Trending Assets

Top investors this month

Trending Assets

Top investors this month

Today, we want to analyze a peculiar case involving two companies that have practically more cash than market capitalization and no debt (except for leases). These companies are related because one is a spin-off of the other and the latter holds a 44.35% ownership stake in the former.

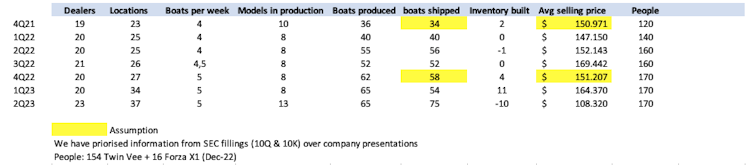

Twin Vee PowerCats ($VEEE) is a company that manufactures recreational power sport boats and has been in operation for over 25 years. However, it went public recently (August 2021), raising $18 MM to finance its growth. Subsequently, it spun off one of its three business lines, electric boats (Forza X1 $FRZA), in August 2022, raising $15 MM.

However, what has caught our attention about both companies is not just that, but the fact that both have significant catalysts on the horizon.

- Twin Vee has recently acquired a AquaSport at a bargain price as its parent company (Limestone) was bankrupt. It had been idle for only 8 months, but AquaSport began production on July 1st and several managers and employees have returned. The facility was ready to go but Twin Vee estimate that it will need $2 million investment to ramp up production. (Details on production, breakeven, and forecasts later.)

- Forza is about to start selling its first electric model and already has an order for 100 boats for 2024, worth around $12 million, with shipments planned at a rate of 2 per week.

We have read all the available information about both companies and have conducted a comprehensive analysis (we believe there is nothing similar on the internet) to determine the size of the opportunity, potential red flags, critical aspects to monitor in the coming quarters,...

We will explain their business lines, assets, strategies, finances, shareholders, and provide a forecast of their production by business line, revenues, burn rates, along with our thoughts and conclusions.

Before we begin:

$VEEE has 9.52 million shares and a market cap (as of Friday's close) of $16.75 million. Forza, after its capital increase in June, has 15.784 million shares and a market cap of $16 million. As we mentioned, $VEEE owns 44.35% of Forza. In this latest capital increase, $VEEE reduced its ownership of $FRZA from 69%. The reasons were not indicated, but it seems evident that the acquisition of AquaSport in 2Q23 played a role.

Warrants and main shareholders will be discussed in the Capital Structure section

Before delving into the details, from an initial glance, we can see that this company is clearly in an expansion phase, focusing on revenue growth and expanding its network of dealers and production. Currently, it has one boat manufacturing facility in production, the second one is entering production, and the third is set to begin operations in 3Q24. We will analyze each of these individually later on.

Business lines

Twin Vee has 3 business lines:

- Gas powered boats: Traditionally, catamarans (GFX, STX), but at the beginning of this year, they launched their Monohull line (LFG), and in April, they had the opportunity to buy a bankrupt company (both the trademark and its assets - AquaSport), so they integrated LFG into it.

- Electric powered boats / Forza X1 $FRZA: An early entrant into the EV boat market, expecting to commence sales to customers in 1Q24. Forza went public in 2022 and raised an additional $7.3 million in June 2023. We will analyze it as an independent company later, but for now, let's consider it as the electric boat line. Furthermore, Forza also plans to start offering electrification expertise and hardware packages as a service to some other clients (including one of the main Pontoon manufacturers in the US).

- Fix My Boat: This is the maintenance franchise that they plan to launch it in 2024 (it has been inactive so far). It will use a franchise model for marine mechanics across the country.

Gas powered boats

Twin Vee

- Catamarans: There are three types, each with several combinations of length and power. GFX Center Console, GFX Dual Console and STX Centre Console. Price’s range is quite guide going from $120k to $950k (The crown jewel model 400 GFX CC)

- Monohulls: LGF brand launched in 2023. The price of them is around $60k (much lower than the average catamaran). And it has disappeared from the 2Q23 10Q, so we understand that it is going to be fully integrated within the AquaSport brand. We believe that this is a good thing, as it allows best of both worlds Twin Vee Center Console technology and AquaSport brands (average price is now around $100k - being higher for the 2500 and 3000 Center Console AquaSport models)

AquaSport

Acquisition structure: Twin Vee acquired AquaSport™ boat brand and manufacturing facility (including related tooling, molds, and equipment to build five Aquasport models ranging in size from 21 to 25-foot boats for $3.1MM. However, Twin Vee has the option of paying a $22,000 monthly lease (with $16,000 deducted from the outstanding balance) or purchasing the facility at any time during a 5-year period.

For example, if AquaSport buys the facility after 3 years, during the first 3 years, it pays $792,000 ($22,000 per month), and after 36 months, it pays $2.524 million.

- AquaSport used to belong to Limestone (a publicly traded company with the ticker BOAT.TO) which filed for Chapter 11 bankruptcy last year. The AquaSport factory in Tennessee was in production until November 2022 (although it had not been operating at full capacity for some time). The AquaSport brand has been in the monohull market for over 60 years.

- Jim, the person in charge of AquaSport, has led Maverick Boats for 25 years (acquired by Malibu), and at its peak, they were producing 1,700 boats per year.

- With less than $2 million, they expect to have it up and running (including staff expenses). They have hired 35 people since June 1st, including former managers and employees, and started production on July 1st.

- They anticipate to produce 8 boats by the end of August and then 2 per week from September to December. From January, there will be a ramp-up. They expect to progressively increase production over the next 5 years, reaching breakeven quantities by the end of 2024 (for the AquaSport line). The projections they have shared are quite aggressive (adding approximately $10-12 MM in revenue per year during the first 5 years) - some investments are needed to reach this goal -

- Integration of the Monohull brand LFG, launched by Twin Vee at the beginning of 2023, into AquaSport (Detailed in Forecasted production and prices as AquaSport prices >> LFG).

open.substack.com

Twin Vee & Forza X1 Analysis - $VEEE $FRZA + $GLNG Earnings + model

Two microcaps twinned to be pioneers in electric recreational boats with EVs close to 0 and catalysts in the horizon.

Already have an account?