Trending Assets

Top investors this month

Trending Assets

Top investors this month

No Pain, No Gain. $XPOF Going Higher

If you'd rather listen to the pitch instead of reading all this, I've included the link here that has an audio version.

If you'd like to hear the pitch/debate I had with @ccm_ryan and @ccm_brett on Chit Chat Money, you can find that here.

Summary

- Company hurt during COVID has executed well on a post-pandemic comeback and has almost returned to full pre-COVID levels

- Broader tailwinds fueling a return to in-person workouts and the desire to try new fitness concepts

- Management executing well on diversifying revenue channels, improving margins, and growing internationally

- The stock is currently trading at 13.9x FY’22 earnings, a discount compared to the broader S&P index, consumer discretionary index, and other high performing fitness names

Business Overview

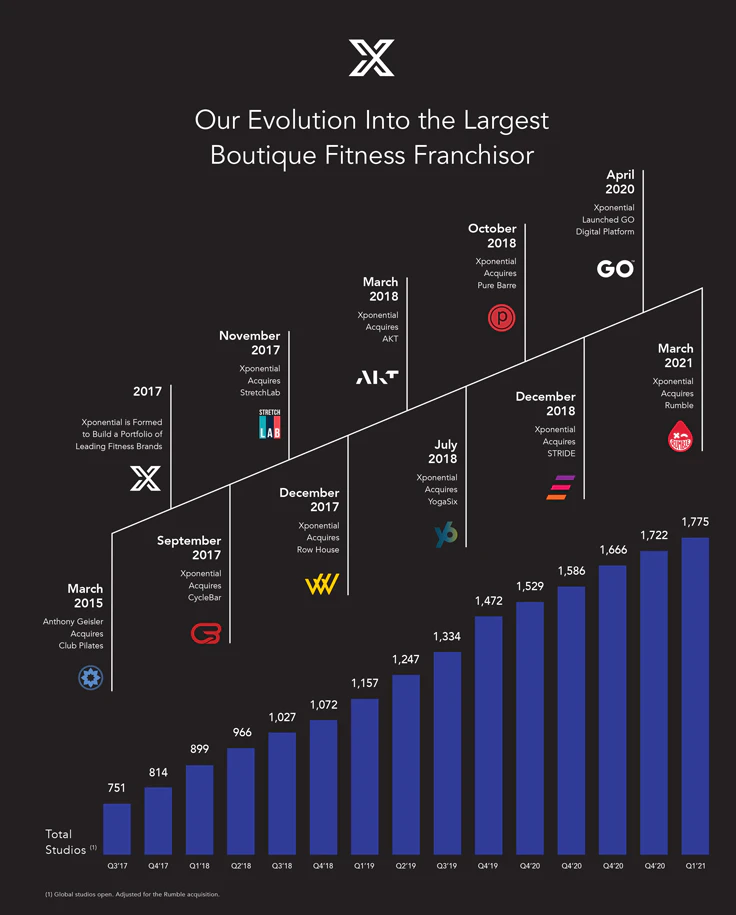

Xponential Fitness XPOF -1.74%↓ is a boutique fitness studio franchisor that operates in North America and 11 countries globally. Within their portfolio, they have 10 name brand franchises that you may have heard of before: Club Pilates, Pure Barre, Cyclebar, StretchLab, Row House, YogaSix, Rumble, AKT, Stride, and BFT. I’ve included a description of each in the footnotes - just click the number to teleport down there and then you can come right up.1

They’ve grown from 751 studios in Q3’17 to 1,889 as of Q3’21 (September 30th, 2021) and the company believes that they can have a total of 6,900 studios in the U.S. alone. They operate under an omnichannel approach with three main categories,

- XPLUS - their video-on-demand platform with over 1,000 workouts

- Studios - where individuals can physically go in and exercise at any franchise location

- XPASS - a membership option that allows members to gain access across all 10 brands

All these three membership options help the company drive overall system-wide sales and thus, bigger franchise revenue.

Initial franchise investment is around ~$350k, and they have a playbook designed to generate an AUV of $500k in year two of operations and studio-level operating margins ranging between 25% and 30%.

