Trending Assets

Top investors this month

Trending Assets

Top investors this month

Introducing, SaaS Multiples (free resource) 🎉

Hey Commonstock! Wanted to share a free valuation tool for technology investors. It is called SaaS Multiples @ https://saasmultiples.co/

Both private and public market investors can use this free tool to quickly build valuation comps on public Software as a Service (SaaS) businesses.

SaaS Multiples tracks hundreds of sales multiples on public SaaS companies and gives you the ability to filter and visualize valuations.

First, SaaSmultiples.co is a 100% free resource.

It aims to provide both builders and investors a great tool to view the landscape of SaaS valuations.

In addition, give you the data in a way that is easy to understand and manipulate for further analysis.

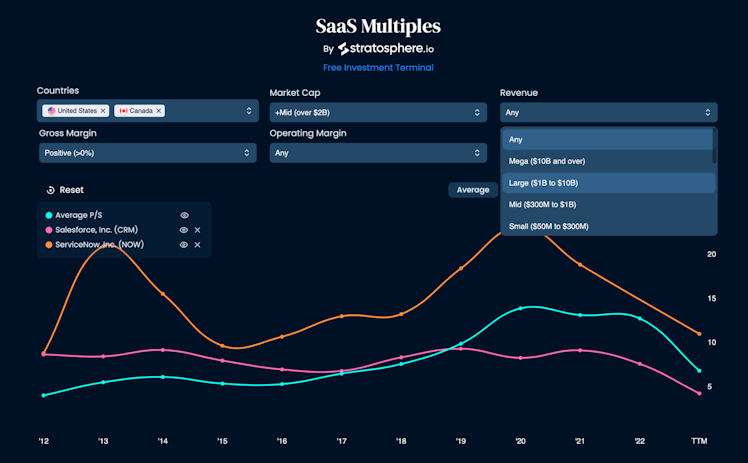

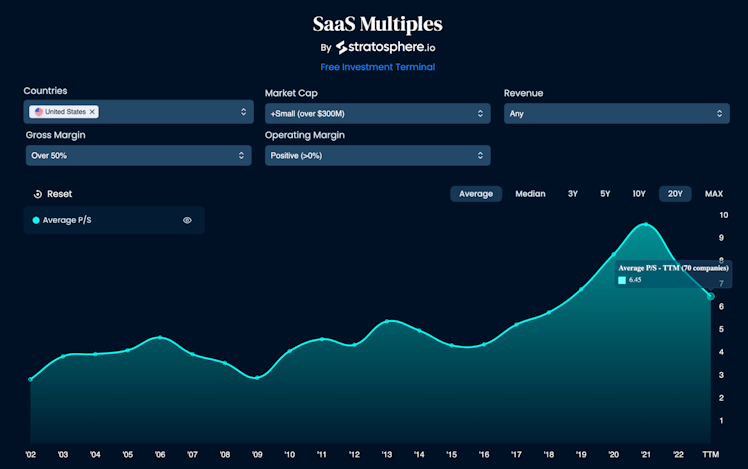

As an example, lets select U.S. 🇺🇸 listed software stocks that have a market cap >300M, has gross margins >50% and positive operating margins.

I can view the historical average. This query is returning the results of 70 companies indicated by hovering on the chart.

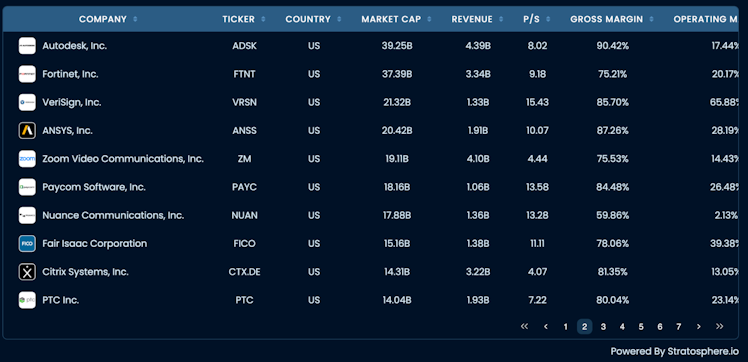

After scrolling down, the table of data appears.

This data is sortable and you can dig further into the data provided.

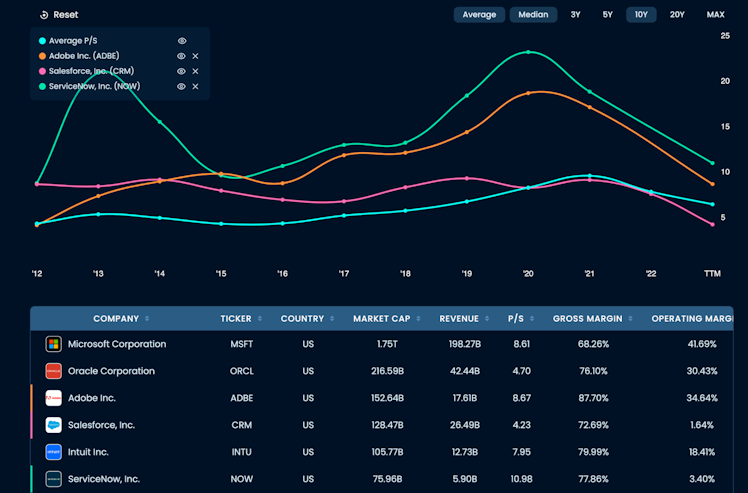

But, what happens when I click on a specific business?

By clicking on the results in the table, you can view historical valuations compared to the average of the search query.

You can also select the “type” of software company.For instance, I like setting it to “Software - application” and then it will pull up a more true list of pure play SaaS stocks.

The world is your oyster.

And, damn the visuals are nice.

I hope you enjoy this resource!

We put it together as a great use case and example of the wonderful data you can pull from Stratosphere.io and the data visualizations out of the box available to you.

saasmultiples.co

Track Valuation Multiples of Public SaaS Companies | Stratosphere.io Tools

SaaS Multiples tracks the valuation of public SaaS (Software as a Service)

companies using the commonly used Price to Sales ratio. Filters like market cap,

margins, revenue, and geography can be used to build more effective comparables.

Already have an account?