Trending Assets

Top investors this month

Trending Assets

Top investors this month

Interest Rate Fundamentals

There are three basic factors that determine the real interest rate: supply of funds from savers, demand for funds from businesses, and government actions.

The nominal interest rate is the rate we observe before we subtract out the expected rate of inflation.

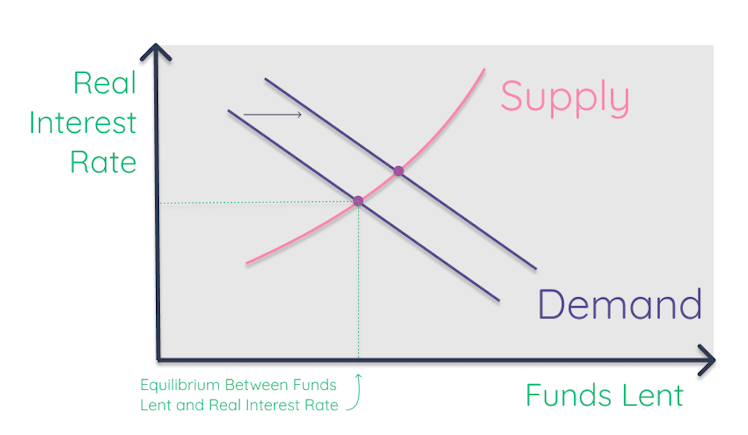

If we consider the supply and demand curves for funds we can gain some insights into the real rate of interest

On the horizontal axis, we measure the quantity of funds, and on the vertical axis, we measure the real rate of interest.

The supply curve slopes up from left to right because the higher the real interest rate, the greater the supply of household savings.

The assumption is that at higher real interest rates households will choose to postpone some current consumption and set aside or invest more of their disposable income for future use. (Although experts disagree significantly on the extent to which household savings increase in response to an increase in the real interest rate.)

The demand curve slopes down from left to right because the lower the real interest rate, the more businesses will want to invest in physical capital. Firms will undertake more projects the lower the real interest rate on the funds needed to finance those projects.

Equilibrium is at the point of intersection of the supply and demand curves.

The government and the central bank can shift these supply and demand curves either to the right or to the left through fiscal and monetary policies. For example, consider an increase in the government’s budget deficit. This increases the governments borrowing demand and shifts the demand curve to the right, which causes the equilibrium real interest rate to rise. That is, a forecast that includes higher than previously expected government borrowing increases expected future interest rates. The Fed can offset such a rise through an expansionary monetary policy, which will shift the supply curve to the right.

Thus, although the fundamental determinants of the real interest rate are the propensity of households to save and the expected profitability of investment in physical capital, the real rate can be affected as well by government fiscal and monetary policies.

Thats a lot of theory for today- tomorrow we’ll look at the current supply of household savings and if that can give us any insight on interest rates in the future.

Already have an account?