Thesis - LONG

As the stock market continues to be very volatile and tech stocks continue to be selling off with no remorse, I’m looking into various subsectors within the consumer and retail space that can hold up better in a slower economy while still having significant upside potential. This has led me to the fitness subsector and I recently wrote an article on how the fitness industry has evolved from pre-COVID to post-COVID and how we as investors could capitalize, see the article “Fitness in a Post COVID World.”

This article will give you some context for this article but I think that Xponential Fitness has a lot going for it that will drive upsized returns in the long run.

Here’s why.

1) Asset light model

Like I mentioned previously, Xponential Fitness is a franchisor of boutique fitness brands. So what does this mean? Well, it’s probably best to quickly explain how franchising works.

Franchising means that the franchisor (Xponential Fitness), offers a branded package deal to qualified individuals (the franchisee) that includes the goods and services and the name of the business to be used for a fee. I (the franchisee) would pay Xponential Fitness upfront fees to “buy” a franchise and then pay an ongoing fee to continue utilizing said name, pay for marketing-related costs while also receiving the necessary training and support needed to make this a success.

So in this case, Xponential Fitness owns all the IP and gets paid for others to use it. Because the company does not want to have company-owned studios long-term, that means that they will only be collecting fees from their franchisees as more studios open.

Simple enough, right?

Yes, however, there is a caveat to this. If the franchisees don’t make money, then Xponential doesn’t make money since the real source of the company’s revenue comes from taking a cut of gross sales from the franchisee.

This, in turn, keeps interests aligned and the need for the franchisee to become successful so that the company (Xponential Fitness) can also become successful.

While the company technically owns 43 studios (out of 1,889 and were acquired during COVID) as of September 30, 2021, they plan to re-franchise or discontinue all of them by the end of the year if they aren’t profitable. This will allow them time to hopefully get things back to running order and then they can hand the ropes to someone else and strictly focus on the growth of their franchisees.

Little to no physical assets = little to no costs in owning those physical assets.

2) Return to in-person

Like I mentioned in my fitness deep dive, people who were forced to do at-home digital workouts during the pandemic are over having to be confined in their tiny apartments or homes and not have any social interaction whatsoever.

Consumers are longing to get out of the house, try something new (or old), and be a part of a community where you’re being pushed by those around you and held accountable.

According to Mindbody, a third of consumers surveyed stated that they plan to visit more studios after trying new workouts virtually (remember this for later) and that 40% of consumers are booking workouts with studios they have never physically visited before, allowing businesses to reach “digital-first” clients.

Adding fuel to fire, from a McKinsey report, 70% of fitness consumers reported missing their gym as much as they miss family and friends. Extreme but hey it proves a point.

Even The CEO of Xponential highlights on a Q2’21 earnings call just how well the business has bounced back.

> When comparing the end of the second quarter of 2021 to January 31, 2020, without even taking into account our newest brand, Rumble, our business has recovered to 103% of actively paying members, 98% of total visits and nearly 90% run rate AUVs.

So while digital fitness will always be a thing, consumers’ shift back to in-person will benefit Xponential Fitness as more and more consumers feel comfortable with attending group-oriented classes.

3) COVID contracts available supply

While returning to in-person is a good thing for the company, it didn’t come without any bloodshed. COVID really put some tough times on fitness centers when we all went to lockdown and with various state orders, many did not survive.

In fact, eight major chains filed for bankruptcy and 17% of fitness centers closed permanently, according to industry trade group IHRSA.

With a significantly reduced supply of gyms and studios across America, there is naturally more demand with limited supply as consumers continue to work out in person.

This will allow those companies that have survived to fill classes faster, boost AUVs (average unit volumes), and in time, even raise prices.

So while tragic that there were bankruptcies and closures, Xponential can help fill the void.

4) Omnichannel approach

As I mentioned in the business overview portion of this post, Xponential Fitness operates through three different channels: XPLUS (video-on-demand), studios (in-person), and XPASS (membership offering across all brands).

