Trending Assets

Top investors this month

Trending Assets

Top investors this month

$VMD Earnings

$VMD is a home medical equipment supplier and the nation’s largest independent

provider of ventilation that provides post-acute respiratory care

services, today reported its financial results for the three months and

year ended December 31, 2021.

QoQ increase in earnings by approximately 4% (Sep to Dec 20/21)

YoY increase in earning 11% (20/21)

(Excluding COVID-19 response sales and services)

The Company had a cash balance of $28.4 million at December 31, 2021

($31.0 million at December 31, 2020) and an overall working capital

balance of $29.5 million ($24.2 million at December 31, 2020). Total long-term debt as of December 31, 2021 was $4.3 million.

Total revenues for the first quarter of 2022 are estimated to be approximately $30.6 million to $32.0 million.

Gross Profit of 62% (no major change)

Important Metric/Number: Total Vent Patients is 8,405 (increase of 205)

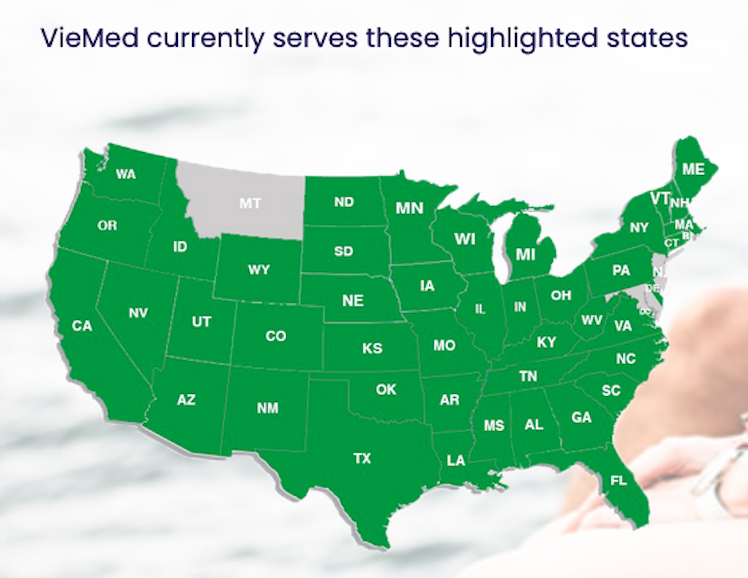

The Company currently serves patients in 47 states in the United States.

From 10K:

(Known) We also hold an approximate 5% equity interest in VeruStat, Inc, a company focusing on remote patient monitoring (“RPM”). The investment is part

of an ongoing initiative to enable our salesforce to offer a new revenue

source to its nationwide physician network. RPM platforms allow

physicians to bill for in-home monitoring of patients that are

struggling with chronic diseases. The VeruStat RPM solution can be

placed in the home in conjunction with Viemed’s existing patient

engagement platform (“Engage”). During 2021, we formed Viemed

Healthcare Staffing LLC, a healthcare staffing division. The underlying

recruiting platform is expected to support internal resource fulfillment

as well as external, contractual placement of allied health and nursing

professionals.

I thought they owned 10% (bought additional 5% but I guess I'm mistaken)

(New) We hold a 49% equity interest in Solvet Services, LLC, an unconsolidated

joint venture which provides health care support to state and federal

governments.

This one is interesting as they bought 49% of a DME/HME company that was started by one of their employees that focuses on government contracts. Might be potential play on VA as the owner of Solvet is veteran (this is my speculation but will be interesting what they say on the earnings call tomorrow)

SG&A is still too much :/

OIG audit is still going on...

Guessing the stock will be down tomorrow :(

The Company will host a conference call to discuss fourth quarter results on Tuesday, March 8, 2022 at 11:00 a.m. ET.

Already have an account?