Trending Assets

Top investors this month

Trending Assets

Top investors this month

CPG brands seize on the high-inflation environment to boost profits

The trend: Consumer packaged goods (CPG) companies are using the inflationary environment as cover to increase prices beyond their costs, boosting their profit margins.

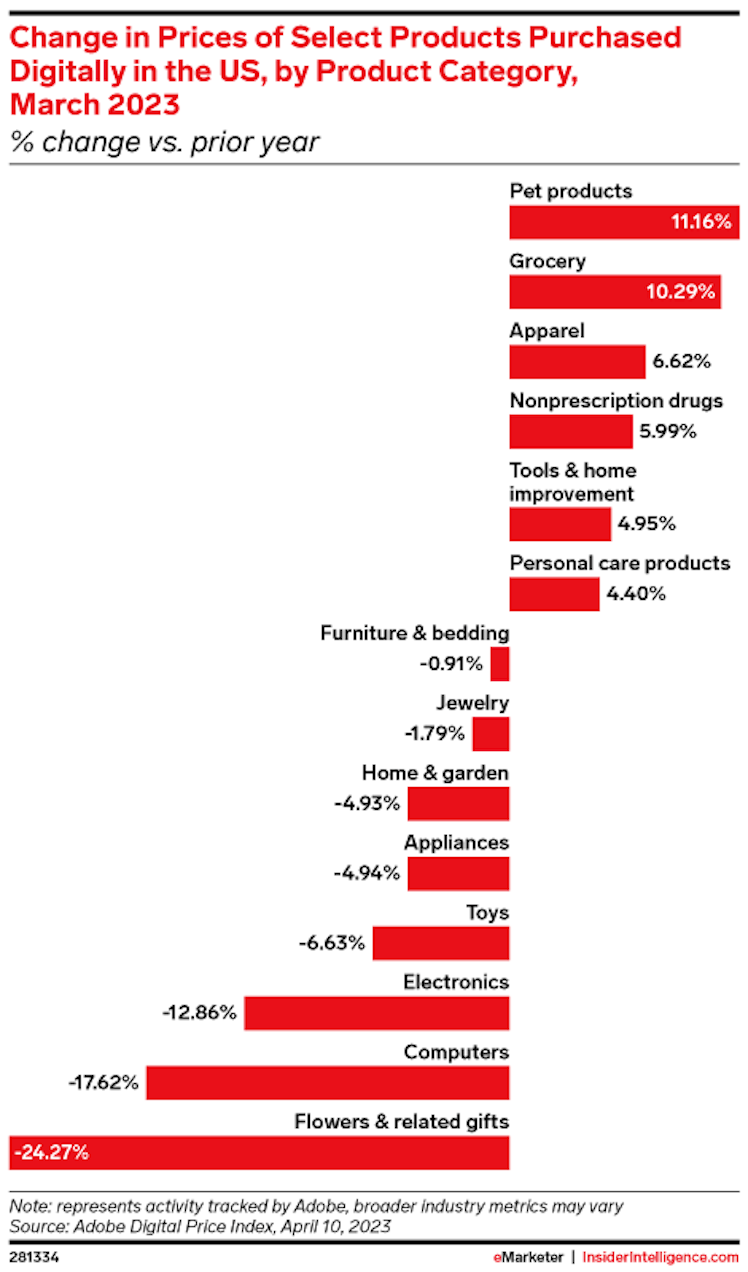

Prices keep rising. This is despite the fact that many of the issues that led CPG companies to hike prices, including supply chain disruptions caused by the pandemic, surging energy costs, and raw material shortages, have subsided.

That has helped inflation remain high. Prices for cereal and bakery products rose 13.6% year-over-year in March, for example, and snacks were up 9.5%, per the US Commerce Department.

Yet, consumers, for the most part, have been unusually willing to pay for name brands. That trend drove companies such as Kellogg, PepsiCo, and Hershey to boost their outlooks for the remainder of the year even as many of them saw their volumes decline.

What’s going on: A survey by Kroger-owned 84.51° found that 27% of consumers are more loyal to their preferred brand than last year. However, only 5% define loyalty as exclusively buying a single brand and 26% say that while they have a “preferred” brand they’re willing to try something else.

The survey also flashed a clear warning sign: Sixty-two percent of consumers prioritize “good value for money” when buying grocery or household items, which suggests companies need to tread carefully as they continue to pull the price hike lever.

More than a third, 36%, of grocery shoppers have traded down to cheaper alternatives of the same products, such as store brands, per a new PYMNTS survey, and 47% have switched to retailers that offer better prices.

Many CPG brands saw some declines in sales volume in the wake of the price increases. For example, Kraft Heinz’s volumes fell 5.3% YoY in Q1 and Procter & Gamble dipped 3%.

Finely targeting consumers: To minimize the number of consumers who trade down, CPG companies are turning to sophisticated data analytics tools to finely target existing customers and attract new ones.

Kraft Heinz, for example, is using tools developed in-house to produce more effective promotional events that are likely to resonate with specific consumer segments based on their past behaviors or actions, said CEO Carlos Abrams-Rivera, during the company’s earnings call.

Hershey is paying close attention to any shifts in consumer behavior so that it can quickly optimize “media and our in-store activations,” said Melissa Poole, Hershey vice president, investor relations.

The big takeaway: With even loyal consumers increasingly willing to try another brand’s products, CPG brands need to tread carefully as they increase prices.

Reassuring as a holder to know that Hershey is paying close attention to any shifts in consumer behavior so that it can quickly optimize $HSY

Already have an account?