I’ll go over each one and speak to why they are key for future success.

In-person

This one is a no-brainer and better yet, it’s actually their bread and butter. Without having physical studios this company would just be a fitness app that offers digital workout classes. A Peloton membership without a bike. But while this seems rudimentary, it’s necessary because of those who either started their fitness journey digitally during COVID or for those that had to compromise with digital because they used to be an in-person type of exerciser.

Xponential fitness did a survey on their members and about 43% or more are excited to jump back in (in-person classes) and cancel their digital subscriptions. Plus, 83% of members who had previously had a big box gym membership canceled those after they joined an Xpo studio.

So as we continue to return to normal, XPOF is seeing once digital users and those that were already physically going to a fitness center, want to get back into the studio. Having these new types of classes built around a community is what is helping the company get back to full occupancy and work towards achieving pre-pandemic AUVs.

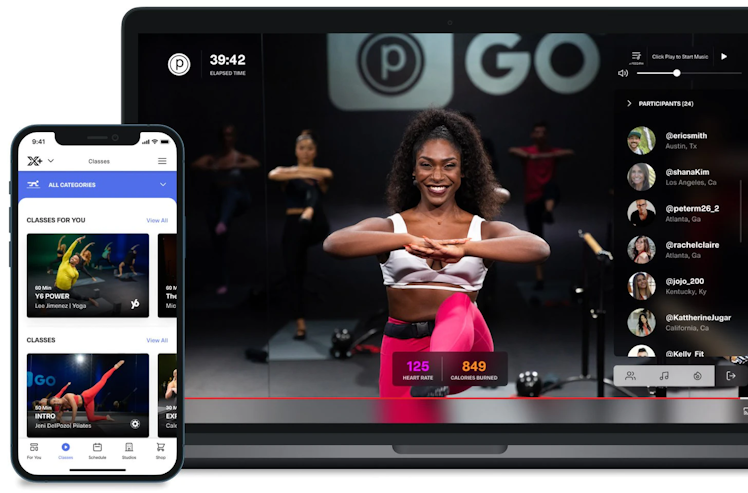

XPLUS

XPLUS is Xponential fitness’ answer to video-on-demand. Users can access a library of over 1,000 workouts from their devices.

Source: Website.

You can choose workouts from any 9 brands that the company offers and then select targeted classes within that area of fitness focus. The monthly price for this offering is $30 a month and content is never stale with new classes and programs being released weekly.

With the overall shift in how work is conducted (WFH vs. on-site), people are integrating their lives with more technology. In fact, 46% of Mindbody survey participants stated that they intend to make virtual classes a regular part of their routine, even after studios reopen.

XPLUS allows for the company to branch out and target those fitness users who might not want to physically go into a studio but still want access to all the great workouts that the company has to offer within the safety and comfortability of their own home.

In essence, the best of both worlds. Plus, being an owner of a physical brick and mortar studio, having a digital option is just table-stakes in this new world we live in.

