Trending Assets

Top investors this month

Trending Assets

Top investors this month

Booking Holdings $BKNG Investment thesis

We have initiated a position in Booking Holdings $BKNG. Below is a summary of our investment thesis with the most important factor being its valuation:

- After being hit by the pandemic during 2020-2021, the online market for travelling and accommodation is recovering. According to Business Wire, Global Online Travel Market Size is projected to be US$ 1,464 Billion by 2027, from US$ 801Billion in 2021 (CAGR of 10.6%).

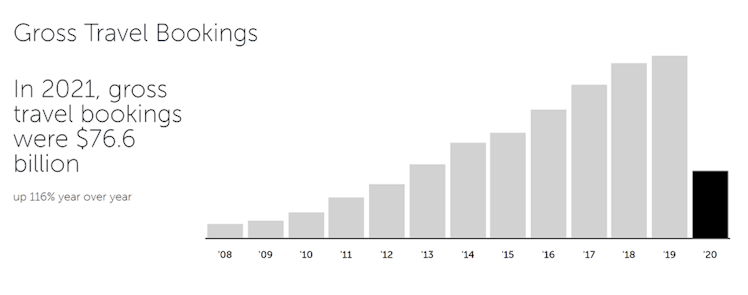

- Online travel agencies (OTA) like Booking will be one of the beneficiaries of of this trend. Early signs of recovery appeared with GBVs of major OTAs surging to all-time highs due to increase in nights booked and increase in Average Daily Rates (ADRs). For example, Booking had Q1’2022 GBV of $27.3B, up 129% Y/Y and up 7% from Q1 2019. Airbnb had GBV of $17.2B, up 67% Y/Y and up 73% from Q1 2019.

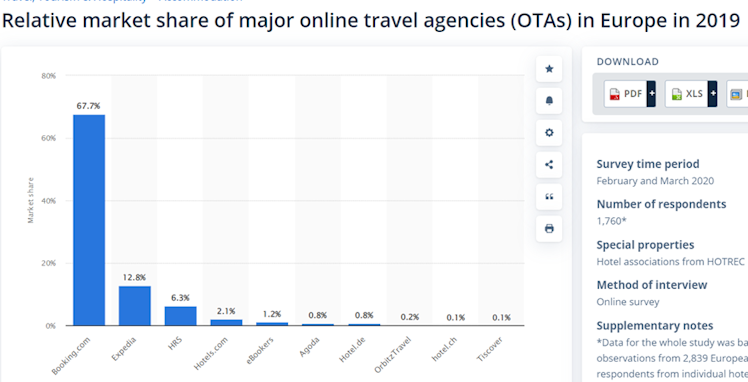

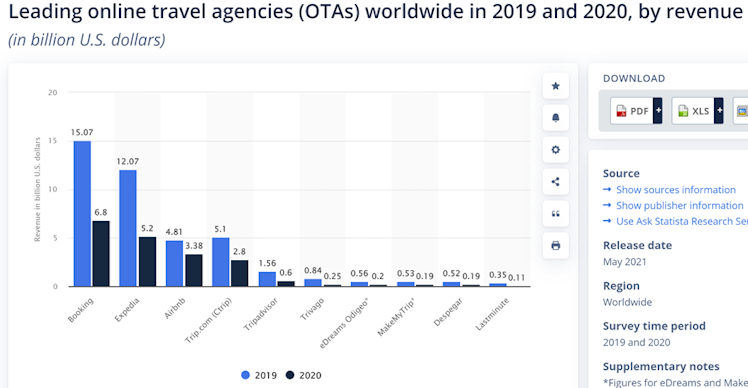

- Booking is a leader in OTA market. For example, its market share in Europe in 2019 was 67.7% according to Statista. Global wise it generated the highest revenue in US$ billion for 2019 and 2020. Also the large number of hotel listings on Booking creates a network effect and acts as a barrier for new entrants in OTA. For instance, in 2021, 590 million room nights were booked across Booking Holdings. This is below the pre-pandemic 2019 figure of 844 million which is explained by the fact that the market has not fully recovered.

- Heavy share buybacks over the span of the last 10 years. Total shares have been reduced from 49.9M in 2012 to 41.1M in 2021. This approximates to $23B of share buybacks compared to cash generated from operations (over the same period) of approximately $32B. Around 70% of the cash generated from operations were returned to shareholders, without disrupting the business from growing.

- Optionality: Other than accommodation/lodging choices, Booking offers the option to book a flight, to rent a car, to book a visit to an attraction or activity and to book an airport taxi transfer. Needless to say, but you can also use your Genius discount on certain items.

- Valuation: Analysts expectations for 2026 EBITDA average at $10.1 billion, whereas in our valuation we use an EBITDA of $8.9 billion. Assuming a multiple EV/EBITDA of 18 (in line with 2015-2019 average) we reach an Enterprise Value of $160.6 billion (difference is due to rounding) compared to today’s EV of $80.8 billion. Potential IRR on EV terms is around 16.5%.

Already have an account?