Trending Assets

Top investors this month

Trending Assets

Top investors this month

Intro to Risk, Reward, and Financing in Junior Exploration

“The biggest rewards come to those who invest early”

Risk and reward are important because they’re the two key factors that inform any trade or investment decision. The risk is the possible downside of the position, while the reward is what you stand to gain.

In financial markets, risk and reward are inseparable, as they form a trade-off pair – ie the more risk you’re willing to take on, the higher the potential reward or loss could be. On the other hand, the less risk you accept, the lower your potential rewards.

Investments related to juniors are high risk as they are new in the market and don’t yet have a proven asset base. Juniors may still be in the exploration phase and might not find any resources at all. On the other hand, the potential is there for great reward and huge excitement if the exploration and development is successful.

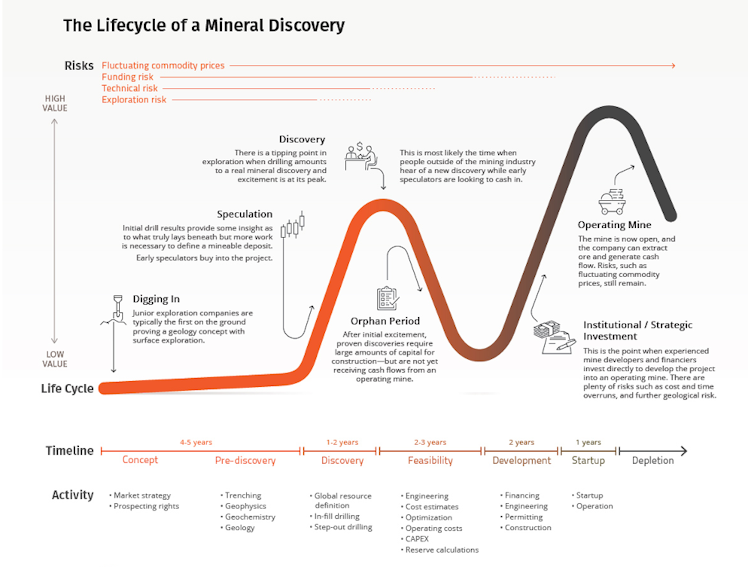

To understand the function of one stage, it's necessary to understand the lifecycle of a mine as a whole. Typically, a successful mining story will start as a junior and progress through to a major, increasing in value and size along the way. The risk of an investment also tends to decrease, but so do the potential rewards.

The early stage of a mining lifecycle is a particularly risky time to invest in a junior company. At this stage, there is plenty that can go wrong with securing funding, permits, and asset viability. Companies are a long way from proving a deposit and earning profit. Despite all of this, the biggest rewards come to those who invest early – if the company succeeds.

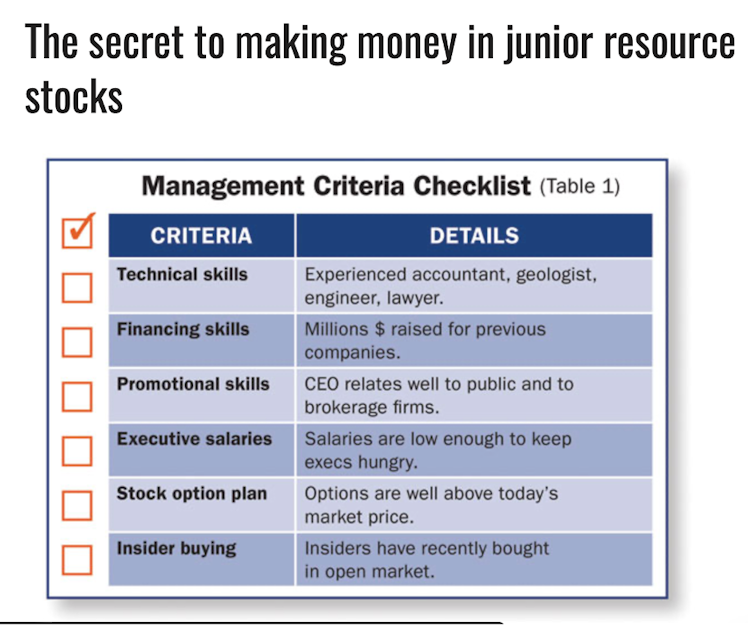

‘The management team is critical to the success of a junior resource company and its stock. Management must find projects, develop them in a timely manner, control share structure and complete financings at progressively higher share prices.’