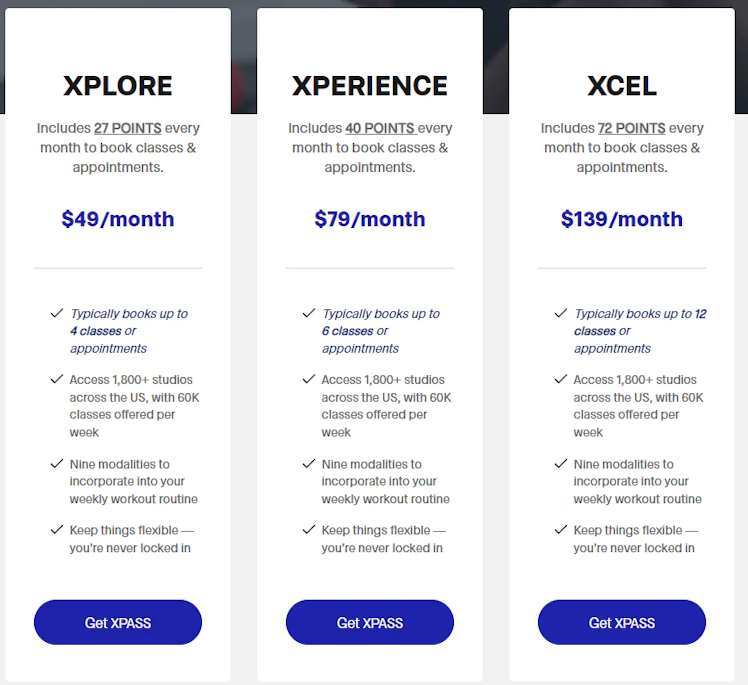

XPASS

With in-person and digital covered, what more could the company do? Well, they decided to launch an internal ClassPass membership option. ClassPass is a membership that you can buy that allows you to use “credits” in order to sign up for different workout classes from different fitness companies in your area within one membership. This allows you to have access to different fitness concepts without needing to have multiple memberships.

So, Xponential Fitness thought, why not make an option so that members could access all of its brands instead of just one? Thus, XPASS was born.

Source: Website.

XPASS utilizes the same concept of “credits” to be utilized across its brands and costs anywhere from $49/month to $139/month depending on how active you want to be.

Two helpful stats that also came out in the company’s Q3’21 transcript that reinforces the effectiveness of the XPASS offering are below.

- 15% of XPASS users never interacted with the company prior to joining XPASS

- 23% were previously deemed “inactive” by studio sales staff

So not only have they done well to recruit net new users, but they also have been able to get churned members to get on this service.

When reading the company’s Q2’21 earnings transcript, the CFO brought up a really good point on how this offering can help boost retention, which is a core metric that membership-oriented companies need to keep as high as possible.

> Further building out things like our XPASS, using some of our auxiliary revenue streams to drive members back into studios and allow them to try different verticals and kind of taste the various brands we have, I think will also improve retention across the system as people who may be have been doing rowing for a long time or bar for a long time, it gives me the opportunity to try Club Pilates, keep them in our ecosystem by using XPASS as a tool for member retention.

Instead of churning because “I’m over one thing,” I can just try something else out and hopefully stay on the platform. Makes sense.

With brick-and-mortar, digital, and cross-channel offerings currently being offered, I think the company has a good grasp on acquiring and keeping as many customers under their umbrellas as much as possible.

5) International expansion

While the company has a lot of its footprint already in North America, it does have its eyes set on international expansion. Currently, the company operates within 11 countries like Australia, Saudi Arabia, Japan, DR, South Korea, etc. and with the addition of BFT, it now has over 1,000 studios open or obligated to open internationally.

What’s interesting to note is also how revenue gets recognized internationally. When a franchisor in North America sells a license, they amortize that over 10 years or the length of the license, but that’s not the same when you go abroad.

Internationally, the “master franchisor” is actually servicing the franchisee, the payment, or the proceeds that the company gets from each license sale or each equipment package, gets recognized as revenue immediately. So as they start to see an accelerated ramp on the international front, the impact from a revenue and margin standpoint hits the P&L immediately.

So that will be probably the largest component of revenue and margin growth in the coming quarters as XPOF grows internationally.

6) Economies of scale

Just like any company that makes or sells goods and services, your costs will still grow as a % of growth but perhaps not as quickly, which allows you to grow your margin and thus increase profits. How XPOF can accomplish this with their current business is two things.

- Offloading their corporate stores which they’re incurring all the costs for at the moment and,

- Continue to sell and open more studios while keeping the growth in their SG&A expense down as much as possible

To my first point about getting rid of corporate-owned studios, the CFO said in their Q3’21 earnings call,

> We discussed that we would be refranchising those out, and we've made really good progress and continue to make good progress on delivering on that commitment by the end of the year. So you'll see SG&A ramp down associated with the company-owned studios throughout the end of this year.

Though this is more of a one-time thing, it will have an impact on the fiscal year 2022 margins.

However, the real margin improvement comes from just doing business as usual. XPOF hires staff to sell licenses and support their franchisees as they continue to grow. As they grow, their staff can support more franchises which means that top-line growth should outpace the growth in SG&A expense.

