Trending Assets

Top investors this month

Trending Assets

Top investors this month

What I Learned from Trading: Convergence & Divergence

We apply the principle of convergence to decide whether to buy a company stock. Convergence is the alignment of corroborating factors pointing to to the likely success of an investment. These factors can be both qualitative and quantitative. I'm sure most retail investors apply this principle whether they're conscious of it or not. Every business has its weaknesses and areas of concern, but the weight of evidence is what everyone uses to make that decision to press the "buy" button or not. We look for fundamental factors like rising sales and earnings, secular tail winds, high gross margins, positive free cash flow yield and a strong balance sheet. Once the business passes all our fundamental filters, it becomes a pre-qualified stock for purchase.

Traders require an alignment of indicators before their entry criteria is satisfied. For example, a breakout trader might want to see a 1% breach above a line of resistance to be supported by higher trading volumes and a stochastic indicator at least above 50. The convergence of these indicators can point to a sustainable breakout with further upside ahead.

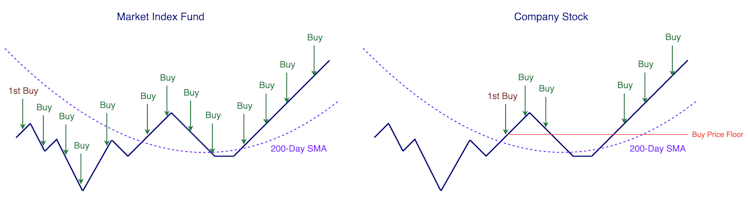

We apply a final price filter criterion on a pre-qualified stock. We’ve mentioned this in earlier passages, but we're going to reiterate and elaborate on this point because it’s such a integral feature of our investment strategy. We’re restricted to buying a company stock in an uptrend. The stock price must trade above a flat to rising 200-day simple moving average (SMA). If a pre-qualified stock doesn’t pass this price filter, it remains on our watch list. We’ve had occasions where a stock has remained on our watch list for months. As the price has fallen further, more news about the business comes to light that wasn’t known when we did our due diligence. Sometimes this new information invalidates our business thesis. The simple price trend filter has saved our bacon many times over the decades. We’ve said this before: sometimes it’s the stocks you don’t buy that have the biggest impact on your future returns.

Once we’ve purchased an individual company stock, we can only average up. This means our first purchase of a company stock will always be our lowest cost tranche. Our restrictive 200-Day SMA and average up rules only apply to company stocks. When it comes to market index funds, we can buy additional units at any time. This permits an averaging down strategy (buy the dip).

Why do we have such a restrictive rule for a company stock but not for a market index fund? It’s because a broad market index has never failed to recover and reach a higher high, unlike a company stock. With a market index fund, we’re all but guaranteed to achieve positive returns over the long term. If the market index fund falls into the red, we’ll be paid dividends while we wait for the recovery. This has been true when we first started investing 35+ years ago and it remains a valid assumption today (more on this in a later post). We can't assume it's the same for individual company stocks. Business empires rise and fall. You expose yourself to greater company-specific risk when you buy an individual stock.

Here’s our rule visualised for a market index fund and a company stock if both had the same price history:

A diversified portfolio of company stocks will usually comprise of 15 to 25 stocks across a range of sectors. Some investors are comfortable running a concentrated portfolio of less than 10 company stocks, but we never wanted to take that chance in case our stock picking skills severely disappoint. The possibility of missing out on market returns while being exposed to equity risk didn’t appeal to us at all. Imagine putting up with all that price volatility and only achieving returns equivalent to fixed interest. This is why we invest the bulk of our capital in market index funds. We still maintain a portfolio of around 25 company stocks, but collectively they represent a much smaller allocation in our portfolio.

The downside of managing a portfolio of 15 to 25 stocks can be the time and effort required to sufficiently monitor the businesses. Few have the time to monitor every development across 20 or more businesses. Who has the time and discipline is listen to 20 quarterly earnings calls, 4 times a year? Not us. We proudly take short cuts. We’re very protective of our free time and prefer not to busy ourselves with obsessive monitoring of our stock positions.

"The things you own end up owning you" - Tyler Durden, Fight Club (Author: Chuck Palahniuk)

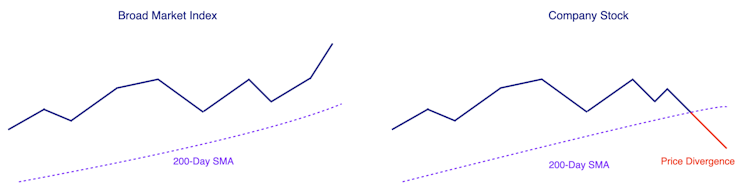

Our solution to managing our time has been the adoption of the principle: management by exception (MBE). This is a style of business management where you identify and manage situations that deviate from the norm. In the case of managing a portfolio a company stocks, this means only attending to those stocks whose price action significantly deviates from the market index in an adverse manner. This gives our stocks a wide berth with plenty of breathing room for market noise. But when the stock price suffers a significant decline when the broad market is still rising, our attention becomes piqued.

This is where the 200-Day SMA plays such an important role. We take advantage of the quantitative and objective nature of the moving average to alert us when we need to review and reassess a company stock. When a stock price falls below its 200-Day SMA while the broad market indexes still trending higher, then we have a divergence event. This requires us to seek a business explanation for the current weakness in our stock. If it’s the emergence of an enduring threat to the business, we’ll revise our current business thesis and evaluate whether to continue holding the stock. It’s important to note that a business will evolve over time and your thesis for owning that stock should evolve in lockstep.

A breach of the 200-Day SMA does not mean we’ll automatically sell the stock, it’s just a trigger point to review our holding. If we’ve chosen our businesses wisely, the times when price falls below the 200-Day SMA when the broad market is still up trending is usually due to a one-time business issue or valuation concerns because the price has gotten ahead of itself. These aren’t a deal breaker for us. We’ll only sell if we see clear evidence of a secular decline in business prospects that invalidates our current thesis for holding.

In a nutshell, it’s adverse price movement relative to the broad market that’s of interest us. We’re not concerned when the stock price falls below its 200-Day SMA in unison with a falling market. Market corrections affect almost all stocks. If the price decline is significantly deeper than the fall of the broad market percentage-wise, then there’s a case for reviewing and reassessing our holding. Once again, most times it’s a contraction in the valuation multiples that got too overstretched in the first place. You can expect growth stocks that get frothy during a bull market will fall severely lower than the market index during a bear market. That’s the nature of beta β, it tends to be symmetrical. Stocks prices are tethered to a rubber band that stretch above and below the underlying intrinsic value.

Our management by exception approach relies on a price divergence strategy. If the stock price moves in the same direction as the broad market both up or down, we tend to leave the position well alone. During a bull market, it lets our winners run because we’re not really paying much attention. We only get the "call to action" when the stock price move significantly against the broad market. Most of the time it results in inaction, but sometimes we come to a genuine sell decision. We believe the sell discipline is equally as important as the buy discipline, despite being much less frequently used when you’re a long-term investor. We’ve found a focus on price divergence to provide a good balance between giving your portfolio of company stocks a wide berth while being attentive to problem stocks that might arise. It’s never been too taxing on our free time. After all, that’s the ultimate goal of investing in the first place: to achieve plenty of free time.

Already have an account?