Trending Assets

Top investors this month

Trending Assets

Top investors this month

Stocks Beat Cash In A Recession

Stocks beat cash even if you can time a recession. The S&P 500 has a track record of being resilient during these times

Even if financial advisors are suggesting swapping stocks for cash, no one knows exactly how to time a recession. Investors could wait years for a downturn, missing out on stock market gains while their cash loses value to inflation

Or worse, they could dip in and out of stocks as recession predictions come and go, losing money to poorly timed trades along the way

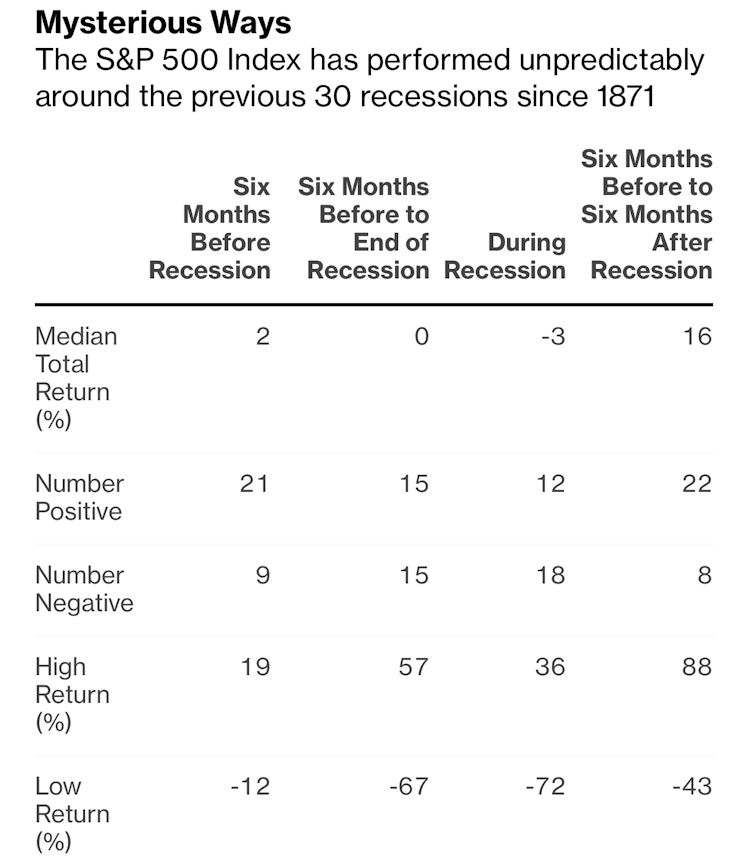

There have been 30 recessions since 1871. Research into the S&P 500 performance six months before each of those recessions has found that it produced a positive total return 21 times

So even if you knew a recession was coming, you would still most likely be better off in stocks in the months leading up to it

The market is most interested in the fortunes of publicly traded companies, whereas the economy is far broader, encompassing government and private businesses

The stock market is also forward-looking and multivariate. Numerous factors drive stock prices, including those specific to each industry and individual companies, and for many multinationals in the S&P 500, the outlook beyond US borders

Stock prices also digest these considerations well before they are expected to occur. The S&P 500 may have absorbed recession fears last year when it declined nearly 20%. And its turnaround so far this year may signal that it's already looking past a possible recession

Already have an account?