To give you an example, SG&A expense as a percent of net revenue has gone down from 75.2% in 2018 to 57.1% in 2020. Granted 2020 was a unique situation but even in 2019, SG&A was only 62.3% of net revenue. A difference of ~13 percentage points.

With top-line growing fast and SG&A growing moderately, among other factors, the company believes it can achieve EBITDA margins in the 35%-40% range long-term. This compares to adj. EBITDA margins of 9% in 2020 and 13% in 2019.

7) Psuedo fitness ETF

As I dove deeper into my research on the company I came across a realization that I haven’t experienced in any other business, aside from restaurants, and that is diversification. Some restaurant companies have brands under their portfolio across different cuisines that they franchise out (example, Yum! Brands which owns KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill). This same principle applies to Xponential Fitness.

The company has 10 brands that each offer different types of workout classes that revolve around two things: functionality or high-intensity interval training (HIIT).

So instead of buying into a one-concept type of business (think, Peloton), you can buy into a single stock that has exposure to many different types of fitness offerings.

This in and of itself gives you pseudo diversification amongst the boutique fitness industry so that if you were worried that a fitness trend might fade, you have 9 others that are different that might grow even faster.

This is why the concept of a pseudo ETF came into my mind because you’re holding a basket of different fitness concepts by just investing in one name. Pretty interesting if you ask me.

8) M&A and partnership opportunities

When you already have 10 great brands under your belt, how do you make sure that you can continue giving members optionality while bringing in fresh new concepts into the fold? You either build (create your own), buy (acquisitions), or partner.

Xponential Fitness has done just that across its lifetime and I don’t believe they’ll be stopping anytime soon. Let me explain what they’ve done in the last two years.

Acquisitions

XPOF has made two acquisitions as of recent, Rumble, and BFT. For those of you that are not in the NYC area, Rumble was all the craze pre-COVID and it seemed like so many millennials would talk about it as a status symbol within their conversations.

Rumble operated under two different concepts; boxing or running. This appealed to many fitness enthusiasts that wanted that special HIIT class but with a strength component to each. XPOF acquired Rumble in March of 2021 and will be spending time building out that brand as it is still in just the single digits for the number of studios.

The most recent acquisition that the company has made was for BFT. What’s unique about this acquisition is that the company paid $44 million and immediately expects the deal to be accretive on an EBITDA margin basis, but also opens more doors internationally. Because of this one deal, BFT alone led to a 15x increase in international studios to bring the total to 130. What’s also great is that there are over 150 BFT studios that were previously sold prior to this deal that is contractually obligated to open across the Asia Pacific region within the next 9 months. So not only immediate growth but a pipeline for future growth as well.

Source: Company S-1.

Aside from these two deals that the company has made, XPOF has a track record of rolling up strong, name-brand fitness concepts into the fold such as Stretch Lab in November 2017, Row House in December 2017, AKT in March 2018, Yoga Six in July 2018, and Stride in December 2018.

I think we will continue to see the company paying close attention to new and cool fitness trends and concepts to acquire in an effort to improve optionality and stay with the times.

Partnerships

A recent, exclusive, partnership that XPOF has signed actually has to do with LA Fitness. This deal allows Xponential fitness franchisees that already have a studio open in their protected territory, to open another studio within an LA Fitness or City Sports Club gym. Pulling a quote from the press release,

> Studio development time and buildout costs of these locations will be less than those of a traditional standalone studio, and existing franchise partners will have an opportunity to drive additional revenues while operating these locations free of initial franchise fees and lower marketing fund fees. AUVs at these locations are expected to be lower than those of traditional studio locations; however, this opportunity provides for reduced operating costs than standalone studios.

The agreement lays out a minimum development of over 350 franchised locations over five years to add Xponential brands in more than 500 Fitness International locations.

The reason I point out this partnership is because of how creative management is getting to fuel studio growth and even on the most recent transcript they mentioned that they could see themselves continuing to do agreements like this in the future with other gyms.

