Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - GDP and Jobs

Stock were lower this morning GDP results indicating the economy continued to shrink in the second quarter but have since bounced back.

GDP contracted for a 2nd straight quarter posting a -0.9% annualized growth rate, much lower than the 0.5% growth many economists expected and on the heels of a 1.6% decline last quarter. The decline was broad-based with inventories, residential and nonresidential investment, and government spending at all levels declining. Consumer spending showed an increase of just 1% as the consumer price index rose 8.6%, resulting in an inflation-adjusted after-tax personal income of -0.5%. Overall, the back to back declines are a warning sign for many that a recession is here or will be soon, and for the rest that a severe slowdown is here.

The strong jobs market appears to be weakening with initial jobless claims continuing to inch higher each week since April. Claims for the week ending July 23 came in slightly lower than the revised previous week at 256,000. The 4-week moving average was up 6,250 to 249,250. Continuing claims decreased by 25,000 to 1,359,000 and the 4-week moving average increased slightly to 1,362,000

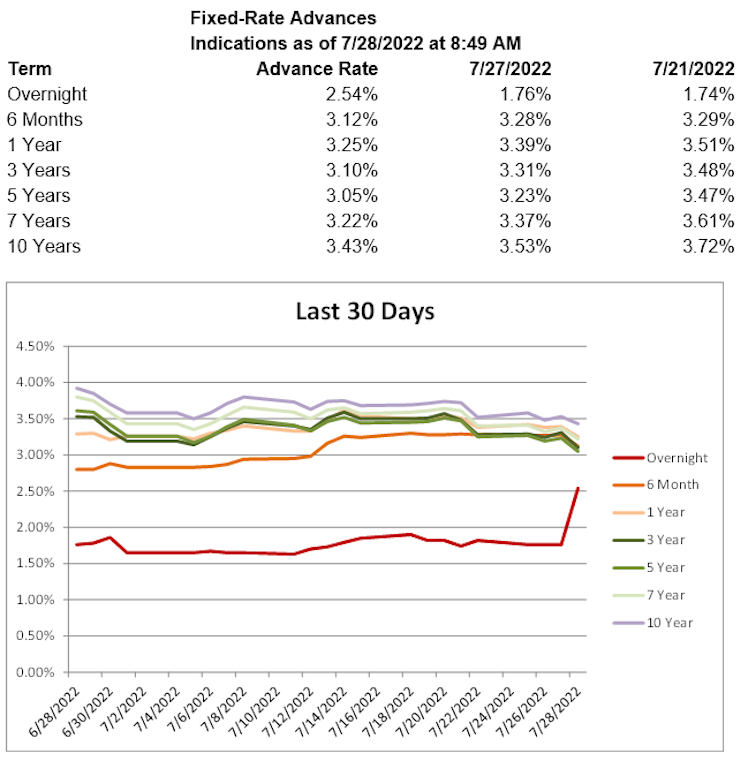

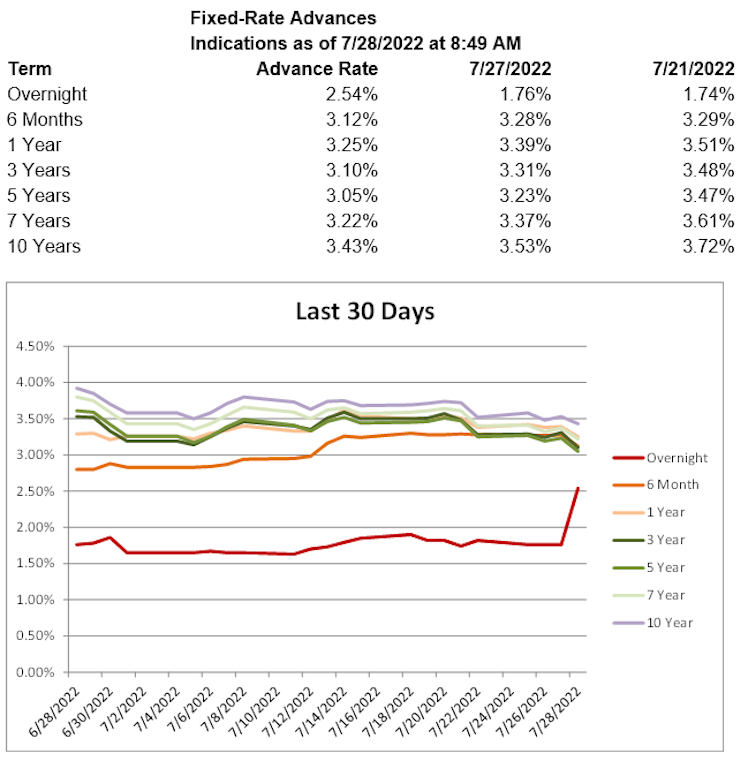

Treasury yields are lower, with the 2-year T yield down 19.3 basis points to 2.85%, the 5-year T yield down 16.7 basis points to 2.68% and the 10-year T yield down 9.4 basis points to 2.66%. Advance rates are lower across the curve, with the exception of the overnight advance.

Already have an account?