Trending Assets

Top investors this month

Trending Assets

Top investors this month

Credit Card Companies rely on the financially illiterate for their survival

If you've ever wondered why it is that financial literacy isn't heavily encouraged throughout schooling in America, it is for a very specific reason—the credit & banking industry relies on financial illiteracy in order to make money.

Don't believe me?

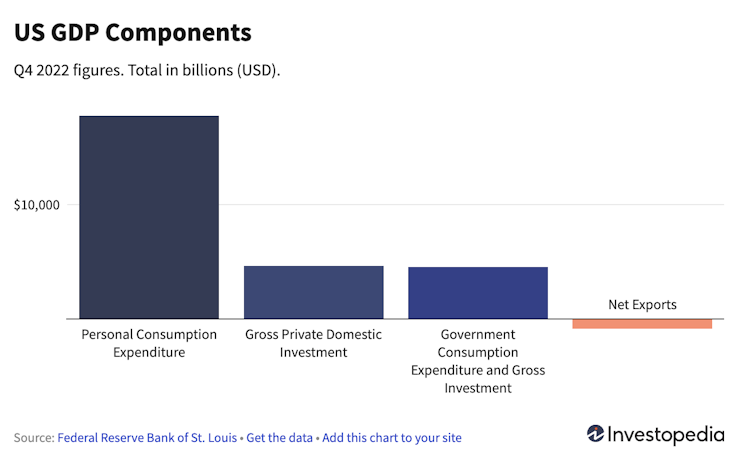

The basic economic equation for GDP is C + I(r) + G + NX = Y. Where C = consumer spending, I = investment which is impacted by r the interest rate, G = government spending, and NX = net exports or imports minus exports. In 2019, U.S. GDP was 70% personal consumption, 18% business investment, 17% government spending, and negative 5% net exports. This just goes to show that the majority of the US economy is upheld by consumer spending, and if people were to only buy what they could actually afford, much of the American economy would vanish.

Enter Credit Card companies.

Credit cards appeared after World War II, when a consumer spending boom spurred banks and retailers to find more options for the everyday financial needs of American families. But given that they weren't an immediate hit, elaborate marketing campaigns by the likes of people like PR maven Edward Bernays were put forth to convince people that they were inadequate without the stuff being sold. It wasn't until 1950, however, that the credit card would make its true debut.

Fast forward a couple of decades, and now we're at a place where the economy is damn near dependent upon irresponsible credit card usage, and as usual, it is the people who have the most to lose who end up footing the bill.

If you haven't watched this video already, I encourage you to watch Who Actually Pays for Credit Card Rewards? by CNBC. Although if you care not to, this closing exchange between a CNBC reporter and managing partner at Bell Advisory Group sum it up:

Reporter: "But doesn't that then mean that the banks need less sophisticated individuals to participate in this business in order for it to be so profitable that they can continue to offer such great rewards?"

Managing Partner: “100% yes, they need unsophisticated customers — high credit scores, medium credit scores and low credit scores. Absolutely. If everyone made the rationally correct decision at every point, the banking industry in the US would, would probably not exist.”

youtu.be

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

Already have an account?