I frequently hear investors ask the question “How can one value a mining exploration company in the early stages?” Unfortunately, that’s an incredibly difficult task, because the drill bit will bring the answer, and until then you are investing in the unknown – hence the high-risk nature of the sector and why the stocks are generally valued in pennies and not dollars.

This is why I personally spend most of my due diligence process looking at management’s track record. Even successful mining magnates such as Pierre Lassonde or Robert Friedland won’t bat a thousand, but sticking with reputable names greatly increases your odds of success and in the early stages, management is largely the value driver of the company – particularly when they do not have a producing asset and the only way forward is raising capital. If you’re investing in junior resource stocks, this means placing your trust in management to make effective and efficient use of shareholder capital.

Peter Besler, an investment advisor with MGI Securities Inc., wrote this excellent article originally published on www.miningmarkets.ca, and I have pulled several important points for you to consider.

Most junior resource companies are engaged in early stage, “greenfield” exploration where risks are high, but where good drill results can send the share price rocketing. Greenfields have huge upside potential. Since no one knows what is hidden underground, junior resource stock speculators should not focus on geology, but instead on understanding the stock.

The big secret about investing in greenfield sites is that there are no secrets or special insight required to profit from them. The only requirements are due diligence and patience. The primary considerations for investing in junior resource stocks are management, structure and timing.

After completing a qualitative assessment of management’s skills, investors must determine how motivated management is to have the stock move materially higher. Ideally, management should have a large, vested interest in the stock and primarily depend on the success of the stock for compensation rather than salary.

Share structure

The share structure of a company is important. Share dilution is often an issue for junior resource stocks, so several factors that can increase the number of shares outstanding need to be considered when gauging price points.

After an initial public offering, juniors tend to raise capital through private placements. Sometimes, a junior will announce impressive early exploration results. Its stock prices may move sharply higher on frenzied trading for several days following this good news. This is referred to as a “breakout.” The company will likely require additional capital to carry out the next phase of exploration, and since it is easier to raise money when the stock is rising and actively trading, it is common for a new financing to be arranged shortly after announcing exciting results. This may be done at a discount and take some time to complete.

New share offerings often feature one- to two-year warrants that allow the holder to purchase more shares at a fixed price. Shareholders who receive warrants attached to a new share issue often sell the shares at or above the issue price, and retain the warrant for no cost. As the expiry date approaches, holders will normally exercise and sell the stock, and this selling often depresses the share price. A stock will have difficulty going far above the warrant’s exercise price without a lot of new buying to absorb the selling from the warrant holders. Similarly, a stock may appreciate just after warrants expire, as the potential overhang no longer exists.

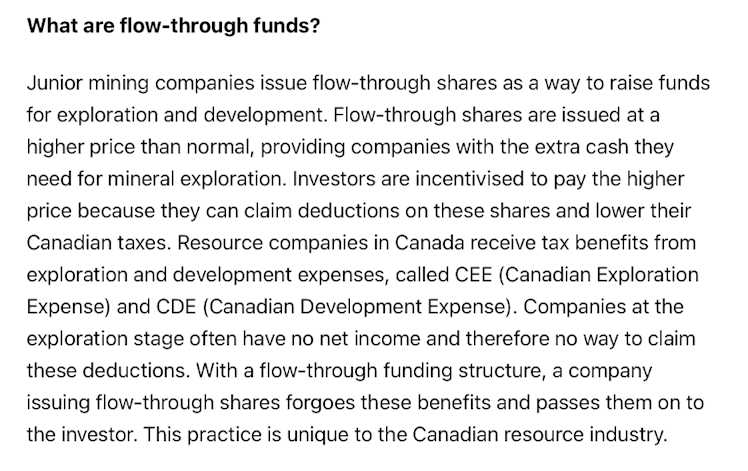

Resource companies frequently turn to flow-through investors, such as limited partnerships for exploration financing.

Buying into the right company in the earliest stages is fundamental to investor success. The optimum structure for a junior resource stock is tight enough so that incremental buying results in stock-price appreciation when milestones are met. This allows the company to raise money at consecutively higher prices.

For a company, having money in the treasury is considered akin to having gas in the tank of a car: it is viewed as a requirement for movement. Many investors restrict themselves to investing in junior stocks that already have enough capital to finance a near-term exploration program, believing there is less uncertainty in such stocks. However, that belief is ubiquitous and largely discounted in the market, rarely coinciding with buying near a low. It is possible to make money at this stage, but the returns will generally not be as high. By the time sufficient funds have been raised, the price action on the stock becomes dependent on drill-hole assays. Investors at this level must compete with other like-minded shareholders for trading profits.

