Trending Assets

Top investors this month

Trending Assets

Top investors this month

Cost of capital

Finance’s most important yet misunderstood price is capital. Here’s what happened to the cost of money in the past fortnight.

•••

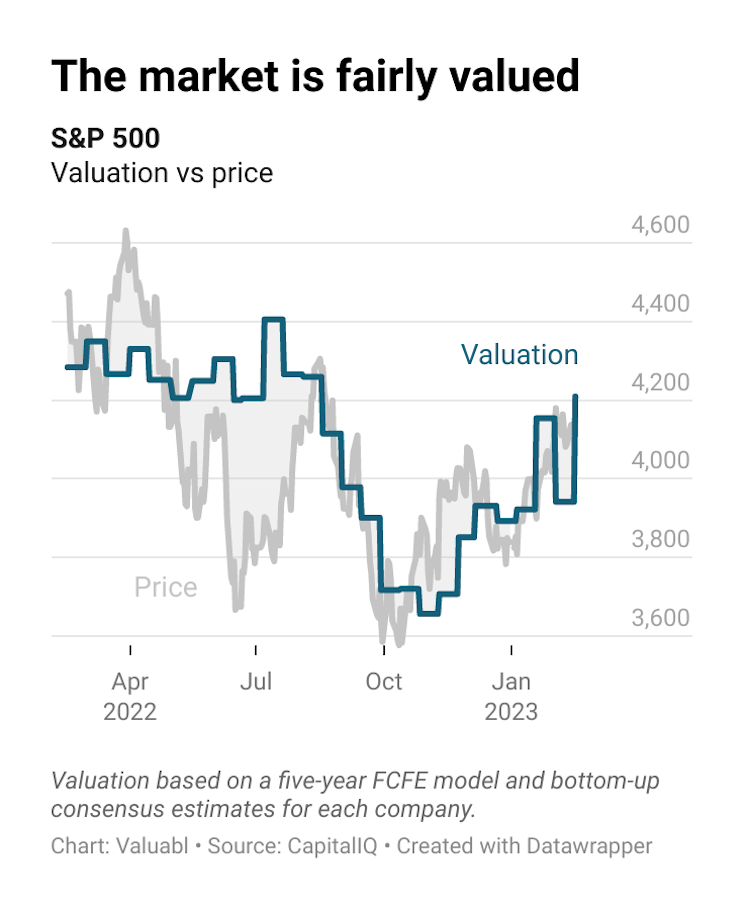

Stock prices rose last fortnight. The S&P 500, an index of big American companies, climbed 1% to 4,136. The market continues to rise from its October lows but is still 7% below where it was last year. I value the S&P 500 at 4,209, which suggests it is fair value.

The companies in the index earned $1,658bn in the past year, down $83bn from last fortnight. They paid out $407bn in dividends, bought back $884bn worth of shares, and issued $64bn of equity.

