$NEOG Q1 update

NEOG had a fine quarter given the macro. Results exclude the 3M merger so limited insight there. Grew revs 3%, ex-currency changes would have been 6%. Profitability lagged and bottom line numbers were near flat y/y. I still feel confident in the long term investment thesis despite the obvious issues.

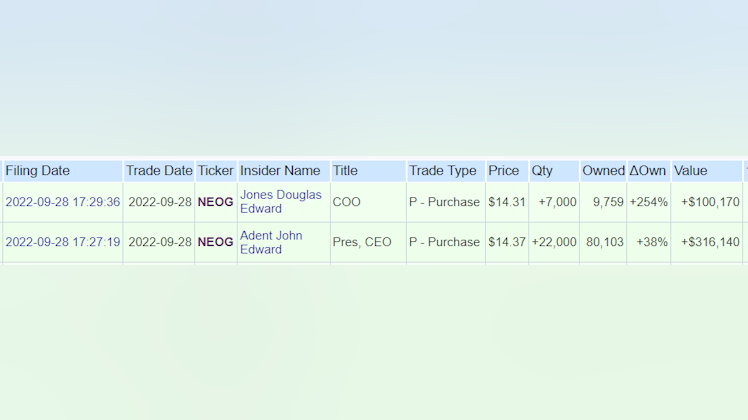

Insider Buys

CEO and COO bought more stock after the release of the Q. Pretty significant purchases from both. Clearly putting their money where their mouth is.

Also from the earnings call:

3M Food Safety lagged forecasts due to supply issues. They announced that they likely wouldn't hit the NTM $300mm EBITDA target and they will announce full year forecasts with Q2 results. Not great but didn't seem a long term impairment issue.

They are already finding synergies from the merger. They talked a few situations where they were benefiting both on the cost side and revenue side.

I think management made it clear the 3M integration is huge task and its taking most of the focus of management.

CFO is retiring next year. He will stay on to manage the transition to the next guy. It is an amicable situation that doesn't signal any major issues.

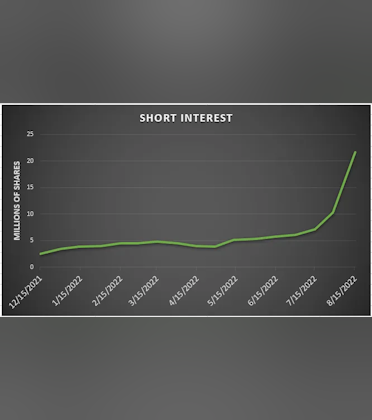

Analyst questions focused on the inherent uncertainty of the business due to the merger. I think this highlights a key aspect of the investment thesis: other investors are scared of the uncertainty surrounding the merger and are applying an uncertainty discount, as investors get results of the combined business that discount will go away.

Valuation

Lets say they don't hit the $300mm AdjEBITDA target and miss by $30mm, so $270mm. By my calculation that is still ~14.5x EV/EBITDA at current prices. Seems fair to me.

Conclusions

If the earnings call did give good concreate examples of growth opportunities and synergies and the CEO and COO didn't buy a big chunk of stock I would be much more critical of the Q.

The margin compression is not encouraging especially considering they just took on a sizeable amount of debt in the 3M deal. Rising Dollar will continue to hurt results, right now is not the time that global exposure will shine.

However, I like the food safety business long term and like the organic and inorganic reinvestment opportunities. I think the consistency of the business should shine in macro weakness, and, despite all the challenges of the integration, sill believe that 3M Food Safety + NEOG will work out and become a dominant player in food safety.

I'm open to messages.

Nice to see your first couple of posts here AbsCap! Time to get a profile photo :)