Trending Assets

Top investors this month

Trending Assets

Top investors this month

Figures of note for this busy week!

Throughout the week, I post threads on all of the economic data releases and news headlines that move the market.

Below is the highlight for each day this past week, enjoy the recap!

Monday: Bank stocks had a strong showing, spurred on by the news that $PACW had entered into an agreement with $KW to sell a portfolio of real estate construction loans with an outstanding balance of $2.6B

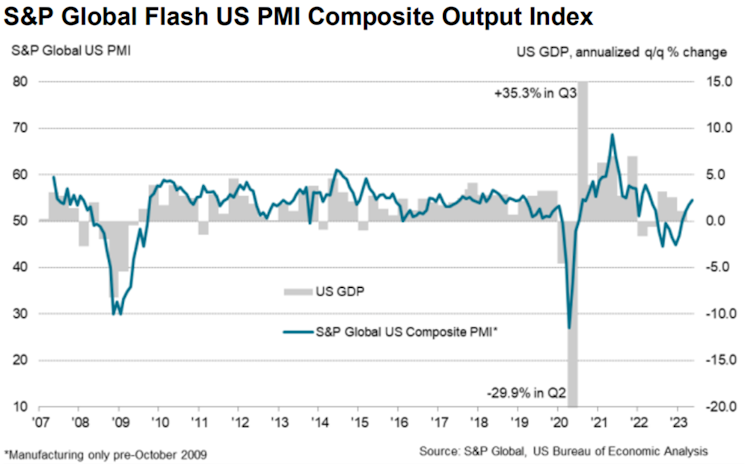

Tuesday: The Manufacturing PMI fell to 48.5 (contractionary territory) down from 50.2 in the prior reading.

The Services PMI rose to 55.1 from 53.6, the highest level in 13 months.

The Composite PMI rose to 54.5, also highest level in 13 months. Overall, strong growth in May.

Wednesday: No significant data, headlines tended to surround the fact that debt ceiling negotiators were still far apart on settling and Fed Gov Waller emphasized flexibility for the next FOMC meeting, rather than a pause.

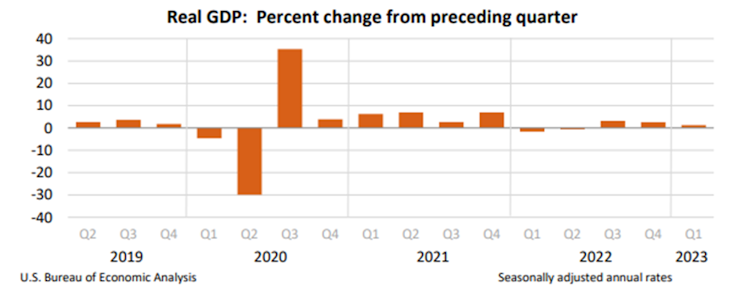

Thursday: US GDP Q1 numbers were finalized at +1.3%, up from the initial 1.1% estimate. This change was mostly due to an upward move in private inventory investment. Consumer spending was also revised higher to 3.8%, a good sign in spite of ongoing inflationary pressures.

Friday: The Personal Income & Spending report had a lot to digest. Both the PCE and Core PCE indexes rose 0.1% on their year-over-year readings, the first increase in a number of months. Personal income was in line with expectations while personal spending surprised to the upside

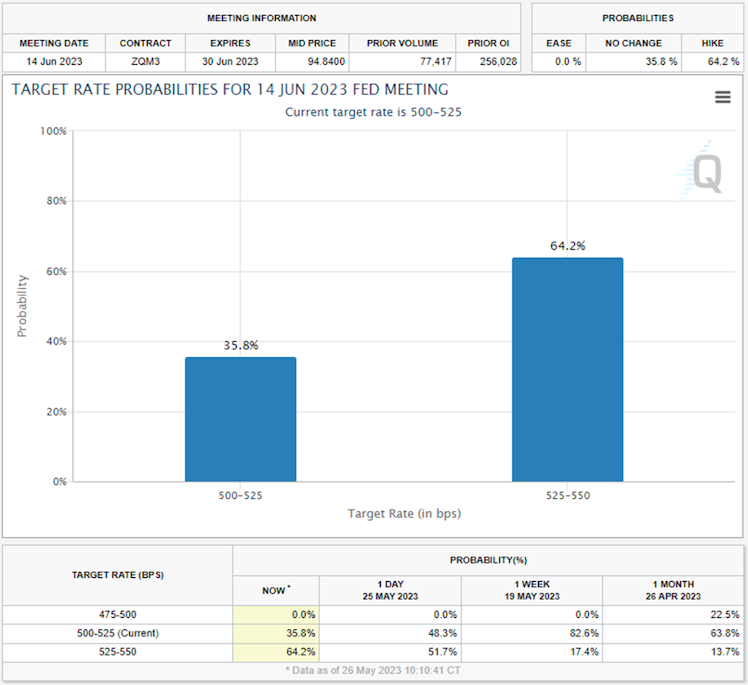

Bonus: Below is the CME FedWatch tool that shows a 64% chance of a 25 bps hike in June, up from 51% yesterday and 13% last month.

Of course, these items weren't the only figures to note for each day! For a bull breakdown of this past week in the stock market and an outlook on next week, check out my full article below and add your email to the notification list on the home page 👇

Dividend Dollars

Stock Market Recap & Outlook (5/26/23) – A Whipsaw Week Fueled on Both Sides By AI and Debt Ceiling Issues

Despite the lack of a debt ceiling deal, the week ended green and near SPX highs. A deal feels closer but is still elusive. As we continue to approach a potential governmental default what should we expect going into next week?

Already have an account?