Dismal Mass Transit Ridership; No Quick Return To "Normal" Working

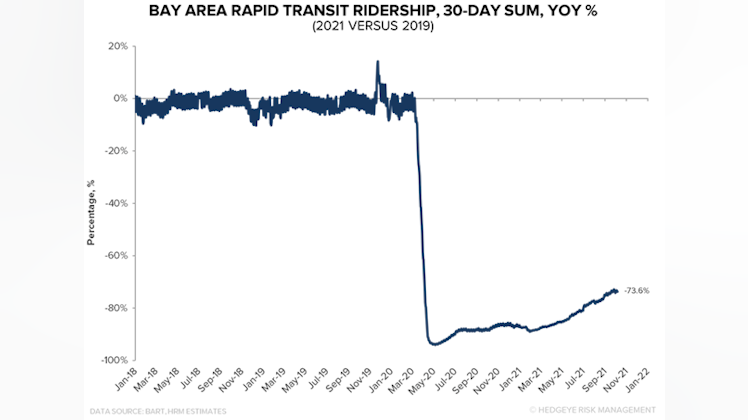

The below is chart showing the percentage of riders on San Francisco's Bay Area Rapid Transit "BART" system. The data for both 2020 and 2021 is comped against 2019 to show the fall from "normal" pre-pandemic levels of traffic:

As you can see, traffic dropped more than 90% at the beginning of Covid. It remained down well more than 80% even into 2021. It's now at a 73.6% decline from prior levels.

San Francisco's metro system is in a uniquely bad place given the particularly tough blow from both rising crime/homelessness in that city and work-from-home on Silicon Valley's uniquely tech-based economy. However, it's hardly the only one.

New York's MTA mass transit system, for example, remains down 50-55% versus pre-pandemic levels and traffic has been generally stalling out. McKinsey only sees it returning to 75% of "normal" by the end of 2024. For a system that was already tens of billions of dollars underfunded and facing seemingly unsolvable pension and capital expenditure requirements, having 25-50% of revenues disappear for an extended period (perhaps permanently?) could be a death blow.

New York's MTA saw service quality slip to new lows over the summer, with the subway canceling more than 10% of rush hour trains in August, for example. That's pretty remarkable -- somehow even with just half of normal commuters, the service provided is getting worse. The subway blamed workers taking vacations and/or not showing up to shifts for the spike in cancelations.

What's it all mean? I don't have all the answers. Rather, I highlight it because I don't see many people discussing this sort of thing at all. It's worth thinking about; what does return to normal after the pandemic, and what never does? Something like international air travel primarily comes back -- our Grupo Aeroportuario del Pacifico (PAC) is back to 98% of normal passenger traffic already, for example.

But other things are not going to. Office REITs in 2021 look like mall REITs in 2014 (i.e. heading for destruction). I'd also be nervous about having heavy investments or commercial real estate exposure to the inner cities of places like San Francisco or New York. It's hard to see how these gaping budget shortfalls get filled with anything other than punitive taxes. Those, in turn, encourage more people to leave, and create a race to the bottom. Tesla (TSLA) fleeing California this week -- after extracting countless subsidies from it over the past decade -- is a perfect example of the road ahead.

What happens if just 10% of former big-city office workers decide they want to work in Austin, Miami or even farther out locales such as Vermont? In your author's case, I used to work a couple blocks from Times Square in Midtown Manhattan. Now I do largely the same work from a nondescript town near a beach in the Caribbean.

If even 5-10% of the old user/tax base disappears, it will create a ton of long-lasting and difficult consequences for cities. And, judging by user stats at something like the BART in San Francisco, in some cases, the drops are going to be a lot larger than that.

Remember, the modern economy is premised on continual growth for an indefinite period. The moment things stop growing, they start to die. A shopping mall, for example, tends to become economically untenable at 85-90% occupancy and will rapidly collapse to total failure within a couple years of breaching that threshold occupancy point. Non-Class A office buildings will likely follow a similar course.

The modern push toward efficiency has left so little margin for error that even a modest reduction in something's usage versus expectations can cause total system failure.

Again, I'm still working on all the investment implications of this. In any case, I'm pretty certain folks are underestimating the long-term side effects of the pandemic.

Investors have worked through the consequences on directly effected things such as Zoom Video (ZM) or Carnival Cruise Lines (CCL). But far fewer people have even started to grapple with the long-term consequences on less obvious things such as inner cities, public finances, or where property tax rates are heading over the next ten years as society copes with the post-Covid world.

Seeking Alpha

Carnival Corporation & plc (CCL) Stock Price, Quote, News & Analysis

A high-level overview of Carnival Corporation & plc (CCL) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

This was counter-intuitive and quite interesting to me. I would have thought that less ridership would have resulted in less strain on the system and therefore better service. I was under the impression that these mass transit system were so subsidized by taxes that a loss in revenue wouldn't have been impactful.

Thanks for sharing @ianbezek