Trending Assets

Top investors this month

Trending Assets

Top investors this month

Carrier $CARR: Analysis and Valuation, 2022

This recently spun, durable business isn't sweating under pressure.

“It was luxuries like air conditioning that brought down the Roman Empire. With air conditioning their windows were shut, they couldn’t hear the barbarians coming.” - Garrison Keillor

It was the summer of 1902. William Carrier, while working at a publishing company in Brooklyn, New York, became irritated as the poor air quality and high humidity continued to result in bad prints. Channeling his frustrations, he created schematics for a new device: the modern air conditioner. In 1915, with a patent and extensive scientific knowledge, William partnered up with a team of engineers to found the Carrier Engineering Corporation.

But the air conditioner, which many take for granted and view merely as a convenience, is actually one of the most critically important modern marvels. Along with heating and ventilation systems, AC has allowed humans to flourish in parts of the world that would otherwise remain inhospitable. Additionally, these inventions (paired with reliable energy sources) are largely to thank for the precipitous fall in extreme weather-related deaths over the last century.

Carrier, along with spreading this critical technology worldwide, has expanded its reach and currently operates in 3 segments:

- HVAC

- Refrigeration

- Fire & Security

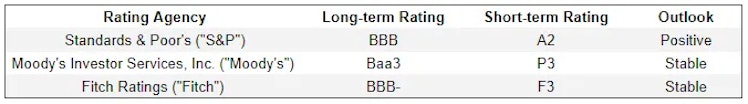

Carrier became a subsidiary of United Technologies in 1980 and, like Otis Worldwide, was spun off as a separate publicly traded company in 2020. Its headquarters are located in Palm Beach Gardens, Florida, United States, and its shares trade on the NYSE under the ticker CARR. The company currently holds the following credit ratings and outlooks:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Carrier operates in critical markets that are growing from multiple secular tailwinds. Through industry-leading products, digitization, strict cost management, and a shift to higher-margin recurring revenues, the company is positioned to create substantial long-term value. At current levels, the company can produce this value while returning significant capital to shareholders via dividends and buybacks on the back of an undemanding growth scenario.

Read the full report at the link below:

open.substack.com

Carrier $CARR: Analysis and Valuation, 2022

This recently spun, durable business isn't sweating under pressure.

Already have an account?