Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why did Pfizer lead the decline in the pharmaceutical sector?

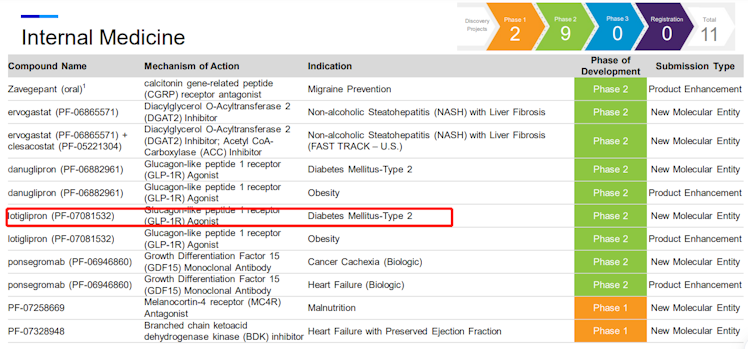

On June 26, the pharmaceutical sector of US stocks generally fell, among which giants $PFE Led the decline by 3.6% as the company said it would stop developing its experimental weight loss and diabetes drug Lotiglipron.

This highly anticipated drug showed elevated liver enzymes (toxic side effects) in experimental patients in mid-term clinical studies. These elevated enzymes often indicate that liver cells are damaged, although patients do not have liver-related symptoms or side effects at present.

Meanwhile, Pfizer said it was focusing on another oral obesity drug, danuglipron, which is undergoing a phase II clinical trial that has been fully recruited.

People with type 2 diabetes lost weight after taking high doses of Danugliplon twice a day for 16 weeks, according to results released last month. It is expected that the final plan of Phase III clinical trial plan on Danugliplon will be completed by the end of 2023.

Why stop this diet drug pipeline, which has a significant impact on the company's stock price?

First, drugs that have entered mid-term clinical trials often have a relatively high probability of success, so the market often thinks that the failure of this pipeline will have a great impact. Pfizer was the first company to announce that small molecule oral diet pills entered the middle and late clinical stage. There are two varieties in the pipeline: danuglipron and lotiglipron, in which danuglipron needs to be taken twice a day, while lotiglipron only needs to be taken once a day. In terms of convenience, lotiglipron is better, so the market is more optimistic about lotiglipron.

Although Pfizer will continue to promote the development of danuglipron and optimize it to be eaten once a day, it is doubtful whether it will have the same curative effect in the follow-up experiments.

Second, lose advantage in small molecule competition. This pipeline of weight loss and diabetes drugs is not unique to Pfizer, Lilly and $NVO The company also has similar pipelines. Although Pfizer first entered the clinical phase 2 trial, now $LLY Orforglipron overtook Pfizer in progress and entered Phase 3 first. Therefore, Pfizer's defeat is also considered by the market to have lost its first opportunity.

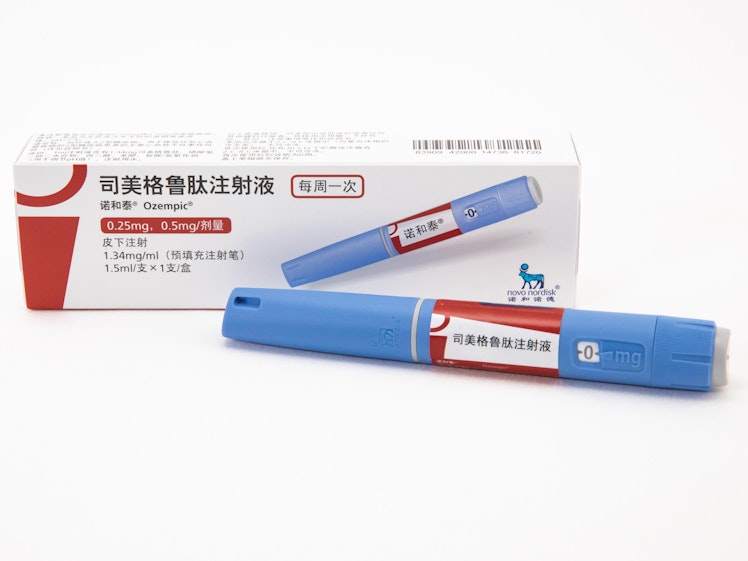

Oral GLP-1 Confers up to 14.7% weight loss at 36 weeks for adults with obesity

In fact, there are more than 150 new drugs for studying GLP-1 in this track, and the indications cover type 2 diabetes, obesity, nonalcoholic steatohepatitis, Alzheimer's disease and other diseases. Among them, the hottest one, which is also the industry benchmark, is Novo Nordisk's smeglutide, which is already on the market. It reduces blood sugar level by simulating the effect of GLP-1. It is an injectable drug, which only needs to be injected once a week and can last for several days.

