Trending Assets

Top investors this month

Trending Assets

Top investors this month

In the below extract, we share our $EVVTY analysis for Q2'23. For $GOOGL and $NVS, refer to our post: Evolution AB, Novartis, Alphabet - Q2'23 Earnings review (stockopine.com)

If you enjoy this memo, make sure that you subscribe to our newsletter. You can always join as a free subscriber, spend some time evaluating our work and decide later if you want to jump in.

-------------------------------------------------------------------------------------------------------------

Results

Source: Koyfin (affiliate link with a 15% discount for StockOpine readers) | We personally use Koyfin on a daily basis to screen for stocks, extract financial data and ratios, read earnings transcripts and run peer comparisons.

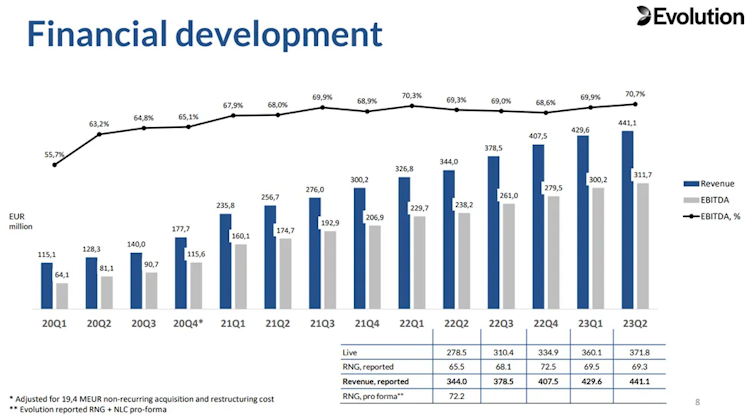

- Revenues of €441.1M, increased by 28.2% (33.5% for Live Casino and -4% for RNG).

- Live Casino accounts for 84% of total sales

- RNG increased 5.8% on reported figures but declined 4% on pro-forma figures (Nolimit City was acquired in 2022)

- EBITDA of €311.7M, increased by 30.8% - EBITDA margin of 70.7% Vs 69.3% in Q2’22.

- Operating Profit of €281.5M, increased by 31.2% - Operating margin of 63.8% Vs 62.4% in Q2’22.

- Profit for the period of €264.1M, increased by 31.5% - Profit margin of 59.9% Vs 58.4% in Q2’22.

Source: Evolution, Q2’23 presentation

Balance sheet

- Cashflow from operating activities of €233.8M (Vs €185.5M) – Margin of 53% (53.9%).

- Free cash flow of €223.2M (Vs €170.7M) – Margin of 50.6% (49.6%).

- Strong balance sheet with Cash and Cash equivalents of €541.7M (€293.9M Q2’22) compared to lease liabilities of €79.9M (nil debt).

Outlook

- RNG was supposed to grow by double-digits on a long-term basis, yet Martin Carlesund, CEO indicated that this will take more time than initially anticipated. RNG is accretive to margins.

- Roadmap of +100 games is intact (more than half in H2) with few interesting games announced.

“And as I said earlier in this presentation, we're already working on the road map for 2024 and creating the most advanced and large game show ever seen in the history of iGaming. Exciting times ahead.” Martin Carlesund, CEO

Other highlights

- New live casino studios in LatAm such as Argentina (launched) and Columbia (planned).

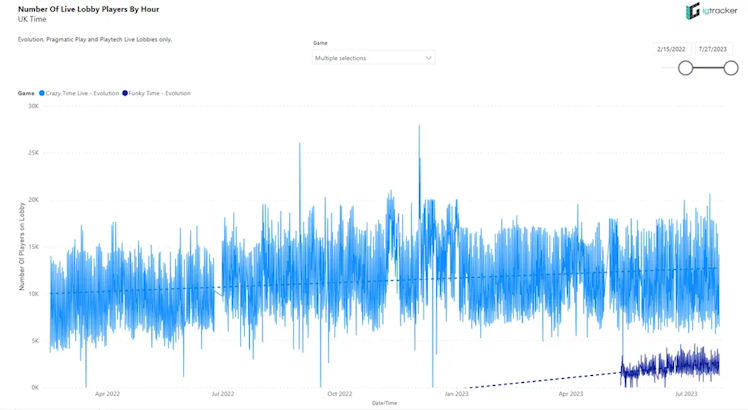

- Launch of Funky time (mid-May) – Looking at players reported by iGaming Tracker it appears that the launch is successful.

Source: iGaming Tracker Limited, Live Casino Player Numbers - Hourly Chart (igamingtracker.com)

- Largest market is Europe ~40% of total sales which grew by 15%, followed by Asia ~37% which grew by 48%. The fastest growing region is Latin America which grew by 61% (~7% of sales).

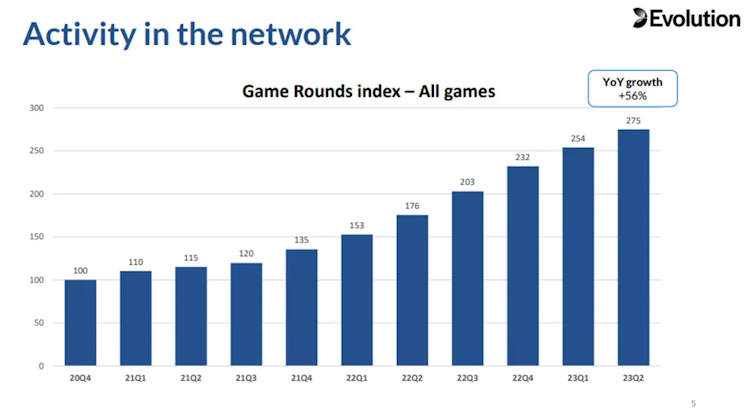

- Game rounds index – shows the development of game rounds played weighted by revenue contribution (measure of activity in its network) → Grew by 56% y/y (higher than revenue) → Why?

“The high growth in game rounds versus revenue partly reflects the volume of new players from new regions coming in with low bet sets.” Martin Carlesund, CEO

Source: Evolution, Q2’23 presentation

Final thoughts

Pros:

- Growth and margins remain healthy: a) above the assumptions implied in our valuation and b) EBITDA margin is in the higher end of the 68%-71% guidance.

- LatAm and Asia growth show that EVO is capitalizing on the opportunity.

Cons:

- North America’s revenue declined sequentially but y/y growth is still at 20%. A key catalyst will be the legalization in a new state (such as Illinois or Indiana) yet expansion of portfolio to existing states (already executing) is also important.

- Reported undersupply in Europe in tables (demand exceeds capacity) but management is aware and is focused to resolve it.

Overall, a solid quarter!

If you are interested to learn more about Evolution, here is our in-depth write-up (Dec 2022): Evolution AB – A ‘sin’ stock with healthy returns

-------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

www.stockopine.com

Evolution AB – A ‘sin’ stock with healthy returns

Evolution AB was founded in 2006 and develops, produces, markets, and licenses live casino and slot solutions to gaming operators. EVO employs c. 16,000 people and has over 600 customers.

Already have an account?