Trending Assets

Top investors this month

Trending Assets

Top investors this month

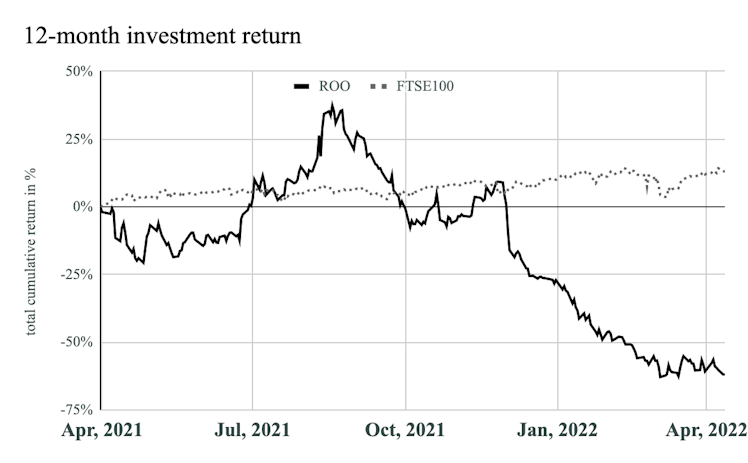

Deliveroo plc (LON: ROO), valuation on April 12, 2022

I last valued Deliveroo in March 2021. You can see that valuation here. This piece will be in the Friday, April 15 issue of Valuabl along with other investment ideas I’ve found. If you haven’t already joined, subscribe here.

•••

Summary

- Stock: Deliveroo plc (LON: ROO) common equity

- Market cap: £2.12bn

- Rating: Buy

- Price: £1.14

- Target: £2.41

source: S&P Capital IQ

•••

Setting the stage

Deliveroo plc (LON: ROO) is an online food delivery platform founded in 2013 in the U.K. The company connects local consumers with restaurants and grocers to order food from and riders to deliver the purchase. The company makes money by taking a commission of the order size from restaurants and grocery partners, charging consumers a service or subscription fee, and charging for advertising. The company gets 54% of its revenue from the U.K. and Ireland, and the remaining 46% from France, Italy, Belgium, the Netherlands, Hong Kong, Singapore, Australia, the UAE, and Kuwait.

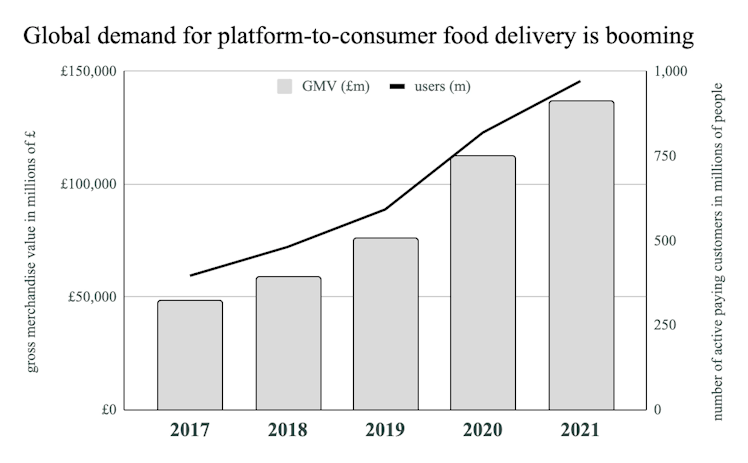

Since Pizza Hut launched online pizza ordering capabilities in 1994, the online food delivery market has snowballed. Aggregator platforms have multiplied by providing reliable online ordering infrastructure to meet burgeoning global demand. In 2017, 397m active paying customers were using online platform-to-consumer food delivery services worldwide. From 2017 to 2021, this number grew at 25% per year to hit 972m. Platform-to-consumer delivery businesses, like Deliveroo and Uber Eats, offer a more comprehensive but costly service by handling delivery, which helps smaller enterprises participate in the delivery market. These services have gained enormous traction over the last few years, especially in densely populated cities and towns.

