Trending Assets

Top investors this month

Trending Assets

Top investors this month

Meta Q2 earnings

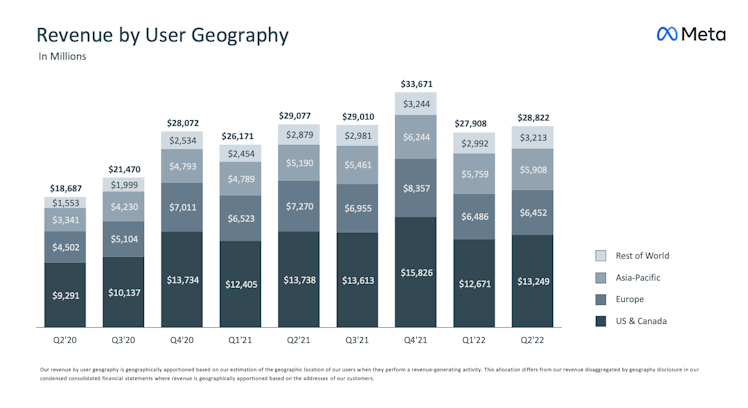

Quarterly results from $META were a bit disappointing again. Revenue came in at $28.8B, -1% YoY. On a constant currency basis, revenue inched up +3%. Revenue guidance is well below expectations, which is not encouraging. It looks like the economic downturn, a strong US dollar and increasing competition are taking their toll.

IMO, Meta will have to cut costs soon if the economic downturn continues like this. After all, they depend on advertising revenues which are a bit cyclical. Unfortunately, I think it’s only a matter of time until the company announces some layoffs.

On the plus side, Meta saw continuing user growth even with taking a hit in Europe due to the Ukraine war. The monetization of Reels is coming along with a $1B revenue run-rate and should meaningfully contribute to the recovery in the next quarters. As is already visible to users, Meta is changing its products to incorporate more content from its AI discovery engine. The first results of these changes are positive, increasing time spent in the apps.

Although I’m lowering my intrinsic value because of this earnings report, the stock is still very undervalued in my opinion. I know this is a somewhat controversial company and people have wildly different opinions. However, it’s not like I’m betting the farm on Meta. It is a reasonably sized part of my diversified portfolio of quality companies. Even if the stock doesn’t recover for some time, it’s not the end of the world.

Already have an account?