A Year in Review: How Did my Stock Picks do?

With 2022 in the books I'm reviewing how my stock pitches did and the lessons learned as I seek a full-time equity research job.

Let's get into it! (Long Thread but hopefully useful!)

PICK 1: Short $META on 1/10, market not pricing risks to $META's growth, margins, and competitive position

Result: Outperformed by ~4700bps (~25% below my bear case, so I was wrong too!)

Learnings: Better understand what facts drive a stock

PICK 2: Long $BBW on 1/17, market incorrectly thinks sales and profits can't grow further

Result: Outperformed by ~4300bps

Learnings: Communicate facts and not just assumptions in a pitch, updating priors, & filtering noise

PICK 3: Short $KIND on 2/14, market not seeing demographic/engagement issues + low saturation level

Result: Outperformed by ~5800bps (over 50% below my base case)

Learnings: Use my and other's real-life experiences to understand businesses

PICK 4: Short $BRCC on 2/21, market not pricing governance and core biz issues

Result: Would've been forced to close for a loss, even if squeeze is allegedly caused by illegal activity from CEO/CFO

Learnings: Find names with actionable CTB rates

PICK 5: Short $HYMC on 3/21, market not pricing reality on biz prospects

Result: Same as $BRCC; winner with time but would've been forced to cover for a loss

Learnings: Avoid short-squeeze candidates

PICK 6: Short $DWAC on 4/25, merger likely won't close + combined biz has 90%+ downside

Result: Outperformed by ~5400bps, but volatile

Learnings: Make future short ideas actionable on cost-to-borrow, shares available, avoid squeeze candidates

PICK 7: Long $ESCA on 5/16, market not pricing pickleball potential + dividend growth potential

Result: Underperformed by ~1400bps

Learnings: Focus on facts rather than just assumptions, better analyze risks, probability-weighting

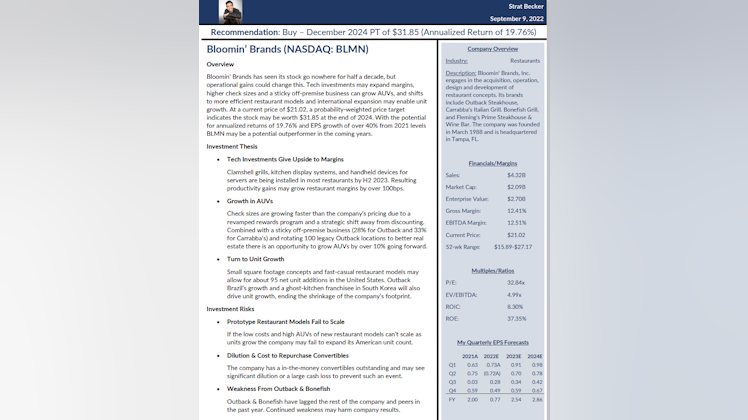

PICK 8: Long $BLMN on 9/12, market not pricing upside in margins and growth. (this and remaining pitches are too short in time to give a "result" to)

Learnings: Quantify facts being presented rather than just giving anecdotes

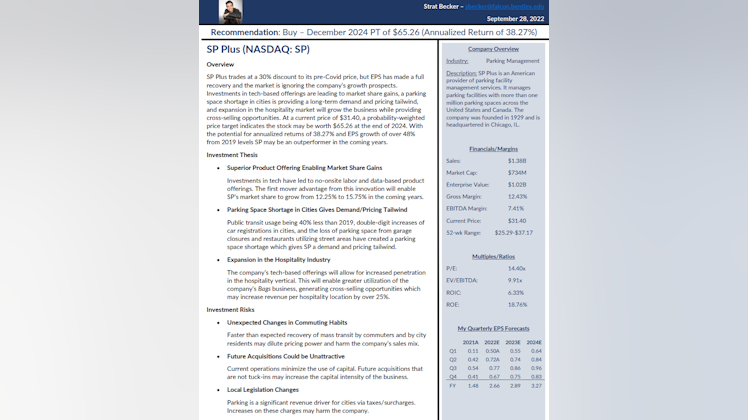

PICK 9: Long $SP on 9/29, market not pricing margin expansion and market share growth

Learnings: Better understand competitive landscape & industry dynamics, clearly communicate facts behind valuation assumptions

PICK 10: Long $GOGO on 10/14, market not pricing profit growth or competitive position properly

Learnings: Thoroughly vet risks, understand the products/services, take the time to understand an industry when it's my first time covering it

Out of my 10 published pitches this year, 9/10 outperformed the S&P. However, the latter 3 are too short of a time to really judge, so I was 6/7 in beating the benchmark. But 2 of my short picks would've realistically been covered for losses, so I was 4/7. This is ~57%, seems mediocre right? Well, the reality of stock-picking is the best of the best will be right 60% of the time if they're lucky. You will be wrong a lot, and while 7 is a small sample size, I think I've shown to myself that I have a framework to make this a career.

What were my biggest lessons of the year?

1) Make actionable pitches! When I'm hopefully working for a firm starting this summer, I need to give actionable analysis. Many of my shorts and some longs were too illiquid, and I should screen these out

2) Learn from people smarter than myself. The reality is I won't be the smartest/most knowledgeable about any industry/stock I'm researching. Learning from those who know more than me will be a vital tool in my career

3) Know my circle of competency and use my real-life experience to create an edge. Peter Lynch like lesson, but true. My experience as a former weather YouTuber helped me understand risks to $META and $KIND that the market couldn't see

4) Having a long-term perspective. Especially on my long pitches, a long time horizon is important. I said I'm "4/7" but My timeframe is 3+ years, so I'll circle back and see if I really outperformed. Social media makes it harder for young people to embrace this imo

5) Updating priors. Learning how to update my priors as new information comes in has been a big lesson and important in teaching me to see when I'm wrong.

6) Thinking in probabilities. I'm not the smartest, so why should my "base case" be the only factor in price targets/portfolio allocation? It shouldn't. Leaning into probability-weighted analysis has made me better

7) Use facts, not just assumptions. One of the best pieces of learning I had this year was from someone telling me a quote from the movie A Few Good Men: "It doesn't matter what I believe. It only matters what I can prove!" A good pitch uses facts instead of just beliefs

8) Put in the effort that others won't. My best pitch, $BBW, is one I found and understand because I've put in work that most market participants aren't (though I've had much teaching from others even on this name). Similarly, cold emails were how I got my fall internship!

And that's 2022 in the books! I'm glad I started putting my ideas online; not only have I grown from it, but it got me an internship and helped me meet several mentors.

My goal for 2023 is simple: Get an equity research job. It's competitive and hard, but it's what I love. I'm currently working on a few ideas, and DMs are always open to talk stocks or about leads regarding jobs. Thank you and Happy New Year!

9/10 pitches are already online at: https://dueyourdiligence.substack.com/