source: Statista

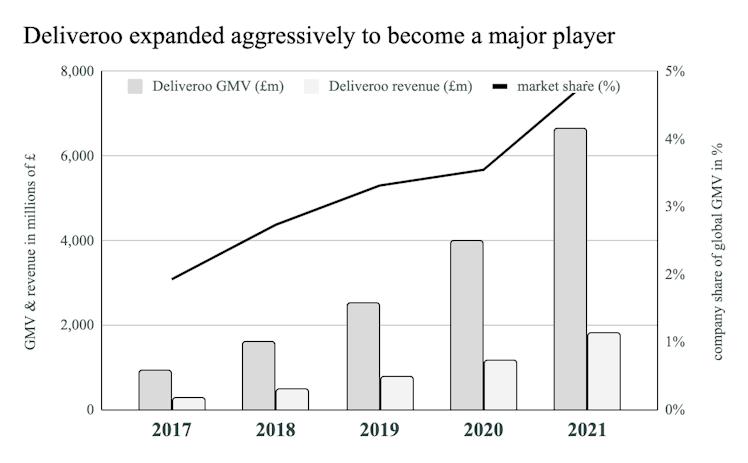

The food delivery market is highly localised and fragmented. Deliveroo has expanded aggressively, both at home and abroad, to become one of the top global players in this large and growing industry. In 2017, the total global value of all platform-to-consumer online food delivery orders, the gross merchandise value (GMV), was £48.2bn. The market was already considerable, but Deliveroo was still a tiny player, capturing just 1.9% of these orders. But by 2021, the value of platform-to-consumer orders had tripled to £136.7bn, and Deliveroo’s share had increased to 4.9%. When combined with Deliveroo’s consistent commission rate, around 29.3%, this expansion of the market itself and the company’s share helped revenues explode. From 2017 to 2021, the company’s revenues almost septupled, going from £277m to £1.8bn, a growth rate of 60% per year.

sources: company financials, Statista, Valuabl

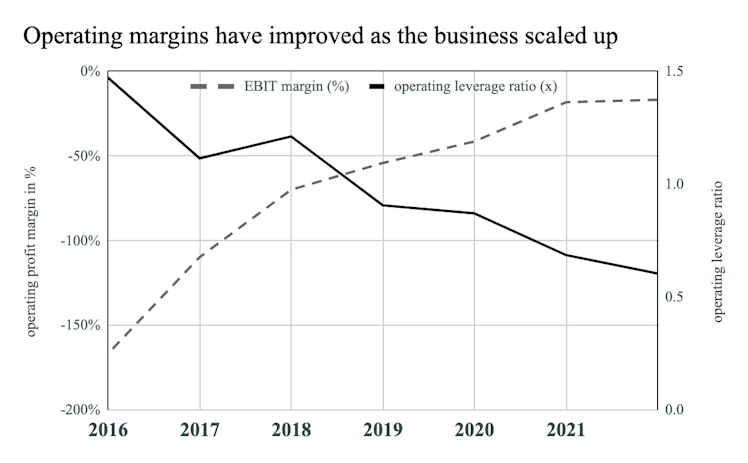

As is typical for young growth companies, Deliveroo’s margins have improved as the business scaled up. Deliveroo first broke even on a gross profit basis in 2016 but is yet to break even on an operational basis because of high administrative costs. In 2015, the company brought in £18m of revenue but lost £30m on an operating basis as it ploughed £29m into selling, general, and administrative activity (SG&A). This result gave the business a -167% EBIT margin as it spent 159% of revenue on SG&A. Every year since then, company revenues have grown by more than SG&A expenses, and in 2021, SG&A activity was just 43% of revenue resulting in improved EBIT margins of -17%. This pattern is typical for young growth companies scaling up.

Deliveroo is a delivery business at its core, so we should value it as one. Compared to my sample of 63 developed world transportation and logistics companies, Deliveroo’s gross profit margins of 27% put them at the 58th percentile, the middle of the pack. However, their -17% EBIT margin puts them at just the 5th percentile, right down the bottom. Deliveroo is still loss-making but is becoming less so each year as the operational leverage within the business decreases. As they have grown their operation and scaled, administrative costs, including marketing, are taking a smaller portion of revenues.

sources: S&P Capital IQ, company financials, Valuabl

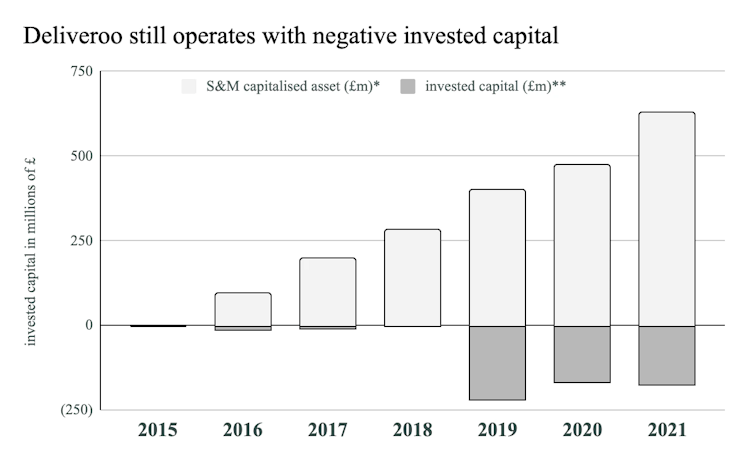

In contrast to most transportation and logistics businesses, Deliveroo doesn’t need trucks, planes, or warehouses. As a result, the company’s business model is incredibly capital-light, and its assets are primarily its brand and the app. Despite turning over £1.8bn, the company still operates with negative invested capital. However, this belies the amount of money they have likely needed to spend on sales and marketing to bring new customers, restaurants, and riders onto the platform and develop the value of their brand. Deliveroo doesn’t break these sales and marketing expenses out individually.

