Trending Assets

Top investors this month

Trending Assets

Top investors this month

$WSO write-up

As we did not manage to restore the extract we released on Friday, here is a short summary of the free version of our deep-dive 👉 Riding the HVAC Industry tailwinds: An Investment Analysis of Watsco Inc

---------------------------------------------------------------------------------------------------------------------------------------------------------

Highlights:

- A leading distributor of HVAC/R equipment in North America, with 673 locations, 7,200 employees, serving 120K+ customers.

- Revenue CAGR of 7.6% and operating income CAGR of 13.2% over FY12-Q1'23.

- TTM Revenues: c. $7.3B, Operating margin: 11%.

- Trades at an EV/EBITDA of 15.4 (10Y average of 14.8).

- Watsco has cash and cash equivalents of $141 million compared to total debt and lease liabilities of $529 million.

History:

- $WSO has a history as a manufacturer of HVAC/R parts before transitioning to a distribution-only business model in 1989. Since then, it has grown through organic expansion and successful acquisitions, generating a 30-year annualized total shareholder return of 18%.

Source: Watsco, Inc. 4Q22 Investor presentation

Business Model:

- Watsco relies on the replacement market, serving a fragmented base of contractors who service end customers. With only 10-15% of its business coming from new construction, the company is resilient to economic downturns.

- The distributor-to-contractor relationship is crucial, as contractors make recommendations to end customers to buy equipment from Watsco.

- Watsco's value proposition to contractors comprises of product availability, a high density of locations, support, and technology.

Sales mix:

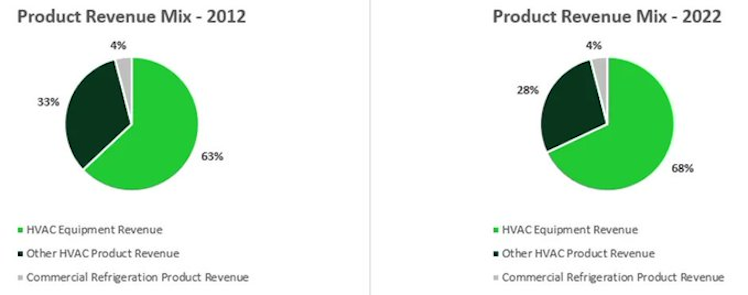

- Revenue is divided into HVAC Equipment, Other HVAC Products and Commercial Refrigeration Products.

- HVAC Equipment dominates revenue (68%), benefiting from the trend towards replacement versus repair.

- 90% of revenue is derived in US (2/3 in Sun belt region -> due to favorable weather conditions).

Source: StockOpine Analysis, Stratosphere.io

Customers & Suppliers:

- 120k customers - no single customer accounts for more than 2% of sales.

- Strategic relationship with key suppliers but high reliance on $CARR (60% of purchases).

- Long standing relationships & other joint ventures with $CARR mitigate concentration risk.

Source: Watsco’s website

Regulation catalysts for the industry:

- The new federal mandate for efficiency standards (effective from 2023) requires the upgrade to higher efficiency HVAC equipment across the entire United States.

- This will drive replacements presenting a long-term tailwind for $WSO.

- New refrigerant standards from 2025, incorporating lower global warming potential refrigerants, will drive more demand for replacements as cost to service and repair goes up.

--That's a high level summary of the free version of our write-up.--

🤝 As a reminder, students with an .edu email can benefit from a 50% discount (if you face any issues or you are a student without an .edu email but wish to subscribe to the paid tier contact us).

---------------------------------------------------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

stockopine.substack.com

Subscribe to StockOpine’s Newsletter

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?