Buy the Dip: Fevertree Drinks ($FQVTF)

!

Thanks, Commonstock for the opportunity to share a stock selection and demonstrate Buy The Drip-driven quests.

One of our favorite areas of emphasis as a bear market/correction trudges along is to seek pummeled stocks. We like them even better if they're loathed. (So long as they've demonstrated quality management tendencies during tests of mettle, etc.) In this case, we'll scan broadly for stocks that seem oversold (as suggested by a relative strength index less than 30.)

In this case, our attention is drawn to the five qualifiers at the top of this post.

Great Lakes Dredging is doing some interesting stuff ... and has extrapolated into offshore engineering & construction for wind farms. It's a good study.

Barrick Gold is well, golden, but just might get even more attractive if recessionary symptoms persist or worsen.

Ranpack is a fascinating company taking a shot at an environmental challenge when it comes to packaging. But the deep discount --26% price-to-fair value (Morningstar) is perhaps a little too deep?

Virtu Financial is a highly-regarded trading and liquidity provider to global financial markets.

Fevertree Drinks PLC is a UK based holding and investment company. The company is engaged in the business activity of developing and marketing premium mixer drinks. Its product portfolio includes Indian tonic water, Mediterranean tonic water, Elderflower tonic water, Aromatic tonic water, Clementine tonic water, Lemon tonic water, Ginger beer, Ginger ale, Smoky ginger ale, Spiced orange ginger ale, Madagascan cola, Sicilian lemonade, Lemonade, Premium Soda Water and Mediterranean Orange. The company operates in the UK, USA, Europe, and other countries, of which most of the revenue is from the United Kingdom.

!

There's some risk that the Boston Beer (SAM) affliction is contagious, but 'tis the season for these beverages and we're seeing them pop up at more locations and establishments here on the other side of the pond.

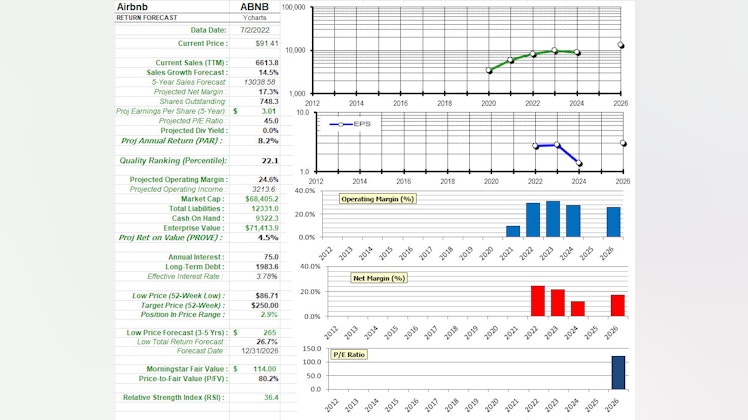

The return forecasts are strong and the track record for sales and earnings are relatively consistent considering the competitive playing field. Profitability is also trending at attractive levels. The price-to-fair value is still an attractive 61%.

So, we'll go with Fevertree Drinks (FQVTF) as our July dipping entry.

Anecdotal research here, but I’ve seen Fevertree used at pretty much every bar I’ve been to in the last couple months! They seemed to have come out of nowhere, probably took advantage of Topo Chico’s supply chain issues. If that’s the case, it sounds like they have a good sales team at least😆