Trending Assets

Top investors this month

Trending Assets

Top investors this month

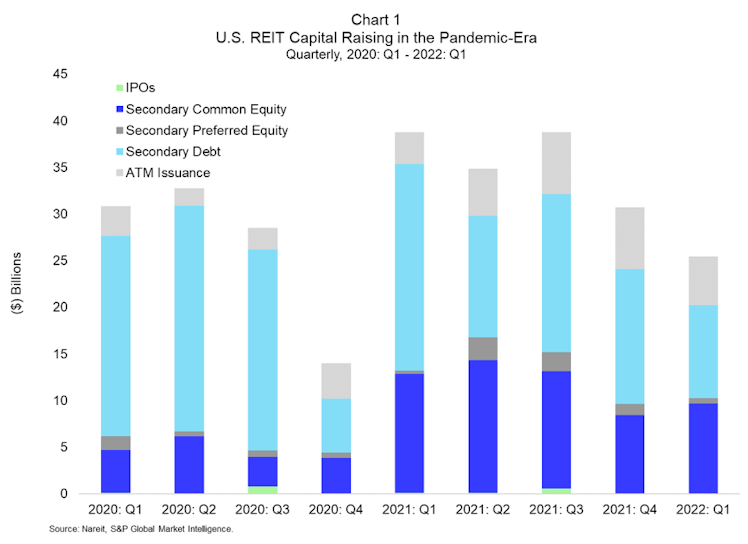

Capital Raises for REITs

- Equity issuance totaled $10.2 billion, including $9.7 billion raised through common equity offerings and $545 million raised through preferred equity offerings. Total equity issuance in 2021: Q1 was $13.2 billion, with $6.1 billion in 2020: Q1.

- Debt issuance totaled $10.0 billion raised at the secondary market, down from the $22.1 billion issued in 2021: Q1 and $21.5 billion in 2020: Q1.

- At-the-market equity issuance was $5.2 billion in 2022: Q1, following $6.7 billion in 2021: Q4. In 2021, $21.8 billion was raised at-the-market, helping propel REITs to a record $133.6 billion raised.

Source: NAREIT

Already have an account?