Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio - Developing a Proprietary Position Sizing Model

The Inception: Moving Beyond Traditional Portfolio Management

In the realm of investments, determining the ideal size for each position in a portfolio is crucial. Traditionally, many investors favored the Mean-Variance Optimization (MVO). This method strives to maximize returns based on past data. But it's evident to me that its heavy dependence on historical trends harbors significant limitations. It's like using a map based only on where you've been before. But since I've been intrigued by an alternative approach: the Black-Litterman model.

Why I Chose the Black-Litterman Model:

The Black-Litterman model is different. It combines what the market thought with what I believe, creating a more balanced investment mix. At its heart, the Black-Litterman model offers a blend. Rather than just leaning on what has happened in the past, it combines:

- Market data: What everyone else thinks might happen based on current info.

- Personal views: My own predictions and insights on a stock's future.

This combination means the model is rooted in the present, but still flexible enough to incorporate personal beliefs and predictions.

However, the challenge remains: How does one confidently derive these 'views' or insights?

Innovating 'Views': My Proprietary Approach

What if I could derive 'views' based on the potential upside of assets, using the Discounted Cash Flow (DCF) method? And to enhance this method's reliability, I decided to incorporate Monte Carlo simulations, thus giving birth to a proprietary position sizing model I've developed.

Here's the rationale:

- The DCF method calculates an asset's intrinsic value by discounting anticipated future cash flows to their present value. While robust, it's traditionally deterministic.

- With the introduction of Monte Carlo simulations, I infused probabilistic dimensions into the DCF model. Thousands of scenarios, each slightly varied, culminated in a spectrum of possible valuations, allowing me to grasp uncertainties better.

By extracting the median value from this multitude of simulations, I procured a more conservative estimate of the asset's potential upside. Merging these methodologies provided a consistent way to evaluate an investment's potential upside. This upside then defined the 'views' that were plugged into the Black-Litterman model, culminating in a portfolio aligned with both market dynamics and rigorous valuation acumen.

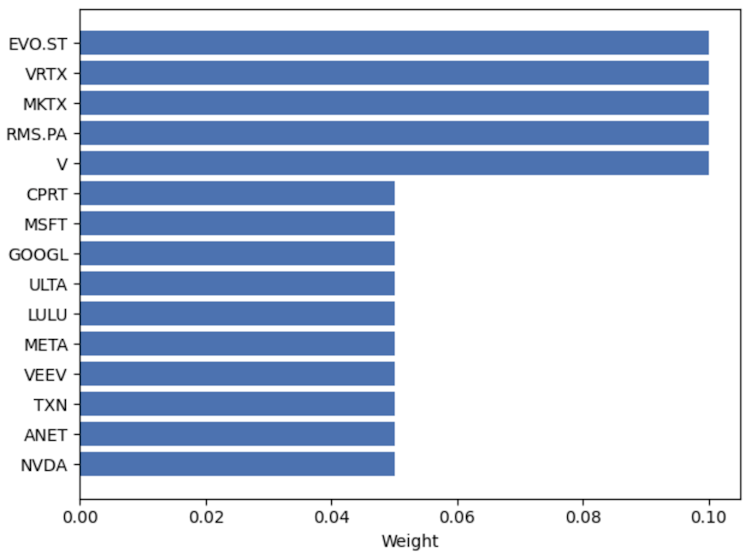

A Glimpse of My Portfolio Allocation:

Final Thoughts:

My journey led me from the confines of traditional MVO to the more dynamic realm of the Black-Litterman model, augmented with insights from DCF valuations and Monte Carlo simulations. This synergy has not only enhanced my position sizing strategy but also allowed me to craft a nuanced, proprietary approach to investment decision-making.

I'm eager to hear your thoughts on this approach! Please drop your questions and opinions in the comments. Your feedback is invaluable as we navigate the complexities of the financial landscape together.

Already have an account?