Understanding Private Placements & Flow-Through Shares

Securing finance is a representation of the market’s trust in the ability of the management team to deliver what they say they can. As the management team continues to de-risk their business plan, the likelihood of money becoming available to them increases. Typically in the exploration/development stage (pre-revenue), this is done through the issuance of shares in the company.

Once a company gets into a near-term revenue or revenue-generating position, it's able to reduce the dilution of issuing shares and instead use debt instruments as a means of financing the development, Capex and Opex of their operation.

FLOW-THROUGH SHARES & THE MINERAL EXPLORATION TAX CREDIT EXPLAINED

This video from Becker Orr Wealth Management provides an excellent explanation on how Flow-Through Shares Can Help You Save on Your Tax Bill. Flow-Through shares allow the issuer to transfer the eligible exploration and development expenses to the investor:

Occasionally, "charitable flow through shares" are offered.

Here's a video from PearTree that offers a good explanation:

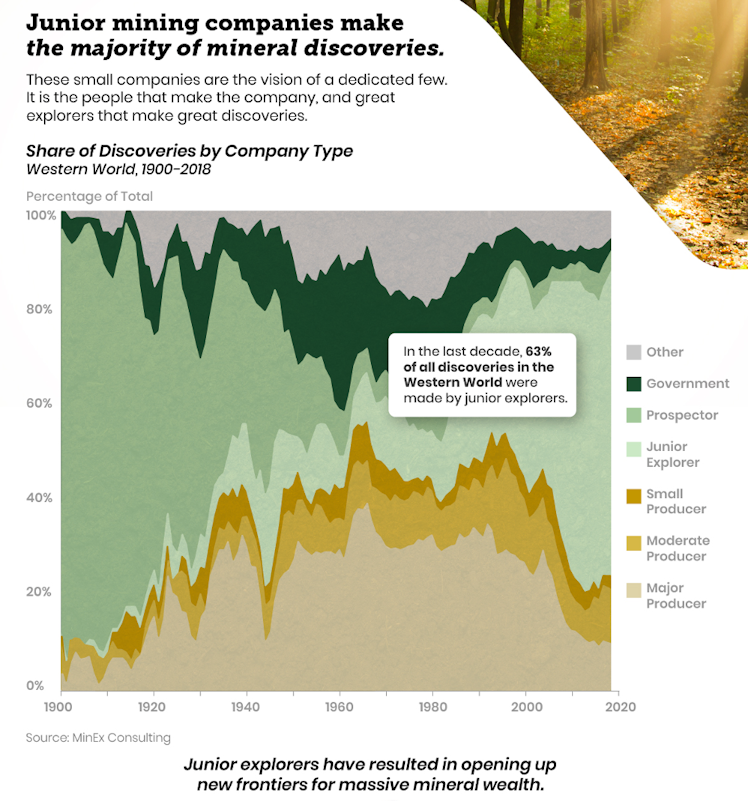

The goal of most junior miners is to be acquired by a larger company. It’s become increasingly common for major and mid-tier mining companies to dedicate their extra cash to acquiring junior miners, rather than exploring for new deposits. M&A is the best way for junior miners to survive. The costs of building and operating a mine are so high that only mid-tiers and majors can sustain them. Keep this in mind when evaluating junior mining companies. Good juniors will complete all the technical and logistical work required to get the mine into production, positioning themselves for acquisition. Look for juniors who are transparent about their data and financial status and are open to working with partners.

If you do the right research and keep an eye on your portfolio, junior mining stocks can prove to be good investments. The early stages are the riskiest when it comes to investing in junior miners. However, many of the junior miners who are traded on public exchanges have already reached the development or production phase. This inherently lowers the risk, as the resources at these mines have been proven and the companies are on their way to becoming profitable. Read about junior miners’ leadership, strategy, drill results, and reserve estimates. Invest in a diverse group of junior miners, so that the highest gainers will offset the poor-performing stocks.

Junior mining equities tend to be volatile, so investors who want to make a profit need to keep a close eye on them, make sure they have an exit plan in place for junior mining stocks. While you’re holding the company stock, there are several things to monitor. Pay attention to the company’s press releases. They will contain information about management changes and updates on financing, exploration, testing, and permitting activities. It’s also important to consider the overall movement of the stock. Information about insider trading, management issuing stock options, share dilution, and timing of previous share issuances are all available online.