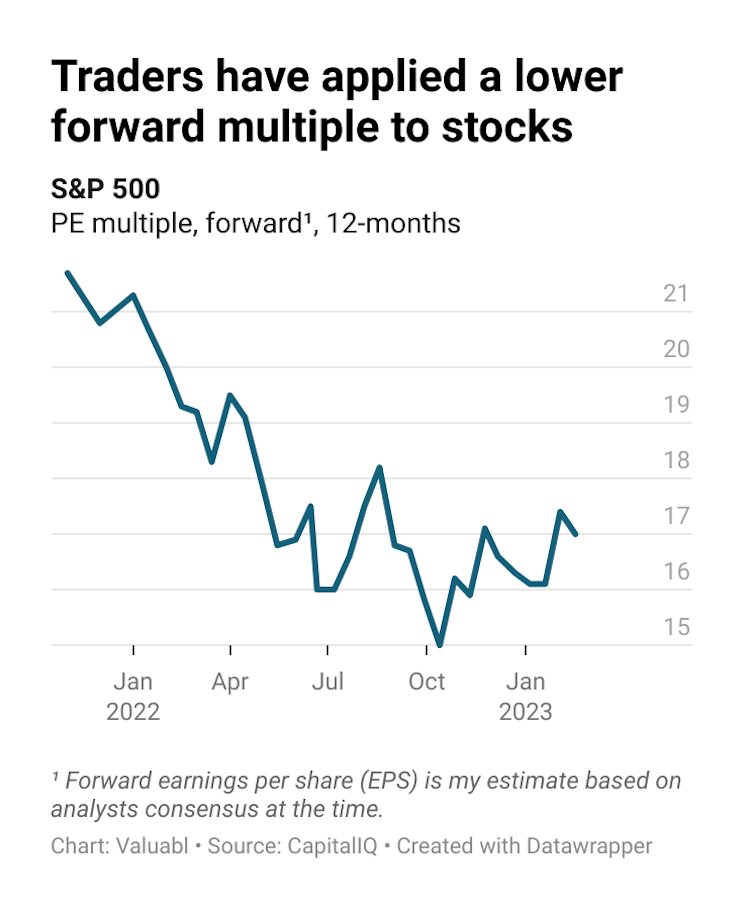

The forward price-earnings (PE) ratio dropped to 17. My 12-month forward earnings per share (EPS) estimate for the index rose from 237 to 244.

