Trending Assets

Top investors this month

Trending Assets

Top investors this month

Blackstone's Q4 results - Trickling back to normal

As I mentioned here recently, Blackstone’s success over the last decade has been driven by its ability to raise an increasing amount of funds across its business segments, convert a larger part of its AUM to perpetual vehicles (raise longer-term capital which means longer duration of fee revenues) and increase earnings stability with a higher proportion of it coming through a more stable fee revenue on AUM.

It has unlocked various sources of capital which it can rely upon for for deployment, generate returns and use the performance to attract more inflows. When the cost of capital was low and financing was dirt cheap, institutional investors were increasingly allocating more towards private markets. The wealthy investor was also looking for alternative sources of returns outside the traditional equities and fixed income, some of which could be found here.

But as the market turned and the fear of recession loomed with much higher interest rates, one would naturally expect inflows to slow down for a business like BX after record breaking fundraising years during 2020-21-H122. Not just yet.

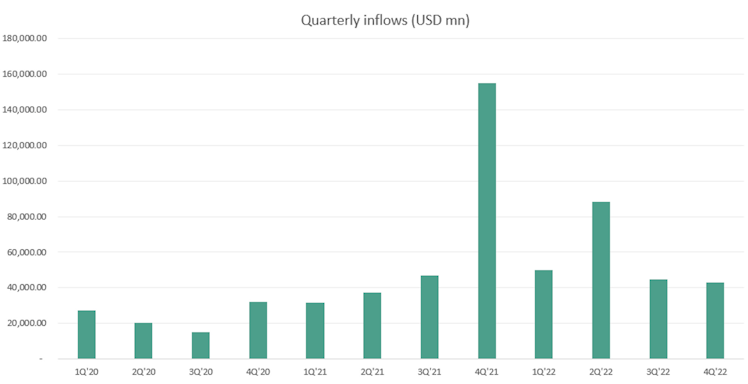

BX Quarterly inflows. Source: Company data

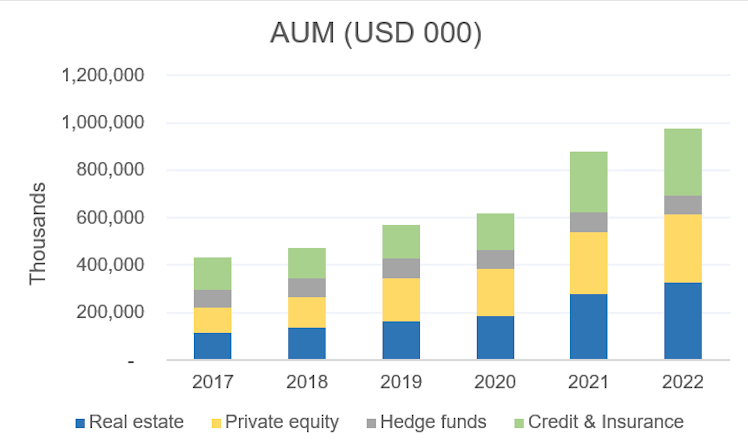

Inflows this quarter were still quite robust at $43bn, taking the 2022 total to 226bn. AUM is now at a record high of $975 billion, up 11% YoY. Fee-generating AUM is now at $718bn while perpetual AUM was up 18% YoY at $371.1bn, now making up more than 32.5% of total AUM.

BX AUM by segment. Source: Company data

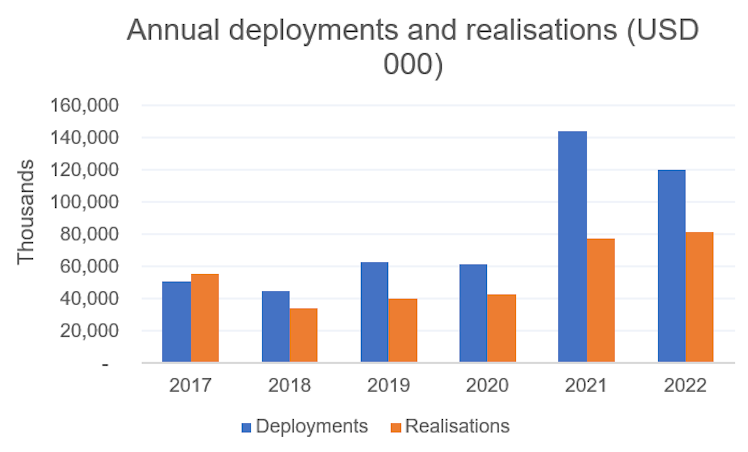

BX deployed $18.7bn in the quarter and $120bn for the year, and realisations (investment exits) were $13.5bn in the quarter and $81.8bn in the year.

Annual deployments and realisations. Source: Company data

For context - BX raises AUM, earns a management fee, deploys the AUM, realises the investments and takes a performance fee off the realised investment returns.

