Trending Assets

Top investors this month

Trending Assets

Top investors this month

What happens if you follow Jim Cramer exactly: a multi-year study of Mad Money picks

Mad Money is an American finance television program at @cnbc hosted by Jim Cramer. Its main focus is investment and speculation, particularly in public company stocks.

Cramer gets a lot of attention - both positive and negative. Some people even say that you should do the opposite of what he says and you would make money. I sticked with a simpler approach trust no-one but numbers.

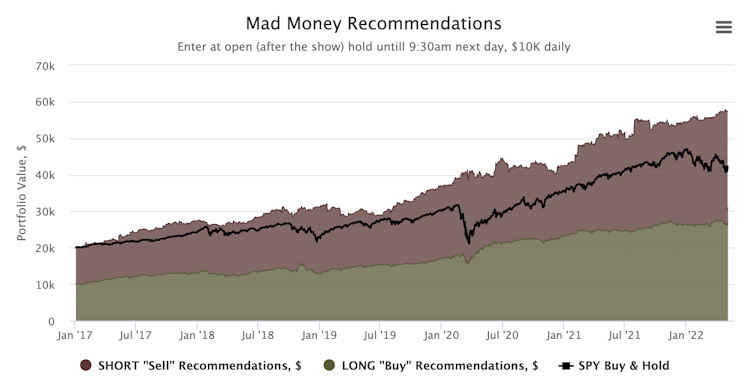

Below you can find the statistics for executing LONG positions for all the Mad Money "buy mentions", SHORT for "sell mentions". Opening positions every morning at 9:30am on the day after the show, holding until 9:30am next day and repeating the same.

The Setup

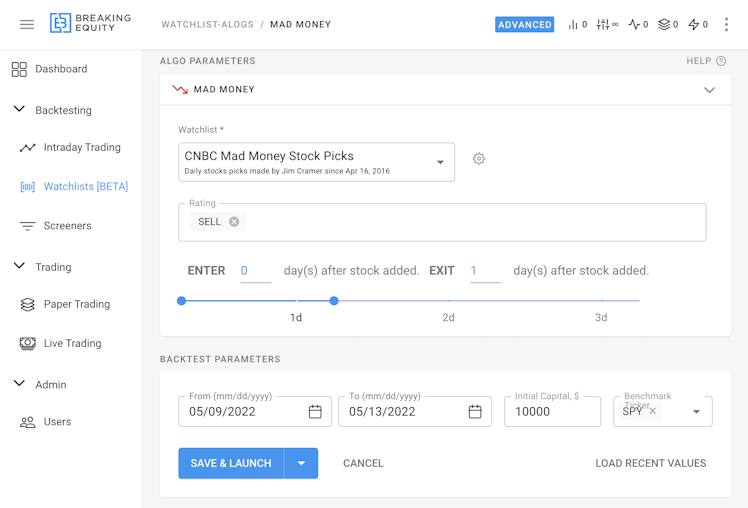

I ran 2 Strategies: SHORT and LONG. Below is the setup. Each Strategy tracks all the historical Mad Money calls and updates with new every night. $10K distributed daily equally among all stocks on each side.

Strategy setup in https://www.breakingequity.com/ ^

The Results

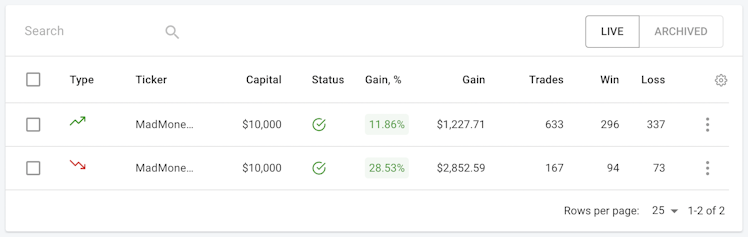

I was a bit skeptical at first. Thinking that it would be mimicking the overall market performance at best or even losing money. I was pleasantly surprised with 2022 performance first

- +11.86% on the LONG side YTD

- +28.53% on the SHORT side YTD

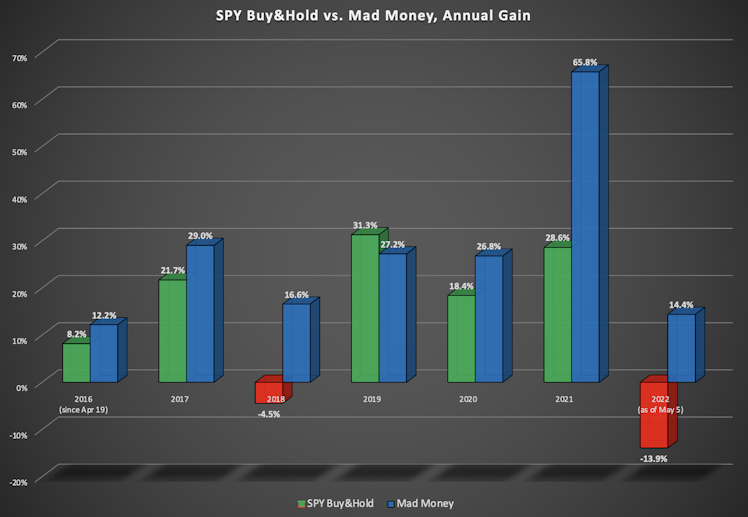

Then I decided to backtest it since 2016 and here is what I got.

www.breakingequity.com

Breaking Equity | Home

Operate active investments of any sophistication in just a few clicks.

Already have an account?