Trending Assets

Top investors this month

Trending Assets

Top investors this month

EV Industry Breakdown

Hey Commonstock community! I wanted to share with you the EV breakdowns that I have started for this year.

💡What will you learn in the Equity Breakdown Report?

- EV Brief History

- Industry Breakdown

- EV Value Chain

- Strategic Resources

- Winners

- Challenges

- Key Insights for Time Investors

If you want to read the full breakdown click here ➡️ EV Breakdown Substack

If you want to download my pdf report, you can click below ➡️

Typically, I will try to understand the industry framework and then focus on companies across the supply chain that potentially have the platform to succeed. I love research and I am always open to additional insights and more importantly feedback to foster a richer transfer of knowledge.

Feel free to reach out with any questions and also additional requests!

Here are some key points as you explore the EV industry:

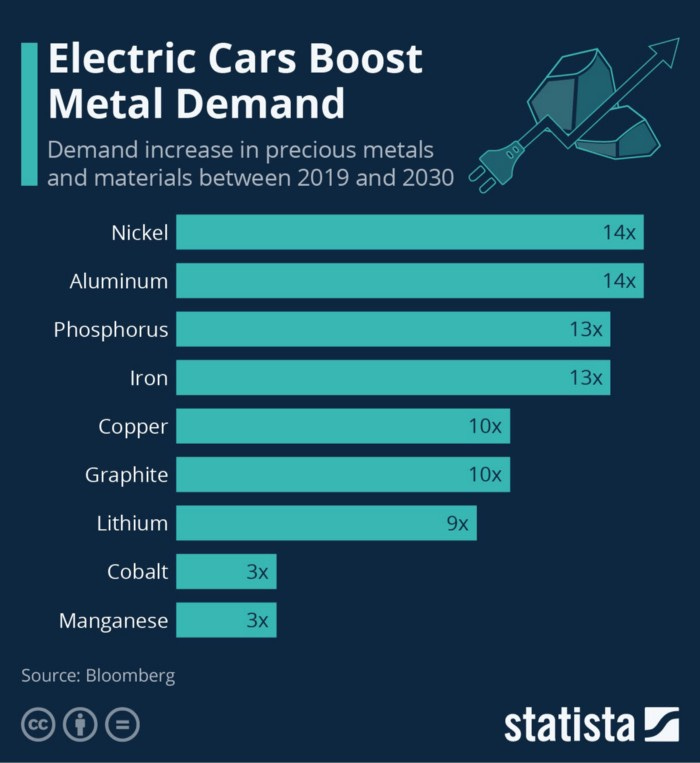

What are the strategic resources in the EV world?

Developing Resources:

1.Exclusive mining rights: Essential in the production of batteries which is one of the most expensive components of EVs. The raw materials are classified as rare earth elements with a high concentration in China, South America, Australia, and one world-class location in North America, specifically in the Mountain Pass deposit in California.

- Mountain Pass Materials is developing the most advanced eco-friendly mining facility

- High Barriers to Entry, Capital Intensive, Limited Supply

Research and Development:

