Trending Assets

Top investors this month

Trending Assets

Top investors this month

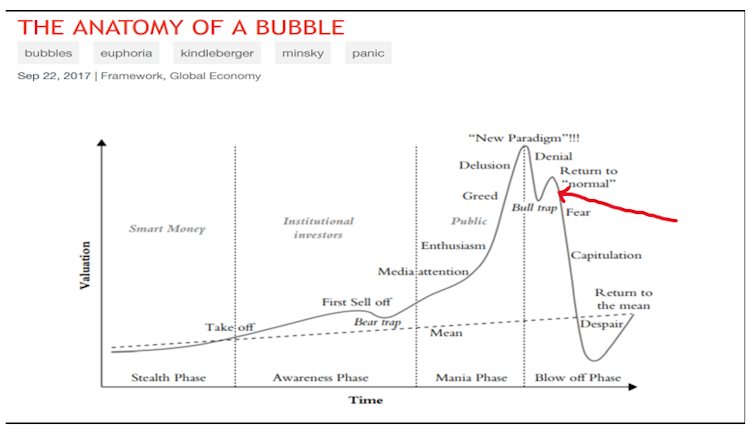

Chart of the Day - investor mindset.

Over the past few days I have had conversations with a number of people on a range of investing topics - why is the Ethereum Merge a non-event, should I move my 401k into cash, are private mkts the next shoe to drop, why is implied volatility not reacting to the move

lower. All have different portfolios & risk tolerance. However, there was a similarity in the questions. When it comes to money, people are always happy when it is growing, nervous when it is shrinking (even if just giving back profits) and panicking when it collapses.

Even in a world of systematic/robotic/algorithmic portfolios there are behavioral biases. The end allocator drives the decision. The fund just executes. It may take longer to react but the path is similar. It follows the chart I have on today. As you look at it, ask yourself,

where am I on this?

The obvious place to start is high growth tech investors. I know in fall of 2021 we were at the New Paradigm phase. Spring 2022 was the denial phase. I think we are solidly in capitulation now. I base this a lot on many conversations with students who a year ago thought value investing and old economy companies were dead to never come back. Now they are pretty bearish overall.

Another place to consider is crypto. When had a major catalyst last week with The Merge. Ether rallied well before, came off some and then tried to rally back. It is heading back lower now. I might argue it is where the red line is. Bitcoin has gone through this bubble diagram twice now. Remember the crypto winter? Are we going back? We now have infighting

between the Ethereum network fans and the Bitcoin maximalists. Uh oh.

More concerning is the move in risk parity portfolios. Early last year, I said the move higher in inflation, which was not transitory, would break these portfolios that relied on negative correlations. With inflation, the major assets are positively correlated. This is the land of

institutions primarily. If we are in a world of permanently higher inflation, where are risk parity investors on this diagram? How much they pivot for the next 10years? Maybe not at the red line yet but still in the bull trap area waiting for the return to normal.

Not to be left out are the traditional 60-40 retail investors. Whether this is done with an advisor or via a target date fund in the 401k, your portfolios is off to the worst start in your career. I know that because 60-40 is off to the worst start since the Great Depression in 1930.

These decisions take long to make but how will retail investors react when they get their Sept quarterly statement. Or the year end statement? Where are they? Probably still in denial would be my guess.

Of course, we do not have to follow this path. It is just that we usually do. I am open to what can change that. However, for now, given the conversations I have had, it is time to ...

Stay Vigilant

Already have an account?