Our thoughts on the NFP report due out at 08:30am EST

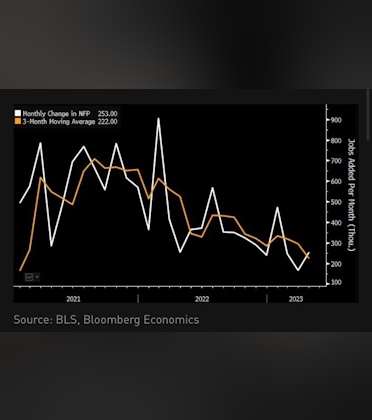

The forecasted Bloomberg consensus of 190k jobs added would be a fall on the previous April reading of 253k. The range from surveyors is 100k - 250k

From the big hitters, JP Morgan are on the low side at 150k, with Nomura at 235k. The monthly and 3-month rolling average looks likely to continue to move lower

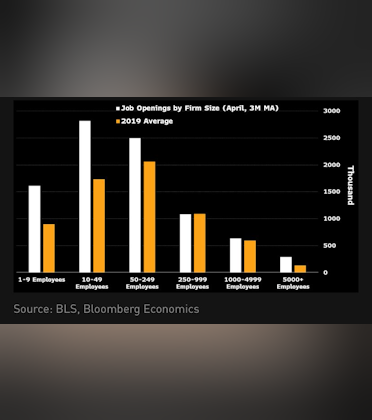

We also flag up the chart showing that job openings for smaller companies is still elevated versus 2019 levels. This indicates to us that there's scope for smaller firms to play catch up in job cutting

As for other notes, the unemployment rate is seen to tick slightly higher to 3.5%, but still remaining around multi-decade lows. Average hourly earnings is expected to moderate slightly too

There's currently just 10bps worth of hikes priced in for the June FOMC meeting, with this being the last major employment report due out before then

The bottom line: we think that any figures around consensus will reinforce the Fed pause, rendering any hike in June (and even July) out of the question. Even if we get a beat in headline NFP, it doesn't change the broader trend lower. Unemployment also will struggle to meaninguflly move any lower

On the other hand, a miss accross the board will likely trigger a much greater reaction, allowing the markets to factor back in cuts later this year

We therefore feel the bias is skewed towards a USD sell off / equity rally post announcement