Trending Assets

Top investors this month

Trending Assets

Top investors this month

DANAOS Corporation ($DAC) - A Sunday Driver

Hello everybody. I am writing this post as a request from @nachomart for another view on DANAOS Corporation.

Introduction

Generally, I like companies from the technology sector but this time I give a try to something different. My first view was that something wrong happens in Danaos, due to generally low debt to equity which comes as a result of very high Retained earnings. I tried to convert them into cash and to adjust all the valuation but

with negative results since the ROIC becomes negative and is wrong for a Mature company. I tried also to convert them as expenses with also negative results because operating margins become also negative, which is again wrong for a mature company. Finally, I think that this type of company is good to value as it is

since they are at a mature and slow growth phase.

Assumption

As Debt, I use the book value of Debt and as Operating leases, I measured:

- Operating leases from the book value

- Leases from future payments to shipyards

- Managers fees

The reason that am I doing this is that are future obligations that must be fulfilled in order for the company to work properly.

Survey the Landscape

First, we are looking at the market cap and %change, to gain a first view of what we are going to purchase. As we can see, market cap was generally stable and gained a record high in market cap in 2020 and 2021. Furthermore, we observe two spikes in 2010 and 2014 but the most obvious thing is the cyclicality of the company.

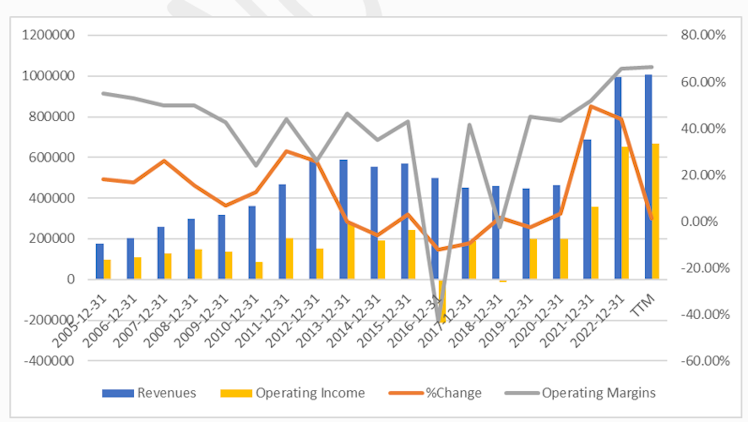

Now lets observe the revenues and the profitability. Company has an average growth of 11% in revenues with operating margins to hit 38%!!Furthermore, transportation industry has 10% (5 year average) growth in revenues which means that DANAOS is growing with similar pace of the whole sector.

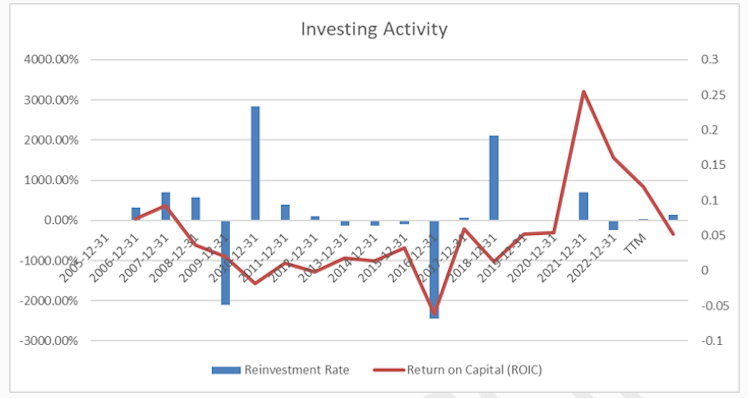

The next thing that I checked was the reinvestment rate and ROIC because with so high profitability the company could be the next big thing. The results are the following:

This company has:

- Reinvestment rate on average which is 150% vs 56% industry average (2022)

- Average ROIC 5.6% vs12.7% industry average (2022)

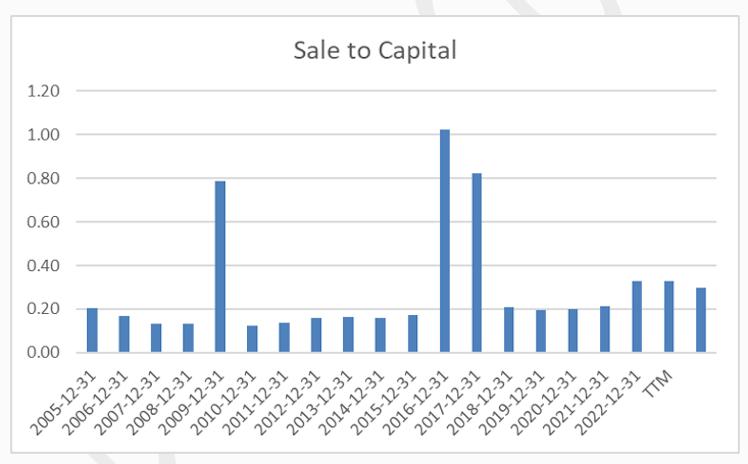

- Sales to capital on average at 0.30 vs 1.95 industry average (2022)Average growth at 8%

Valuation Narrative

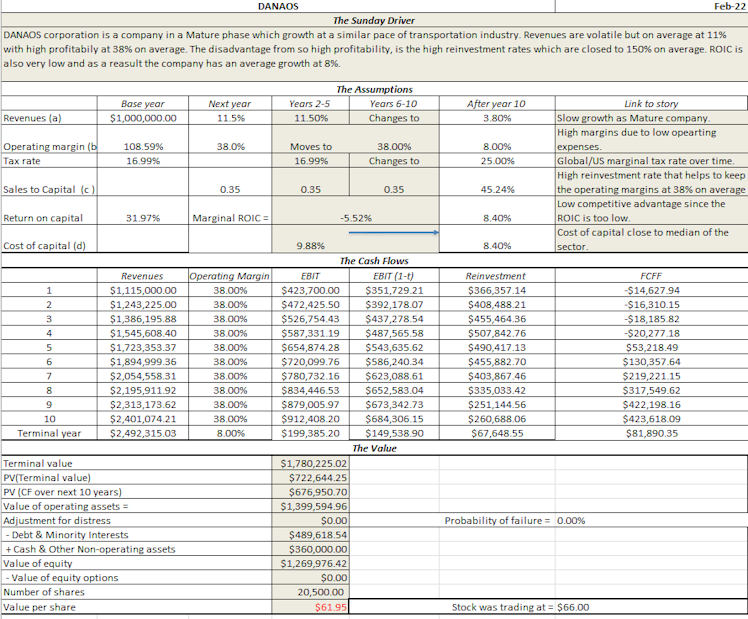

Taking into account the above financial results I will make my narrative about DANAOS Corporation:

- Mature company in a Mature sector (Revenues growth with the same pace of the whole sector).

- High profitably 38% on average.

- High reinvestment rate which is higher of that the industry.

- As a Mature global company I set the Cost of capital at 9.8% which is the global average for Transportation Industry.

Conclusion

I treated the company as a slow mover in the Industry because of the average revenues, low reinvestment rate and low ROIC. For me is a company which has been matured and cannot make excess returns. As a result, I came up with a value per share at 62$ and i am not willing to pay the price that the market offers me.

I would like to hear other opinions about my approach . I hope all of you have good investments and thank you for supporting my work.

Already have an account?