the 4.7% reading the previous month.

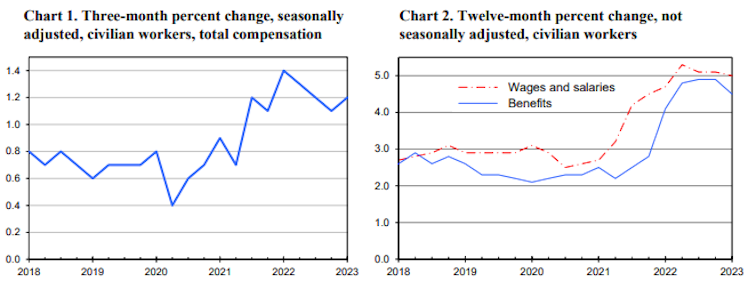

The Employment Cost Index increased 1.2% in Q1, above expectations of 1%. Wages and salaries were up 5.1% YoY.

Elsewhere, the final print of the April University of Michigan Consumer Sentiment Index was flat at a reading of 63.5.

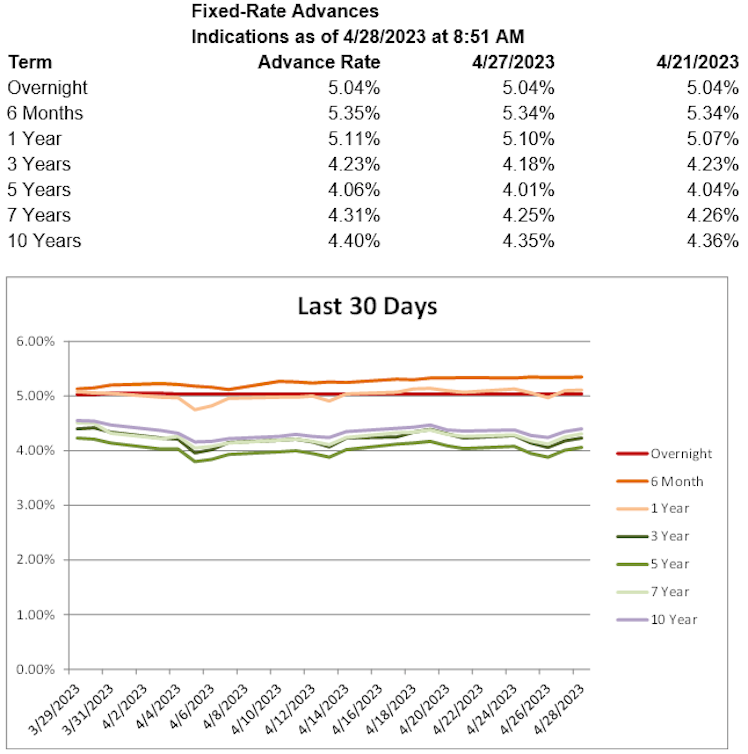

Treasury yields are lower, with the 2-year T yield down 3.7 basis points to 4.06%, the 5-year T yield down 6.4 basis points to 3.54%, and the 10-year T yield down 7.0 basis points to 3.46%. Advance rates are higher throughout most of the curve today.

Already have an account?