If we apply the average proportion of SG&A expenses spent on S&M by Uber Technologies, Inc., Doordash Inc., Ocado Group plc, Delivery Hero SE, Just Eat Takeaway N.V., and Ozon Holdings PLC to Deliveroo, we can guesstimate that the company spent about 59% of its SG&A on S&M. Further if we apply a two-year amortisation period, we can roughly estimate the capitalised value of the Deliveroo brand asset and adjust the invested capital to get a clearer picture of the capital in this business. In 2016 the company had an effective £82m of capital invested in operations, not -£11m. By 2021, this number had expanded to £455m, rather than -£173m. Again, comparing it to the sample of 63 developed world transportation and logistics companies, Deliveroo ranks in the top decline of capital efficiency as measured by revenue to invested capital.

sources: S&P Capital IQ, company financials, Valuabl. * The value of the S&M asset when capitalised using approximated spend and a two-year amortisation period. ** Defined as total equity + total debt - cash & equivalents - investments

•••

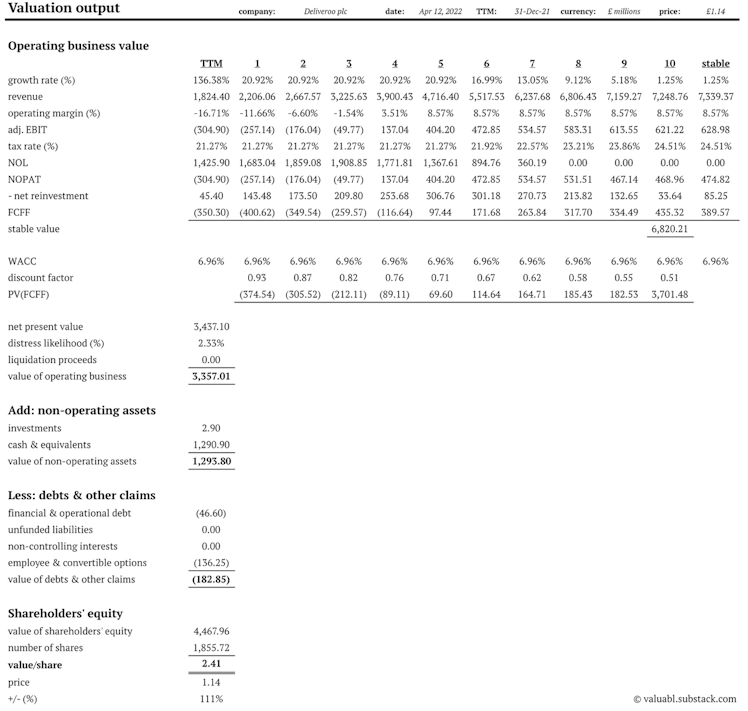

Story & valuation

Deliveroo plc (LON: ROO) is a young, online platform-to-consumer food delivery business. By expanding into new markets, developing their kitchens and optimising sales processes, they will keep growing their market share. Improved network density, delivery batching, and support automation will help bring costs down, but the key here is to scale and reduce marketing, which they will be able to do and achieve middle-of-the-pack profitability. The business is well capitalised but might need to raise capital within three years as they pour cash into expansion.

Growth: Analysts forecast the global online platform-to-consumer food delivery industry to grow at 10.8% per year from £137bn in 2021 to £228bn in 2026. Deliveroo will continue expanding into new markets and regions, develop their advertising business, roll out more of their kitchens, and optimise the sales process of their platform to increase order value and pricing.

Based on this, I forecast them to expand their global market share to 7.5% by 2026 and grow at 20.9% per year. This is in line with the average growth rate of 20.6% forecast by the 14 analysts covering Deliveroo.

Margins: By increasing its network density, batching deliveries, and reducing rider wait times, the company will increase its gross profit margins slightly. However, by automating its support and sales services, reducing its sales and marketing spending, and benefiting from economies of scale, the business will be able to turn an operating profit by 2025.