Monitor the stock prices of the individual junior mining companies you’ve invested in. When you see sudden changes in their stock price, read recent press releases and quarterly announcements to see what caused the change. If a company released excellent drill test results, a sharp increase in stock price is expected. But some stock prices can rise to unsustainable highs because of investor hype. Read the reports carefully and make sure the data backs up any changes to a stock price.

Similarly, look for downward trends and sudden decreases in stock price. They could be reactions to unsustainably high stock prices, commodity prices, or overall market actions. Positive exploration results often cause a stock price to increase, but investors can react in unpredictable ways. Stocks can decrease after positive results if the results weren’t as good as investors were expecting. Research the company’s recent actions before making any decisions about buying or selling in reaction to sudden increases in stock price.

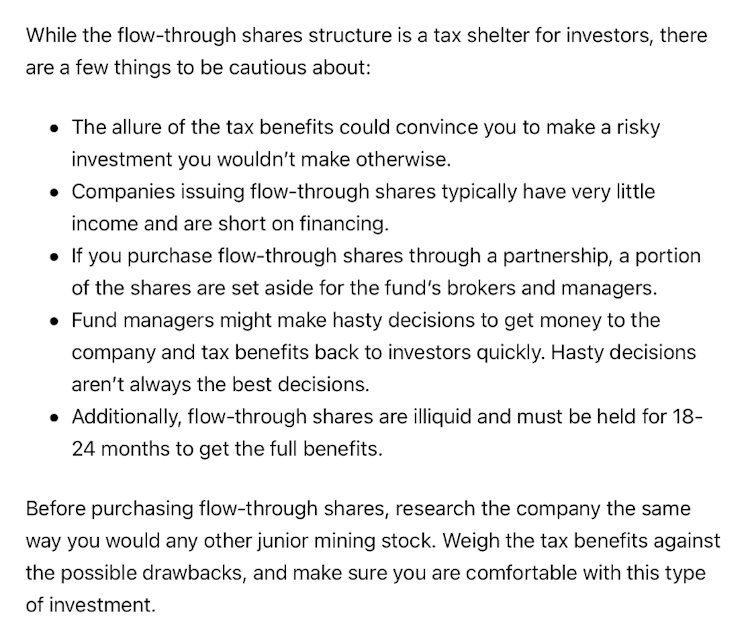

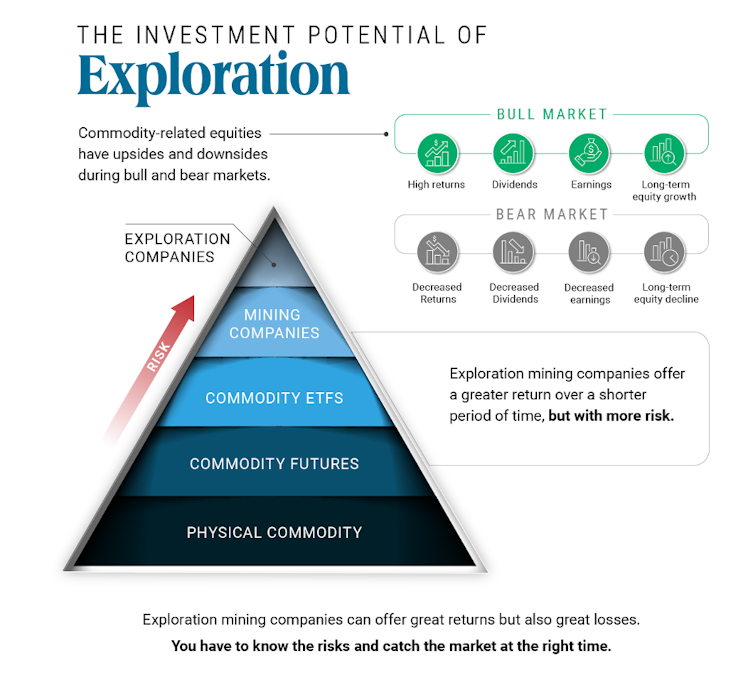

Mining equities tend to outperform underlying commodity prices during bull markets, while underperforming during bear markets.

For mining exploration companies, these effects are even more pronounced—exploration companies are high-risk but can offer high-reward when it comes to commodity investing.

To reap the rewards of volatile returns, you have to know the risks and catch the market at the right time.

Visual Capitalist

Volatile Returns: Commodity Investing Through Miners and Explorers

The companies that mine or explore for metals offer additional leverage to commodity prices, creating opportunities for astute investors.

Already have an account?