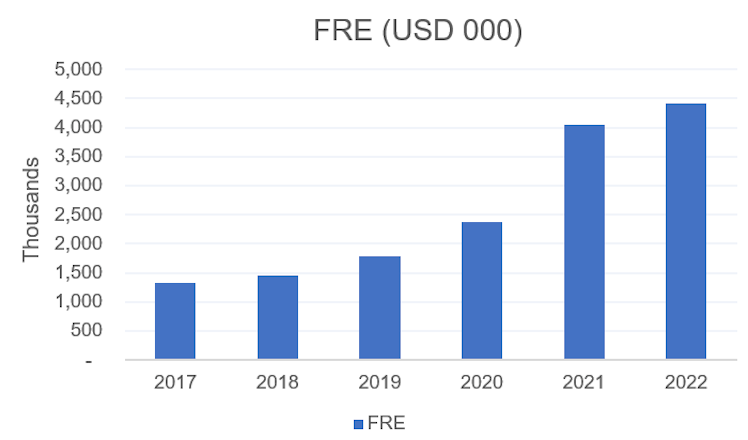

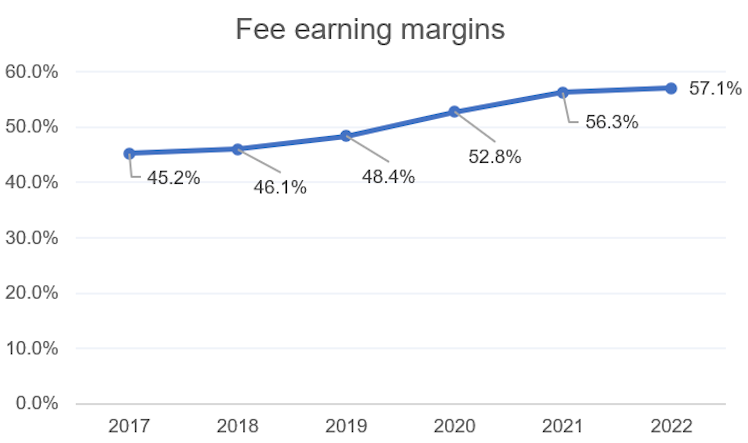

Fee related earnings (Fees - fee expenses) were $1.1bn for the quarter, down from Q4 last year but up for the year at $4.4bn. FRE margins continued to expand and are now at 57.1% (from 56.3% in 2021).

Fee-related earnings. Source: Company data

Expanding margins at higher fee revenues is a good sign. Source: Company data

Net realisations (performance fee - compensation) were at $3bn for the year but down more than 60% for the quarter on a YoY basis (less liquidity and higher rates → tighter financing, lower buyouts and falling valuations)

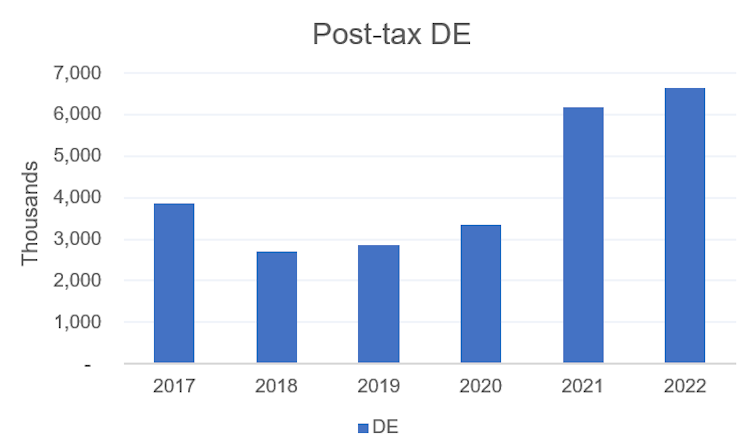

Post-tax distributable earnings (Fee earnings + Net realisations, the cash flow for shareholders) grew to $6.6bn. The DE has a 3 year CAGR of 32%.

Distributable-earninigs have grown at a CAGR of 32% over the last three years

BX declared a dividend of $4.4 per share (which has grown at a CAGR of 10% over the last 5 years and 20% over the last decade) and now has returned $1.1bn in the quarter with over $6.1bn in the year. That’s over 90% of its distrubutable earnings returned to shareholders.

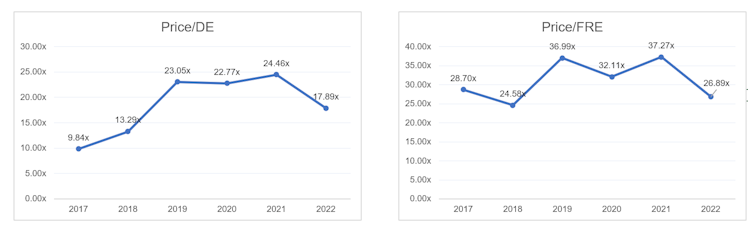

The stock is up 32% this year already, but is still down 30-35% from its high.

BX vs SPY YTD returns. Source: Koyfin

Valuations are down from its highs too, but it is not as cheap as it was just a few months ago.

LTM Price/DE and Price/FRE multiples

Both fundraising and realisations are likely to slow down going forward, which would be a headwind for AUM growth and fees. However, it still has $187bn of dry powder (committed but not invested capital) available for deployments, which might allow it to invest at lower valuations and enhance its future investment returns, and thereby its performance fees.

The management struck a defensive tone during the earnings call realising the macro headwinds and a slowdown in fundraising and investing environment. If it can navigate the outflows from perpetual funds well, the Raise → Deploy → Return → Raise cycle still looks on well on track, albeit with a slower pace of change from one step to the next one.

---------------------------------------------------------------------------------------------------------------------------------------------------------

I also published a post discussing Blackstone ($BX) here.

www.theatomicinvestor.com

The two types of wealthy (I)

Looking at two types of wealthy via BX's and LVMH's recent quarterly results

Already have an account?