Deliveroo is a transportation and logistics business, and competition is fierce between the major players in this space. It will be difficult for Deliveroo to achieve outsized margins as network effects and loyalty are not as powerful here as the company believes. This competition limits the amount the company can charge both customers and restaurants while applying upward pressure on payments to riders. But, the scalability of the business and the brokerage model will help constrain costs.

I forecast Deliveroo to achieve slightly better than industry average operating margins of 8.57% by 2026, putting them at the 60th percentile of transport and logistics businesses.

Reinvestment & taxes: After capitalising the S&M spend, as outlined above, Deliveroo is producing about £4 of revenue for every pound of invested capital. However, using the average marketing spend of their significant competitors doesn’t tell us how much Deliveroo is spending. If we assume they spent 80% of SG&A on S&M, rather than 59%, their capital efficiency would be much lower at £2.50 of revenue for every pound of invested capital. Given that I don’t know the actual numbers for Deliveroo, these estimates are unreliable, but they give me a range.

Given how capital-light the business is, I forecast the company’s reinvestment efficiency to be in the industry’s top quartile as they generate £2.66 for every pound of extra invested capital. They will spend about £1bn on growth assets over the next five years.

Deliveroo has always been loss-making and has accumulated £1.4bn worth of operating loss carry-forwards to offset future taxes. I have assumed that the company’s tax rate will trend from the current underlying marginal corporate rate based on its geographies to the future underlying corporate rate as the U.K.’s corporate tax rate increases to 25%.

Free cash flows: Based on this, I forecast the company to remain FCF negative until 2025 as it burns through £1.1bn. The company has almost £1.3bn in cash and equivalents, so it will be borderline whether or not it needs to raise capital within the next few years.

Cost of capital: Deliveroo is a developed market transportation and logistics business (product beta of 0.62), getting 54% of its revenue from the U.K. and Ireland and the remainder overseas. As it is young and still scaling up, the business has substantial functioning leverage (0.6x), especially compared to the rest of the industry (0.16x). The company has a Baa1/BBB+ synthetic credit rating based on its Altman score, and I have assigned a 2.3% chance of distress based on this rating. The company has just a 2.2% debt to equity ratio.

I estimate Deliveroo’s cost of equity to be 7.07% in GBP and its after-tax cost of debt to be 2.06%, giving it a WACC of 6.96%.

Add non-operating assets: The company has almost £1.3bn worth of cash and equivalents on its books and £2.9m worth of financial securities.

Less debts & other claims: Deliveroo owes £46.6m to landlords, and almost 122m employee options are outstanding that I value in aggregate at £136m.

source: Valuabl

Each share has an intrinsic value of £2.41, and at the current price, the investment has a 111% upside.

•••

Sensitivity analysis & rating

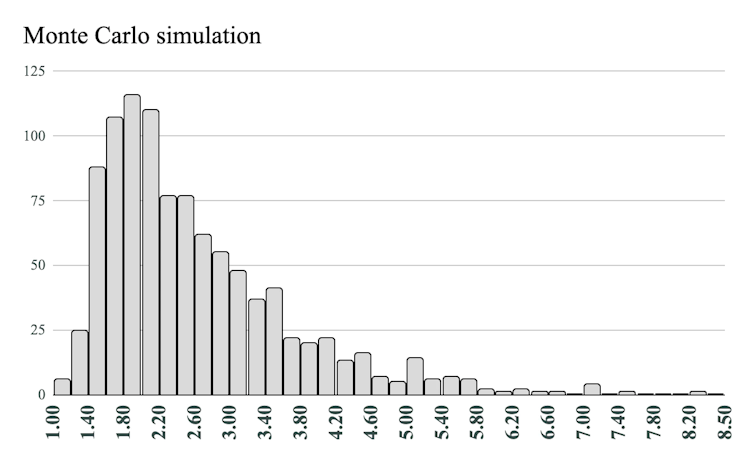

Monte-Carlo Simulation is used to model uncertainty by assuming that the inputs to the valuation model will come from probability distributions around the estimates.

source: Valuabl

Buy ••••••• 10th: £1.57

Add ••••••• 30th: £1.94

Hold •••••• 50th: £2.33

Reduce ••• 70th: £2.91

Sell ••••••• 90th: £4.10

The current price for Deliveroo plc (LON: ROO) common equity is £1.14 and is below the 1st percentile of the Monte Carlo sample of intrinsic values. For this reason, it has a rating of Buy.

I already have a position in Deliveroo. I am not adding to it.

•••

valuabl.substack.com

Subscribe to Valuabl

Expert financial analysis in a straightforward style. Helping professional investors make sense of markets and find undervalued stocks. Click to read Valuabl, by Edmund Simms, a Substack publication.

Already have an account?