Online Exhibition

Pfizer had great ambitions for the small molecule drug market before, hoping to win 10 billion of the 27 billion market. After all, oral drugs have different advantages over injectable drugs, and the market target groups are also reported to be different. However, if the efficacy and safety of these small molecule oral drugs are not comparable to the current industry benchmarks, it will be difficult to gain a larger market share even after the clinical trials are over and put on the market.

What is the current situation facing Pfizer?

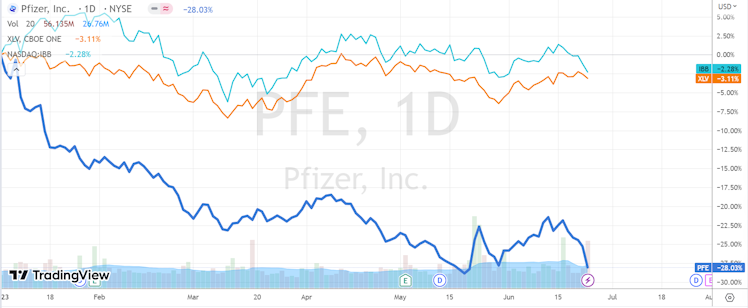

Year-to-date, Pfizer's share price has pullback/retracement by 27%, while $XLV Only 2.5% callback,$IBB The callback range is only 3.21%. At the same time, Novo Nordisk surpassed Pfizer in market value and became the largest pure pharmaceutical company in market value. Why is Pfizer pullback/retracement, as the leader, so big?

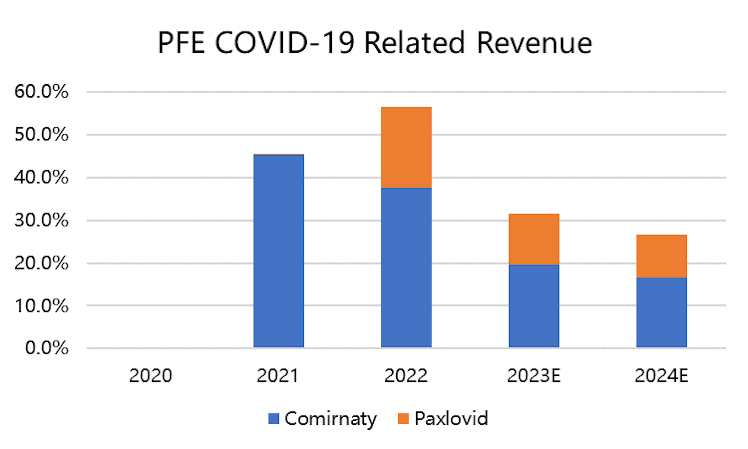

We believe that pessimism is mainly worried about future growth options after COVID-19, and the impact of uncertain acquisition strategies on the company's financial statements.

As we all know, Pfizer's Paxlovid, due to its high pricing and hard demand, gained explosive revenue during COVID-19, and it was also the highest-selling small molecule drug in the world in 2022, leading Eliquis in the second place by more than 60%.

Because of the sweeping of Covid-19, Pfizer was fortunate to get a nouveau riche performance growth on this drug. At the same time, the vaccine of Covid-19 also made Pfizer earn a lot of money. In 2022, more than half of its revenue came from drugs and vaccines of Covid-19, and the company's share price increased by 66% in 2021.

But when you come out to mix, you always have to pay back. When the impact of COVID-19 has passed, these increases are naturally spit out.

At the same time, Pfizer is a company that obtains more potential pipelines through acquisition, and the acquisition itself is prone to higher financial leverage, and there is also the risk that the drug market will not be as expected.

Therefore, investors gave up decisively after Pfizer made a lot of money for two years, not because they despised the savings in its pocket (there may be higher dividends and repurchase actions), but because they were more worried about the future revenue falling short of expectations.

At present, the market may overestimate the revenue from COVID-19 after 2023. Of course, the uncertainty of the pharmaceutical industry is quite large, and it cannot be ruled out that COVID-19 virus will mutate again and form new varieties in the future, and Pfizer's drugs will have the opportunity to go out again.

Already have an account?