Trending Assets

Top investors this month

Trending Assets

Top investors this month

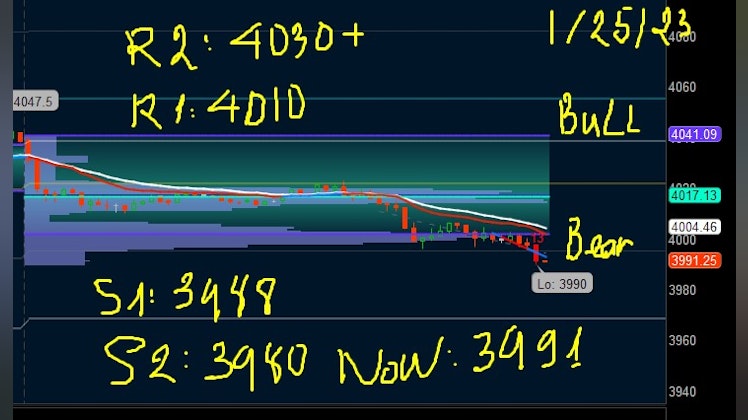

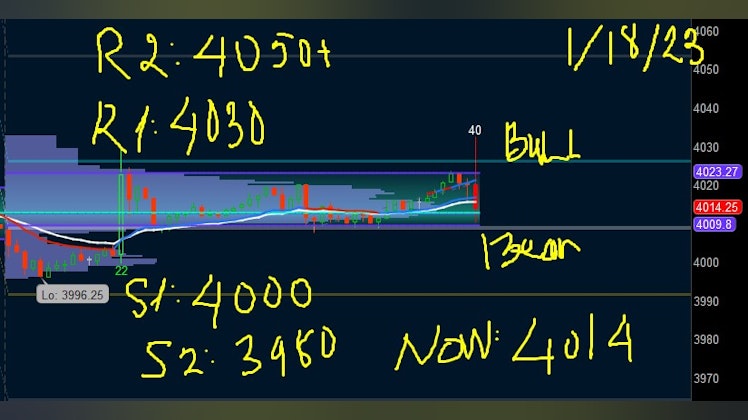

@eminibossman

Barron Nguyen

$12.3M follower assets

86 following142 followers

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?