All in on Lithium America $LAC

Judgement day for Lithium America’s primary lithium mine of Thacker Pass is fast approaching. On 5 January 2023 the Nevada courts are expected to rule either for or against the construction of thackers pass the largest known lithium deposit in the USA.

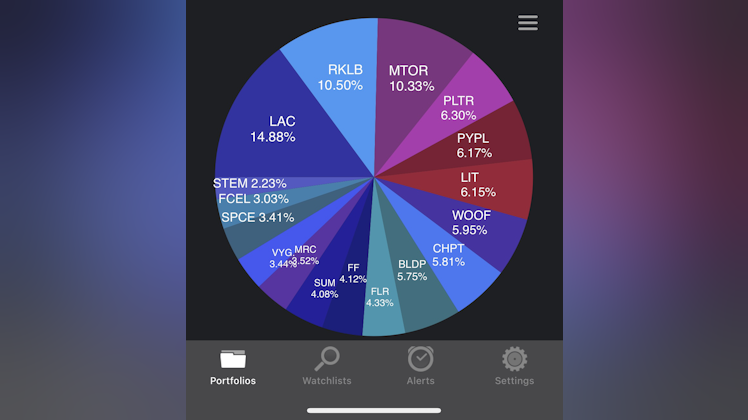

$LAC now make up just under 24% of my US portfolio as I’ve been quietly accumulating more stock every time the share price has dipped under $21

However, it is not entirely boom or bust on 5 January as the company also hold a 50% stake in a Chilean lithium mine which is expected to begin production in early 2023.

Analysts are still pricing LAC at around $38-$42 so there is quite some potential upside but I think everyone knows if the judge rules against the company on 5 January it’ll be a very red day.

I think LAC offers both a short term play (gambling on the 5 Jan decision) and a long term play (transitioning from construction to production)

I’m strapping myself in for the bumpy road ahead and I’ll see you on the other side :)

Nice update Oliver!