Trending Assets

Top investors this month

Trending Assets

Top investors this month

Long $NEOG: Quality business at a discount

Thesis:

Neogen is a predictable quality business that is oversold and undervalued due to the transformational merger transaction with 3M Food Safety.

Thesis Overview:

- Neogen is a quality company with high returns on invested capital with organic and inorganic growth opportunities.

- The food and animal safety end markets are secular growers and not prone to disruption.

- The 3M Food Safety-Neogen merger has caused the stock to fall due to non-fundamental selling pressure below fair value.

- The integration of Neogen and 3M Food Safety will be methodical and could result in synergies, led by the expansion of the product portfolio.

- The added debt from the 3M deal should boost ROE from pre-deal when they had no debt.

- Less than 13x EV/ NTM EBITDA is far below 10 year valuation range. Last time the multiple was this low was the GFC.

The set up

I first read about NEOG earlier in August in connection to the 3M Food Safety merger. The merger was completed on Sept. 1. If you haven’t read about the deal this press release does a good job explaining it. Brief overview of the transaction: 3M spun out their food safety business and sold it to NEOG as a “Reverse Morris Trust” to avoid taxes. Neogen gave 3M ~$1B of cash and 50.1% of Neogen’s total stock post merger, so they roughly doubled the shares outstanding. As part of the transaction 3M offered 3M shareholders the choice to exchange their 3M shares for the NEOG shares at a discount.

Embedded in the exchange offer was an arbitrage opportunity: go long MMM, short NEOG then exchange MMM for NEOG at a discount, washing out the short and capturing the discount spread in the process.

The most recent short interest data is from August 15th. I think it is fair to assume that the upward trend in short interest shown in the chart continued as the date of the exchange approached. I think this put non-fundamental downward pressure on the stock. I also think it is possible that we could see more nonfundamental pressure on the stock from selling by unhedged 3M holders who decided to exchange and decide to sell.

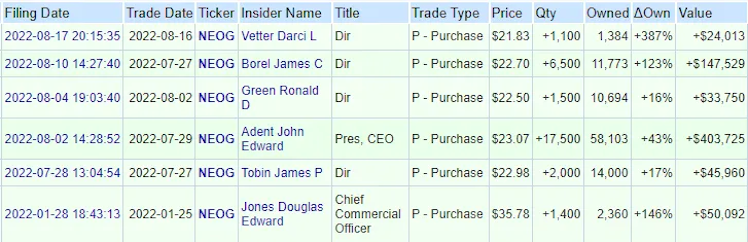

Insiders have bought stock over the summer in the low $20s with the most recent purchase on August 16. The CEO’s purchase was near the size of his annual cash salary.

Business overview

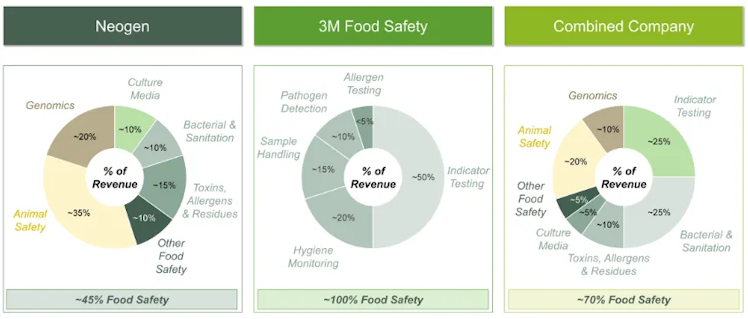

Neogen is a company with multiple product offerings in the food safety and animal safety businesses. Their products span the whole food supply chain, and customers often buy products for more than one use case. A good example of a food safety customer is a consumer packaged goods company’s food test lab; they would buy allergen tests, pathogen tests, and sanitation products. Many of these tests are required by regulators to bring a product to market. Here is a slide from the 3M merger announcement with a complete revenue breakdown by product type:

Historically, NEOG was about a 45-65 split in revenue between food and animal safety, however the 3M Food Safety merger changes the revenue mix to be about 75% food safety. The company sales pitch for a shift towards food safety is that food safety will be the faster growing end market going forward.

Management forecasts that revenue will grow by 10% going forward, roughly in line with their historical growth rate. I think this is obviously high for a long term growth rate but entirely possible for the next few years. Also, a 10% revenue growth rate is only 2-4% above the market growth rate, so not totally unreasonable. Assuming they have similar incremental ROIC to historic levels of 10-14% and reinvest 100% of profits back into the business a 10% growth rate is reasonable.

The business is consistent with attractive margins. Much of the consistency of the business comes from the fact that their products are regulatorily required and aren’t discretionary. Customers can’t stop using them when budgets are tight. Also, most of the revenue is consumable products of which customers don’t carry large inventories, so they usually make regular orders. Additionally, customers face some switching costs if they were to switch suppliers which makes sales relationships sticky. The combination with 3M food safety will increase product portfolio which will add additional economies of scale, and increase value proposition to customers.

https://www.neogen.com

Neogen Completes 3M Food Safety Business Merger

Combination creates an innovative leader in the food safety sector with a comprehensive product range and a strategic focus on the category’s long-term growth opportunities

Already have an account?