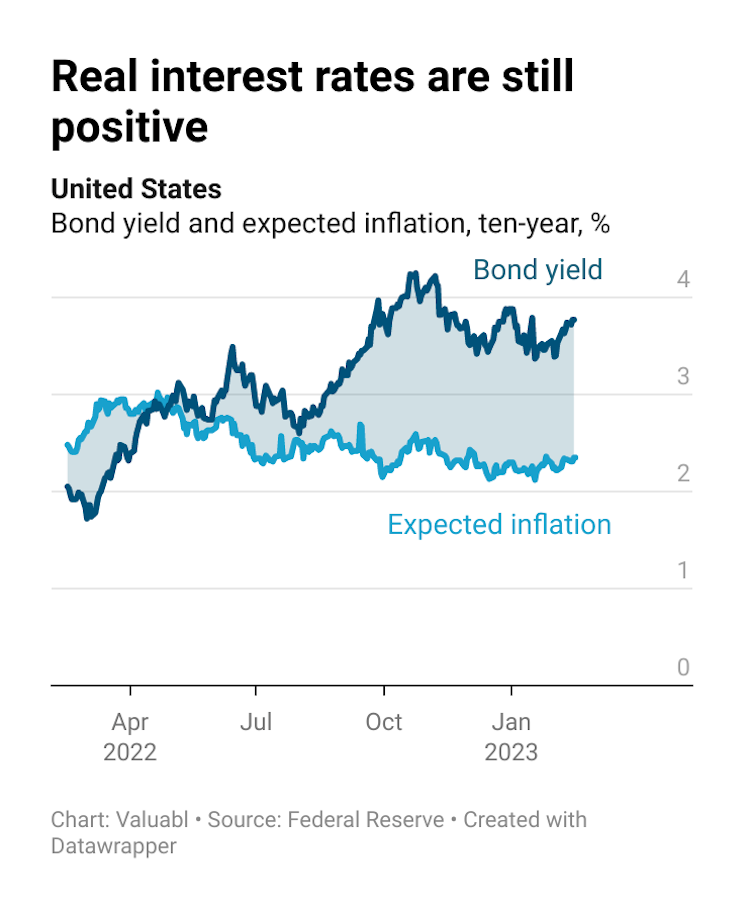

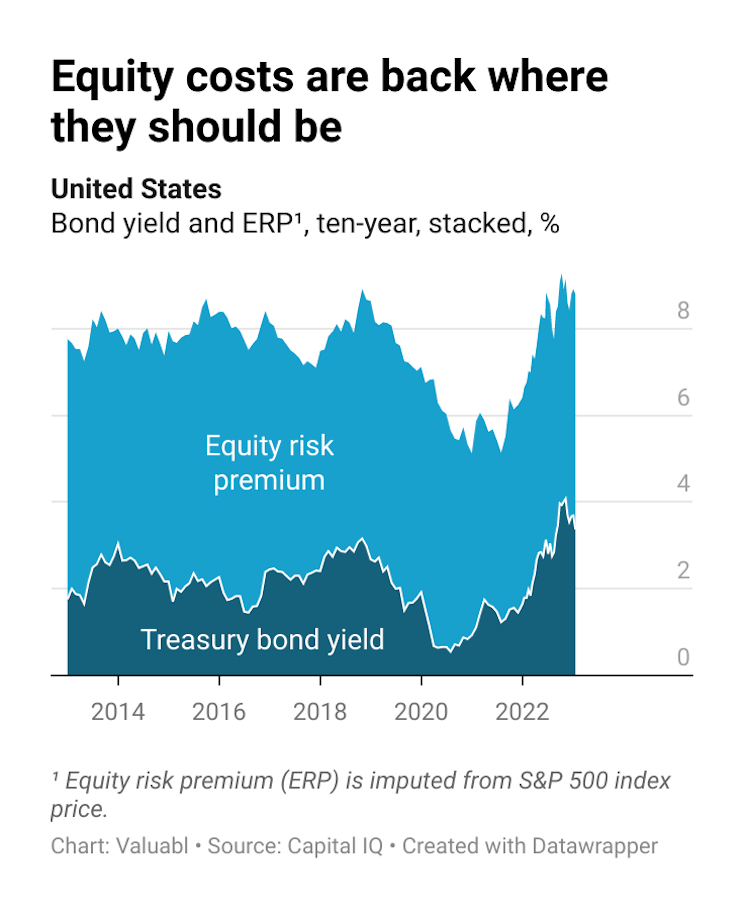

Government bond prices dropped. Yields, which move the opposite way to prices, rose with inflation expectations. The ten-year Treasury yield, a critical financial variable, climbed 38 basis points (bp) to 3.8%. Investors expect inflation to average 2.4% over the next decade. That's 10bp higher than the rate they expected last fortnight.

The real interest rate, the gap between yields and expected inflation, increased by 28bp to 1.4%. These inflation-adjusted rates are up almost two percentage points in the past year.

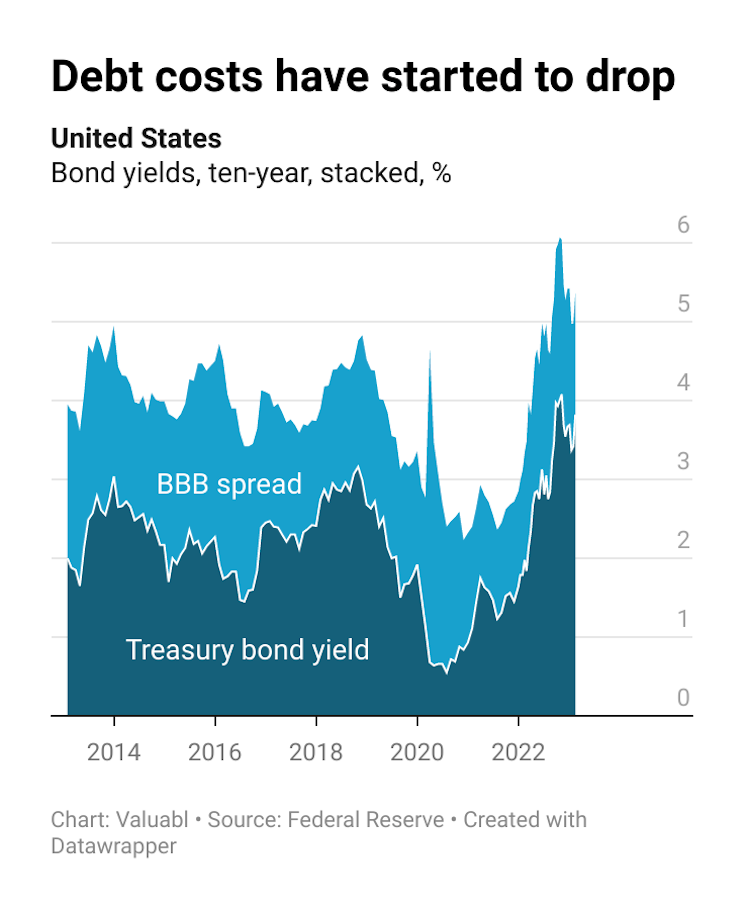

Corporate bond prices also went down. Credit spreads, the extra return creditors demand to lend to a company instead of the government, fell by 2bp to 1.5%. The cost of debt, the annual return lenders expect when lending to these companies, jumped 36bp to 5.3%.

Refinancing costs have almost doubled, up two percentage points, in the past year. But they’ve been declining since they peaked in October above 6%.

The equity risk premium (ERP), the extra return investors want to buy stocks instead of bonds, climbed 29bp to 5.2%. It’s now about the same as it was a year ago. The cost of equity, the total annual return these investors expect, also rose 67bp to 9%. These expected returns are a little above their long-term average.

Already have an account?