Trending Assets

Top investors this month

Trending Assets

Top investors this month

What's up with Unilever $UL?

Yesterday Unilever dropped more than 13% - why that?

The reason is to search in this news:

Apparently, Unilever's shareholders are unhappy about Unilever's offer to buy the Healthcare segment of GlaxoSmithKline $GSK.

I think it is a bit too emotional reaction, and I believe the Unilever CEO when he said:

"Please be assured, Unilever will not overpay for any asset, particularly in the context where GSK consumer health is a very attractive option in the consumer health space."

A juggernaut like Unilever can constantly grow only through acquisitions, and it's in their DNA to expand their brand portfolio with such a system. To evaluate if it's expensive or not, we need to check the revenue/profit of the GSK unit.

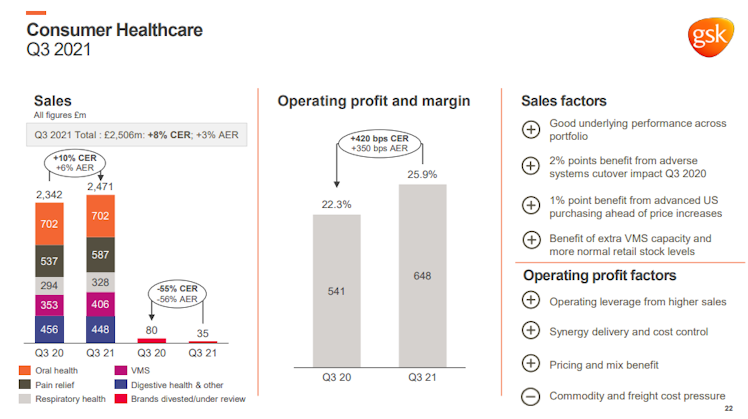

Numbers are not easy to sum up, but here is a slide from the $GSK Q3.2021 presentation.

The data are on quarter only, and we have to wait until 9 February 2022 to see the full-year numbers. Anyway, we are speaking about a business unit with:

+ more than $12B revenue

+ operating profit approx 25%

To oversimplify, we can say that P/S = 5.6 of the unit can be an accurate number. It's high. Considering P/S of $UL is just 2.

But it's an improvement from the Operating profit point of view, cause Unilever is under 20%.

It is far from a complete fundamental analysis of the GSK business unit, but it can give us a brief idea. I think 😏

I bought more shares of Unilever yesterday to average down on my position. 👍

Long $UL

No Position on $GSK

www.gsk.com

Update - GSK Consumer Healthcare | GSK

GlaxoSmithKline (GSK) plc today confirms it has received three unsolicited, conditional and non-binding proposals from Unilever plc

Already have an account?