Risks

Like all companies, there are some risks that cannot be ignored when trying to operate the business as efficiently as possible. For XPOF, I’ve listed out four risks that I feel could be the most damaging to the business and the likelihood of them happening.

1) More COVID restrictions

Just like how it affected the business the first time around, the company is not immune to it happening again. With new variants arising as the norm, the potential for another lockdown might be slim but that doesn’t mean that state or city measures aren’t a real risk. There could be another situation that calls for strict social distancing measures, vaccine mandates, and even occupancy caps.

If this were to happen again in the future, the franchises will see a big hit to AUVs and potentially lost momentum of opening new studios which will directly affect XPOF’s ability to become profitable.

2) Lack of market liquidity

Another point that is definitely applicable to XPOF, at least the stock price, is the lack of market liquidity. What do I mean by this? I mean how little money is flowing in and out of the company on a daily basis which stems directly from the number of shares being traded on a daily basis.

On average the company trades about 208k shares a day. At an average price of $17 let’s say, that’s only ~$3.6 million in dollar terms. This is incredibly low for a company and could pose a risk for investors looking to exit a position since there aren’t enough transactions happening on a daily basis. Volatility in this name will remain high until it becomes more recognized and gains more awareness. Just something to be cognizant of but that shouldn’t deter you from potentially entering a position.

3) Cannibalization

With the incredible growth of new studios opening and licenses being sold, it begs to ask if all these openings could in fact eat into each other’s ability to earn revenue. Because the company has XPASS which can be beneficial for the company and the studio franchisee, it could eat into the revenues of the studios and then make a dent into the company’s revenue. The ability to strategically draw lines and not flood the market with studios too close to each other will be paramount as the company expands to its potentially ~6,900 count in the U.S.

4) Labor costs

Along with the growing great resignation over the last year, workers are hesitant to return to a job that they don’t feel pays them enough or requires more in order to stay. In an industry that relies on good fitness instructors to teach these classes and record workout videos, they are in high demand and they know it.

Interviews have shown that Peloton instructors make anywhere from a six-figure salary all the way up to over $500,000 in total compensation. Now I’m not saying that XPOF pays their instructors that much but a quick glassdoor search for Rumble salaries in NYC says about $3,200 a month. So in theory, ~$38,000.

However, this doesn’t mean that the company hasn’t paid up already or won’t have to in the future.

Valuation

To be honest with you, valuation is probably the easiest part of this entire research. The business in and of itself is not rocket science either.

The company sells franchises → franchises make money → company makes money → company sells more franchises to make more money while keeping costs down → company is profitable. Simple.

So while the company is not yet net income positive for FY’21, it is planning on being profitable in FY’22.

The company is estimated to earn $0.70 a share in FY’22 and with a current share price of $13.46, that gives us a forward P/E multiple of 13.9x. Not crazy considering that the S&P 500 index is trading at a 17x forward multiple, the consumer discretionary index at 22x, and even other fitness names like Planet Fitness PLNT 0.85%↑ and F45 Fitness FXLV 3.11%↑ are trading at 45x and 4.6x, respectively. Though F45 has had terrible management which is thus shown in the stock price.

Factoring in a modest 25x forward P/E, to account for faster growth names, to the company’s $0.70 in estimated earnings and we get a share price of $17.5, or a 30% upside from yesterday’s close. However, I believe with more growth internationally, and with economies of scale, the company can be worth north of $30 a share in as little as two years ($1.5 in earnings - estimates are $1.77 - and a 20x P/E).

Closing Argument

Everyone is so absorbed in the “next big thing” which usually involves technology-related companies while failing to realize that there are many consumer and retail names out there that can return a pretty penny.

I believe that XPOF is one of those names and in a world where mental health and general wellness are huge factors for many, fitness is one of the best ways to accomplish that. For all the above reasons, that is why I am bullish on the future of this fitness name.

To help with operating leverage as well, I've included a follow-up article that explains (visually) just how this is achieved.

cedargrovecapital.substack.com

XPOF: Unit Growth the Driver of Operational Leverage

AUVs near pre-pandemic levels + unit growth fuel margin expansion

Already have an account?