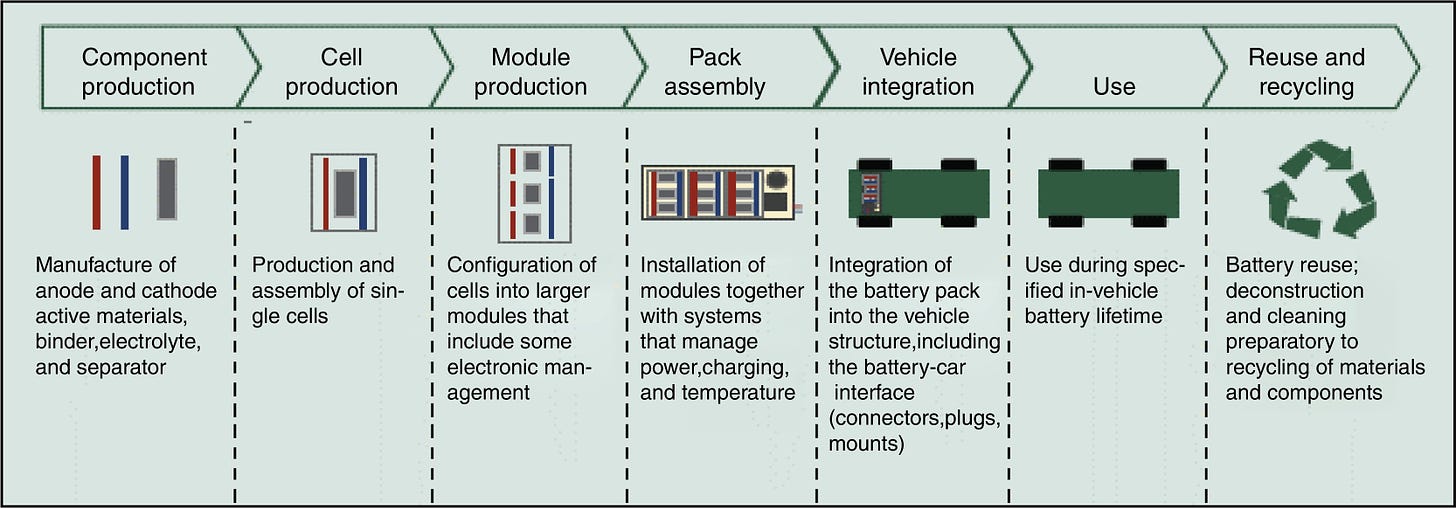

1.Battery Technology: Batteries are one of the most important elements in EVs. The amount of energy that can be stored in a battery will determine the range and performance of the vehicle. The most common type of battery is Lithium-ion batteries making up about 70% of the rechargeable battery market.

- There are three core components in making batteries: cell -> module -> packs

- Cells: smallest, but most critical component that produces energy and make up 75% of the cost

- China and the U.S. are expected to have 84% of the lithium-ion cell production

- Module: contains several cells with terminals to connect and make up 11% of the cost

- Packs: consist of modules that are assembled with cooling equipment and make up 14% of the cost

- Ark’s research indicates that leaders are manufacturing cell-to-battery packs/vehicles without modules to produce more kilowatt-hours and increase the range of vehicles.

- Battery costs have also improved drastically falling by 28% to below $100/kilowatt-hour (kWh)

- Research is heavily focused in cathode materials that can deliver higher energy density

- Tesla/Panasonic partnership leads the pack in battery production followed by LG Chemical, AESC, and Samsung SDI, QuantumScape

Source: ScienceDirect - Battery Supply Chain.

2.Semiconductors: The brain behind EV companies are chips. They enable the electrical sophistication of powering the batteries, supporting tech components in the vehicles, and providing software.

- Nvidia, Taiwan Semiconductor Manufacturing Co, NXP Semiconductors, TE Connectivity, Infineon Technologies, Renesas

3.Autonomous Technology: EVs with the software capability to achieve self-driving autonomy will create an initial competitive advantage. There are assumptions that Tesla plans to launch a fully autonomous taxi network.

- Camera-based strategy, Lidar, HD Mapping, and infrastructure sensors are three main technologies deployed to achieve autonomous driving

- Ark’s research is forecasting a trillion in earnings by 2030

Brand & Vertical Integration across the supply chain:

1.Distribution and scalability to increase market share will be defined by brand strength and infrastructure to produce rapidly. Vehicles with the most advanced technologies that achieve reliability, performance, and practicality will benefit. Additionally, many young EV companies are partnering with existing auto manufacturers who have the appropriate infrastructure to produce at scale, except for Tesla. Companies that develop their own production facilities with practical scalability will have an advantage initially.

2.High margin opportunities will also be present in the recycling process of batteries. Recycling batteries will require unique expertise in chemical management and logistical constraints in terms of the location of facilities.

🧠Key Insights for Time Investors:

- There is a major push from governments to reduce greenhouse gas emissions. The Biden administration has made it clear that they will support many changes that will transform the automobile industry

- Understand the supply chain process and focus on the stages that will have less competition and higher margins. Raw Material Mining, EV brands that have advanced and protected technologies, and the recycling stage will present great opportunities

- More specifically identify companies with the greatest engineering talent, heavily focused on R&D, have viable products, and realistic strategy to scale rapidly

- There are four key segments in the space: passenger vehicles, light commercial vehicles, 2 Wheelers, Municipal Buses

- As e-commerce is exploding and governments support policy the initial growth based on pure economics will be on “last-mile delivery” and buses.

Google Docs

Equity Breakdown - Electrification Economy.pdf

Already have an account?